Here’s Anadarko’s Strategy To Deal With The Commodity Downturn In 2018

While the year 2017 has been a turnaround year for the commodity markets so far, the same is not true for the US-based independent oil and gas company, Anadarko Petroleum (NYSE:APC). The company has been involved in a few unfortunate safety accidents through the year, which have not only hampered its reputation in the market but also resulted in disappointing quarterly performance from the company. Consequently, the company’s stock is down more than 30% year-to-date, despite a 13% rise in crude oil prices during the same period.

However, the exploration and production (E&P) player acknowledges the lag in its ability to deal with the ongoing downturn and has proactively chalked out an operating plan for 2018. Anadarko will continue to preserve value and flexibility rather than chase growth in a low price environment. This is to say that the company will control its capital investments in 2018 while focusing on high-margin scalable oil assets that will drive its value going forward.

See Our Complete Analysis For Anadarko Petroleum Here

- How Will Anadarko Perform In 2019?

- Andarko 4Q: Andarko To See Improved Earnings But Cash Flow May Face Headwinds

- Anadarko Has Been Trading At A 52-Week Low. Where Will It Head Going Into 2019?

- Higher Oil Output And Improved Commodity Prices Will Drive Anadarko’s 3Q’18 Results

- Ramp Up Of Oil Production Will Drive Anadarko’s Value In The Near Term

- Key Takeaways From Anadarko’s Second Quarter Results

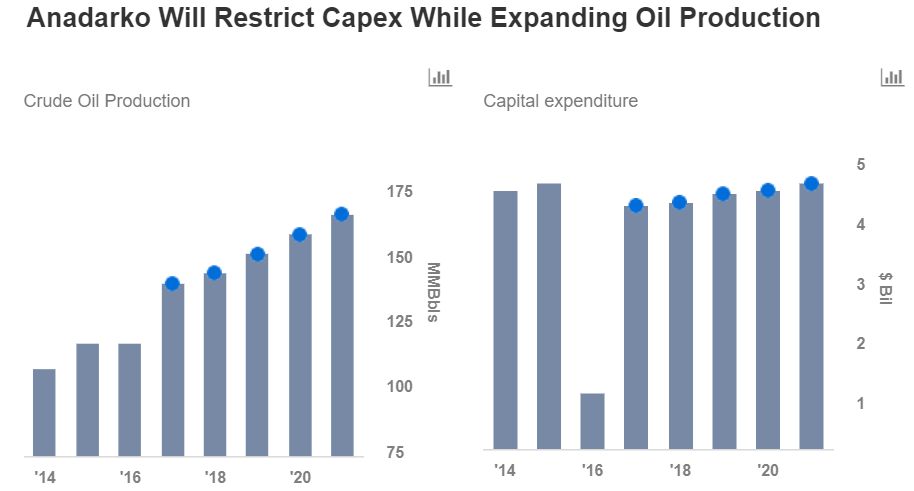

In the wake of the continued volatility in commodity prices, Anadarko had revised its 2017 capital investment budget from $4.5-$4.7 billion at the beginning of the year to $4.2-$4.4 billion in the second quarter. While oil prices have shown resilience in the last few weeks, the company plans to focus on delivering higher value and maintaining flexibility rather than chasing volume growth. Consequently, the company expects to keep its capital expenditure within its adjusted discretionary cash flows, which is expected to be in the range of $4.2 to $4.6 billion in 2018, assuming crude oil prices remain sticky at $50 per barrel and gas prices at $3 per Mcf. A majority of this capital spend will be concentrated on the company’s US onshore and deepwater markets.

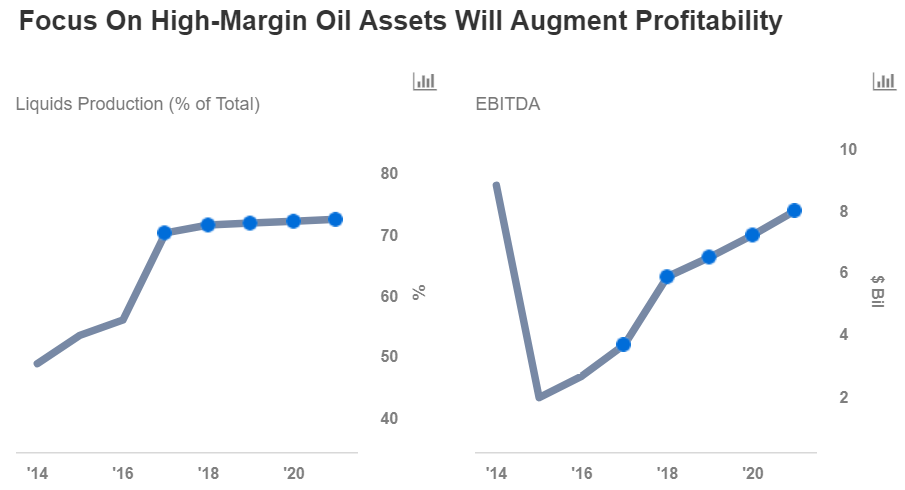

While Anadarko plans to restrict its capital investment in the coming year, it plans to grow its output at a steady rate. Further, the company has maintained its oil production growth target at 12%-14% for 2018, with the Delaware basin, the DJ basin, and the deepwater assets in the Gulf of Mexico (GOM) driving this growth. With this, the oil and gas company plans to alter its product mix and expand its liquids exposure from around 40% in 2010 to over 65% in the coming years. Since the company has already divested a large portion of its non-core and low-margin assets, it may be easy for the company to ramp up its oil production in its key basins and achieve this objective. If Anadarko is able to execute its growth plans by focusing on high-margin oil assets, coupled with the recovery in commodity prices, we expect to witness a notable jump in the company’s earnings as well as valuation.

You can view our forecast for Anadarko’s 2018 targets and create your own scenarios to analyze the impact of each driver on the company’s value using our interactive platform.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap