Here’s Why We Believe Anadarko Petroleum Is Worth $66 Per Share

At a time when most of the oil and gas companies are facing rating downgrades due to their deteriorating financial positions, Anadarko Petroleum’s (NYSE:APC) stock has rebounded close to 20% in the last 3 months. The major reason behind this jump in the company’s valuation has been the acquisition of Deepwater assets in the Gulf of Mexico (GOM) from Freeport-McMoRan Inc. (NYSE:FCX) for a sum of roughly $2 billion (Read: Deepwater Gulf Of Mexico: Freeport’s Loss Is Anadarko’s Gain – Part 2). The deal is expected to strengthen the oil and gas company’s already leading position in the GOM region and enhance its ability to expand its output in the Delaware and DJ basins. This increased activity could result in a compound annual growth of 10%-12% in Anadarko’s oil volumes over the next five years, assuming a $50 to $60 oil-price environment.

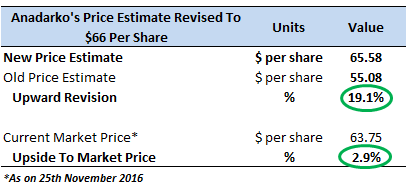

Given the upside potential from this deal, coupled with the expected recovery in commodity prices, we have revised the price estimate for Anadarko to $66 per share. Below we provide the revisions made in our forecasts based on the company’s latest guidance and performance year-to-date.

See Our Complete Analysis For Anadarko Here

- How Will Anadarko Perform In 2019?

- Andarko 4Q: Andarko To See Improved Earnings But Cash Flow May Face Headwinds

- Anadarko Has Been Trading At A 52-Week Low. Where Will It Head Going Into 2019?

- Higher Oil Output And Improved Commodity Prices Will Drive Anadarko’s 3Q’18 Results

- Ramp Up Of Oil Production Will Drive Anadarko’s Value In The Near Term

- Key Takeaways From Anadarko’s Second Quarter Results

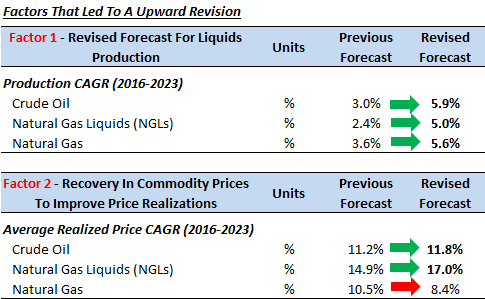

Firstly, we expect Anadarko’s production to grow faster-than-anticipated earlier, largely because of the acquisition of GOM assets. The deal is likely to double the oil and gas producers’ ownership in Lucius, one of the best performing assets in the GOM, to almost 49%. It is expected to add approximately 160,000 barrels of oil equivalents per day (boepd) (85% oil) to the company’s existing production. Further, this acquisition will enable Anadarko to accelerate drilling activity in the Delaware Basin and the DJ Basin. The company has already added two rigs in each of these regions to achieve its target of increasing its combined production to at least 600,000 BOE per day from these plays over the next five years. Thus, we have revised our production forecast for the company over our forecast period.

In addition to this, the commodity prices have shown signs of recovery over the last six months, rebounding from multi-year lows of under $30 per barrel in February of this year, to over $52 per barrel in October, backed by the announcement of a potential agreement among the Organization of Petroleum Exporting Countries (OPEC) members to cap their rising production. Assuming that the deal will pass through, we estimate the commodity prices to bounce back faster, causing a rise in Anadarko’s price realization over the next few years.

However, Anadarko’s recent step to increase its capital budget from $2.7 billion to $2.9 billion (mid-point) for the current year could work against the company. While the oil and gas major can easily fund its capital needs for this year from the proceeds of the asset monetizations of $3 billion closed so far, increasing the capital budget in the current weak price environment could be a big gamble, given its diminishing cash flows.

Thus, while we see a strong value in Anadarko’s high quality assets and execution skills, a high capital spend in a soft price environment could be a huge negative for the company and its valuation.

Have more questions about Anadarko Petroleum (NYSE:APC)? See the links below:

- Anadarko’s 3Q’16 Disappoints Investors; Company Increases Capex Guidance For 2016

- Anadarko’s 3Q’16 Earnings To Remain Low Despite Improvement In Commodity Prices

- Deepwater Gulf Of Mexico: Freeport’s Loss Is Anadarko’s Gain – Part 2

- Deepwater Gulf Of Mexico: Freeport’s Loss Is Anadarko’s Gain – Part 1

- Anadarko’s 2Q’16 Earnings Continue To Decline; Company Revises 2016 Production Target Downward

- Weak Commodity Prices Will Continue To Weigh On Anadarko’s 2Q’16 Revenue And Earnings

- Anadarko Reports Depressed 1Q’16 Earnings As The Commodity Downturn Persists

- Why Have Oil Prices Touched $50 Per Barrel In The Last Few Days?

- Why Is Saudi Arabia The Strongest Member Of The OPEC?

- Lower Commodity Prices Likely To Create A Dent In Anadarko’s 1Q16 Earnings

- How Will Anadarko’s Revenue Move If Crude Oil Prices Average At $50 Per Barrel In 2018?

- How Will Anadarko’s Revenue Move If Crude Oil Prices Rebound To $100 Per Barrel By 2018?

- Why Are Crude Oil Operations Important For Anadarko?

Notes:

1) The purpose of these analyses is to help readers focus on a few important things. We hope such lean communication sparks thinking, and encourages readers to comment and ask questions on the comment section, or email content@trefis.com

2) Figures mentioned are approximate values to help our readers remember the key concepts more intuitively. For precise figures, please refer to our complete analysis for Anadarko Petroleum

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap