Roche To Top $66 Billion In Sales By 2020, Led By Neuroscience

Roche Holding’s (OTCMKTS:RHHBY) revenue grew at a CAGR of 5.3% from $52.5 billion in 2015 to $64.4 billion in 2019, and it is estimated to top $66 billion in 2020, led by its Neuroscience drugs. The company’s oncology drugs will account for 45% of the company’s total sales in 2020, but Neuroscience drugs are key to the near term revenue growth, in our view. Oncology drugs are expected to be the single-biggest revenue driver with $30.1 billion in revenues (45% of Total Revenues), which is 5.7x the size of its Neuroscience drugs revenue in 2020. Neuroscience drugs revenues, which includes Ocrevus and Modopar among other drugs, will be the fastest-growing segment – adding $3.7 billion over 2017-2020 (32% of $11.6 billion in incremental revenues). Oncology drugs revenues, which includes Herceptin, Perjeta, Tecentriq, and Avastin among other drugs, will add about $3.4 billion over 2017-2020 (29% of the $11.6 billion in incremental revenue). Look at our interactive dashboard analysis on Roche’s Revenues for more details, parts of which are highlighted below.

Roche’s Revenue Has Been On A Rise Over The Last Few Years

- Roche’s total revenue grew from $52.5 billion in 2015 to $64.4 billion in 2019.

- This growth was largely led by its immunology and neuroscience portfolios, which benefited from Xolair and Actmera sales growth, and the company’s 2017 launch of Ocrevus, which marked the best drug launch for Roche and garnered over $3.5 billion in sales in 2019. This also explains the jump seen in revenue growth in 2018.

- However, as we look forward, the revenue growth rate could slow to low single-digits, with revenues expected to be north of $68.5 billion by 2022, for the factors discussed in the following section.

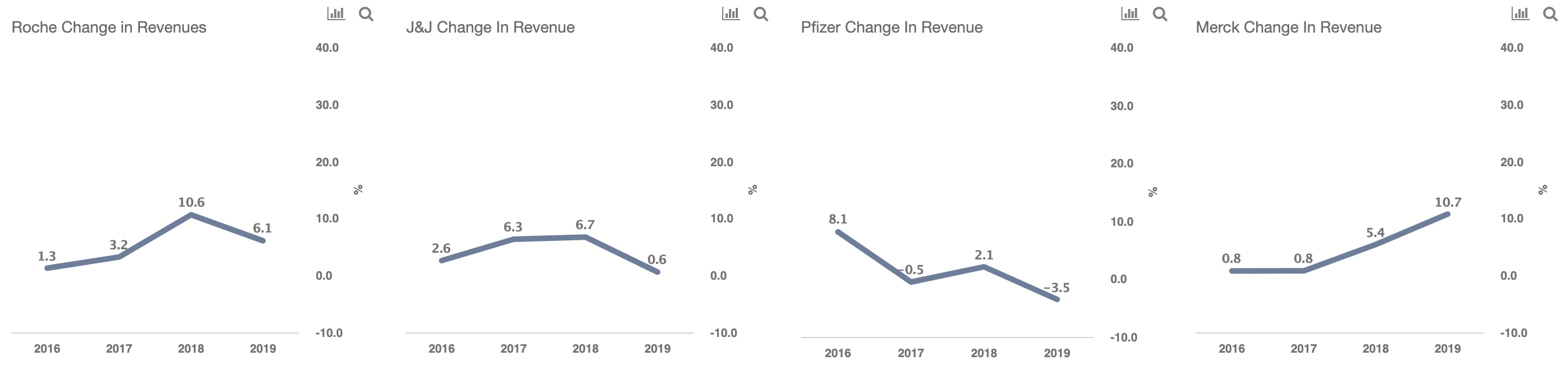

Comparing Roche’s Sales Growth To Its Peers

- Roche’s sales grew at a CAGR of 5.3% between 2015 and 2019, higher than its peers.

- This compares with 4.1% CAGR for Johnson & Johnson, 1.5% for Pfizer, and 4.4% for Merck.

Roche Has One of The Largest Oncology Drugs Portfolio, But It Is Expected To See A Decline Going Forward.

- Roche’s oncology sales grew from $26.0 billion in 2015 to $29.1 billion in 2019.

- We estimate it to grow to $30.1 billion in 2020 but decline thereafter to a little under $30.0 billion in 2022.

- The near term growth will likely be led by the company’s relatively newer drugs, including Perjeta, Kadcyla, Tecentriq, and Alecensa.

- However, some of the company’s big ticket older drugs, including Rituxan, Avastin, and Herceptin are expected to see decline, as they face biosimilar competition.

- The company estimates over $4 billion impact on sales due to biosimilar competition in 2020 alone.

Ocrevus Has Been The Best Drug Launch Ever For Roche, Boosting Its Neuroscience Drugs Portfolio

- Roche’s Neuroscience drugs sales grew at a stellar CAGR of 68% from less than $1 billion in 2015 to $4.6 billion in 2019.

- It is estimated to grow to around $8.0 billion by 2022, according to our estimates.

- Ocrevus is used for the treatment of multiple sclerosis, which is a chronic disease that affects the central nervous system, especially the brain, spinal cord, and optic nerves.

- While Biogen’s Tecfidera is the leader in the multiple sclerosis drugs market, Roche’s Ocrevus with sales of over $3.5 billion in 2019 is rapidly gaining market share.

- We estimate Ocrevus’s share to increase from 0% in 2016 to over 20% in 2021.

Other Therapeutic Drugs Could Also See Growth In The Near Term

- We have combined Roche’s reported other therapeutic and Haemophilia A drugs sales in this segment.

- The segment sales grew from $3.5 billion in 2015 to $5.4 billion in 2019.

- The jump in 2019 can largely be attributed to Hemlibra sales of $1.4 billion, as compared to $229 million sales in 2018.

- Hemlibra is used for routine prophylaxis to prevent or reduce the frequency of bleeding episodes with hemophilia A.

- Hemlibra’s peak sales are estimated to be over $5 billion, thereby boosting the segment revenues over the next few years.

Among Other Segments, In-Vitro Diagnostics Could Continue To Grow At A Steady Pace, While Immunology, Ophthalmology, And Virology Drugs Could See A Decline

- In-Vitro Diagnostics revenue has grown from $11.4 billion in 2015 to $13.2 billion in 2019, and it could grow to $14.4 billion by 2022, partly led by immuno-diagnostics, which has seen strong growth in the recent past, and this trend could continue in the near term.

- Looking at immunology drugs, the sales have increased from $6.9 billion in 2015 to $9.0 billion in 2019, led by increased market share of Xolair and Actemra. However, the sales could decline to $7.7 billion by 2022, as Xolair has lost its market exclusivity while Rituxan sales are also expected to decline amid biosimilar competition.

- Ophthalmology drugs sales have been in the range of $1.5 billion and $1.9 billion over the last few years. However, we forecast the sales to decline to $1.3 billion in 2022, as the key drug in this portfolio – Lucentis – will lose its patent this year, resulting in generic competition.

- Looking at the infectious diseases drugs portfolio, the sales declined from $2.3 billion in 2015 to $1.1 billion in 2019, and they will likely hover around the same mark over the next few years. The decline over the past years can be attributed to Pegasys, which lost over $1 billion in sales over the past few years.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams