F5 Networks Q2: Software Growth, Telco Strength Surprise

F5 Networks (NYSE:FFIV) reported its Q2 on April 24. The company beat consensus expectations on EPS, with revenue coming in below street estimates. The highlight of F5’s results were strong software growth within the application delivery network segment and strong enterprise license agreement (ELA) adoption.

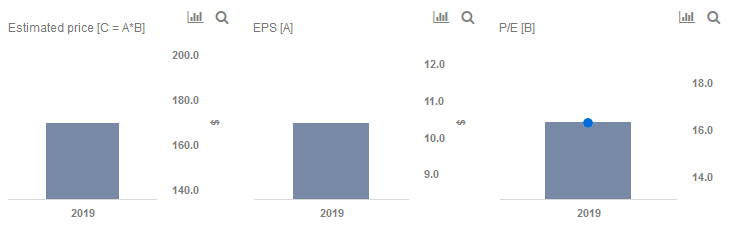

We currently have a price estimate of $170 per share for F5, which is around the current market price. Our interactive dashboard on F5 Networks’ Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation, and see more Trefis technology company data here.

- Should You Pick F5 Stock At $185 After Q1 Beat?

- After A 13% Fall This Year How Does Ciena Compare With F5 Stock?

- Should You Pick F5 Stock Over Teleflex?

- Will F5 (FFIV) Stock Recover To Its Pre-Inflation Shock Level of $250?

- What’s Next For F5 Stock After A 40% Fall Since 2021?

- F5 Inc. Stock Set For Bounce After Dismal Post-Earnings Performance?

Highlights From Q2:

- Total revenue grew to $545 million (+2.2% y-o-y)

- Application Delivery Network: Segment revenues were flat at $238 million (+0.1% y-o-y). Software grew 30% y-o-y and contributed to 19% of segment revenues, driven by multi-cloud deployments, security and capabilities in automation.

- Systems revenue declined 5% y-o-y and contributed to 81% of segment revenues.

- Services revenues: Segment revenues grew to $307 million (+3.8% y-o-y). The company continued to upsell network function virtualization (NFV) solutions to newer areas of service provider businesses. F5 also expects wireline and MSO deals to ramp up. It is notable that F5 saw an uptick in the service provider vertical, given that it has been a difficult segment over the last couple of years. However, the management has contextualized the strength in the telco segment as a natural lumpiness that tends to occur in this segment.

- For Q3, management expects revenues of $550-$560 million.

Other Notes:

- While security services (Advanced WAF and bot mitigation) remain hot topics, due to an increased focus on cloud, customers are taking longer to evaluate hardware-oriented investments.

- ELAs, while not a significant contributor to revenue currently, are generating sizable traction for the company due to the consumption flexibility they offer to customers transitioning to multi-cloud environments and undertaking bigger digital transformation projects.

- The growth in Europe was stunted by challenges in the UK (Brexit related) and in the German-Austrian region. The management expects Europe to remain an area of concern due to macroeconomic factors.

- The NGINX acquisition is likely to close in the second calendar quarter of 2019. F5 plans to augment NGINX controller’s abilities with the capabilities of F5’s own controller and then take to market an enhanced product that should be able to capture additional market share.

Do not agree with our forecast? Create your own price forecast for F5 by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.