Goldman’s Equity Underwriting Fees For Q2 Likely To Cross $500 Million For The First Time Since Early 2015

Goldman Sachs put up an exceptionally strong showing in the global equity capital markets over Q2 to capture a market share in excess of 10% for the period – making it the best performance by the investment bank in three years. While Goldman made the most of upbeat equity market conditions in U.S., the bank did extremely well to also grab the #1 position in terms of equity underwriting deal volume in Europe, Latin America as well as the Asia-Pacific region. This should boost the bank’s underwriting fees for Q2 2018, with Thomson Reuters estimating these fees to cross the $500-million mark for the first time since Q2 2015. Notably, Goldman is the only global investment bank to report more than $500 million in equity underwriting fees for any quarter since 2010 – and the bank has achieved this feat on five different occasions (Q4 2010, Q4 2013, Q2 2014, Q1 2015 and Q2 2015).

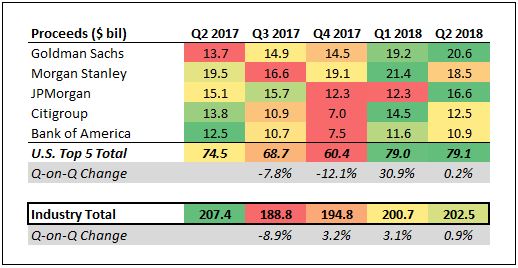

That said, the other U.S. banking giants also fared well, with the five largest U.S. banks helping companies around the world raise $79 billion in fresh equity for the period. This represents a combined market share in excess of 39% for these banks for the second consecutive year.

- Trailing S&P500 By 18% Since The Start Of 2023, What To Expect From Goldman Sachs Stock?

- Down 12% In The Last Twelve Months, Where Is Goldman Sachs Stock Headed?

- What To Expect From Goldman Sachs Stock?

- Goldman Sachs Stock Is Undervalued At The Current Levels

- Goldman Sachs To Edge Past the Consensus In Q1

- Goldman Sachs Stock Is Trading Below Its Intrinsic Value

Goldman’s notable jump in market share around the globe helped it replace Morgan Stanley at the top of the list this time around after the latter held the #1 position for four consecutive quarter. Morgan Stanley’s expertise in tech IPOs has given it an edge over competitors over recent years, with the bank’s strong showing in the Asia Pacific region (where global underwriting volumes have seen considerable growth) also playing an important part. With equity deal volumes seeing a notable improvement in U.S. and Europe in Q2, Goldman made the most of this shift while also improving its share in emerging markets.

The chart below captures the total size of equity capital market deals completed by the five largest U.S. investment banks since Q2 2017. The green-to-red shading for figures along a row show the variations in deal size for a particular bank over this period.

Equity underwriting volumes for individual banks were taken from Thomson Reuters’ investment banking league tables for the last five quarters. The table below captures the respective market shares for each of these banks over this period. The green-to-yellow shading for figures in a quarter should help compare the relative standings of these 5 banking giants in a particular quarter.

It should be noted that the largest equity capital market deals (IPOs and FPOs) employ more than one investment bank, and the market share figures here factor in the proportion of the total proceeds generated by a particular bank.

Higher Deal Volumes In The U.S. And Europe Should Translate To Higher Fees

Thomson Reuters estimates the combined equity underwriting fees for these five U.S. investment banks to increase to almost $2 billion from $1.57 billion in the previous quarter and $1.54 billion a year ago. This represents a gain of around 27% over comparative periods, with their wallet share increasing sequentially from 29% in Q4 2017 to over 37% in Q2 2018. The strong improvement in fees over recent quarters can be attributed to improved deal volumes in their core market of the U.S., as well as from the increase in the volume of IPOs as well as in the issuance of convertible securities.

Goldman Sachs is expected to report more than half a billion dollars in equity underwriting fees, with JPMorgan being a close second followed by Morgan Stanley. While Citigroup’s revenues are estimated to be around $275 million (up 24% sequentially), Bank of America’s fees should largely remain at the same level as the previous quarter.

Details about how changes to Equity Underwriting Fees (and other Investment Banking Fees) affect the share price of these banks can be found in our interactive model for Goldman Sachs | JPMorgan | Morgan Stanley | Bank of America | Citigroup

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own.