BlackBerry’s New Technology Initiatives In Focus As It Reports Q2 Results

BlackBerry (NYSE:BB) is expected to publish its Q2 fiscal 2019 results on Friday, September 28. While the company’s core enterprise mobility management business is performing reasonably well, posting double-digit billings growth with an increasing mix of recurring revenue (about 86% in Q1), we will be watching the performance of the company’s smaller but potentially important businesses – such as the Radar fleet tracking solution and the QNX embedded software – which are seeing traction in the connected auto space. The company’s technology solutions segment, which includes these businesses, posted revenues of about $47 million in Q1, almost flat on a sequential basis. Below is a quick overview of what to expect when the company publishes results on Friday.

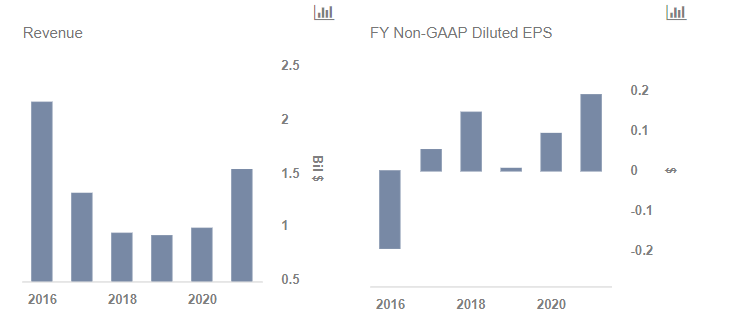

Our interactive dashboard analysis on What Will Drive BlackBerry’s Performance Over The Next 3 Years outlines our expectations for BlackBerry in the near term. You can modify key drivers to arrive at your own estimates for the company’s EPS and revenues.

What To Expect

- American Express Stock Is Up 17% YTD, What To Expect From Q1?

- Down 37% This Year, Will Roku Stock Recover Following Q1 Results?

- Will PepsiCo Beat The Consensus In Q1?

- How Will An Expanding Postpaid Phone Business Drive AT&T Stock’s Q1 Results?

- T-Mobile Stock Has Traded Sideways This Year. Will It See Gains Following Q1 Results?

- With The Stock Flat This Year, Will Q1 Results Drive SLB Stock Higher?

BlackBerry has been looking to scale its QNX software, which is ubiquitous in the automotive infotainment market, extending it to the broader connected automotive space. Over the first quarter, the company saw multiple design wins, including one for digital instrument cluster for a major auto OEM via its partner Denso. We will be looking for updates on the company’s new wins over Q2 as well. BlackBerry’s focus on connected cars could be much more lucrative compared to the company’s automotive information and entertainment system licensing operations, which are only estimated to bring in between $1.50 to $5 per vehicle. In comparison, BlackBerry previously indicated that it could garner between $5 to as much as $25 per vehicle as it expands into more sophisticated automotive technologies.

BlackBerry has been focusing on scaling up the distribution footprint of its Radar fleet tracking solution. During Q1, the company signed multiple deals with North American trucking companies including Flexi-Van and FedEx Custom Criticals, while noting that it also saw repeated buying from multiple customers. Although revenues from the initiative are not likely to be meaningful as yet, BlackBerry’s strong technology suite, which combines security and communications technology, could give it an advantage in the market. We will be looking for updates on how the business is gaining traction over Q2.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.