Trade Ideas by Trefis

What

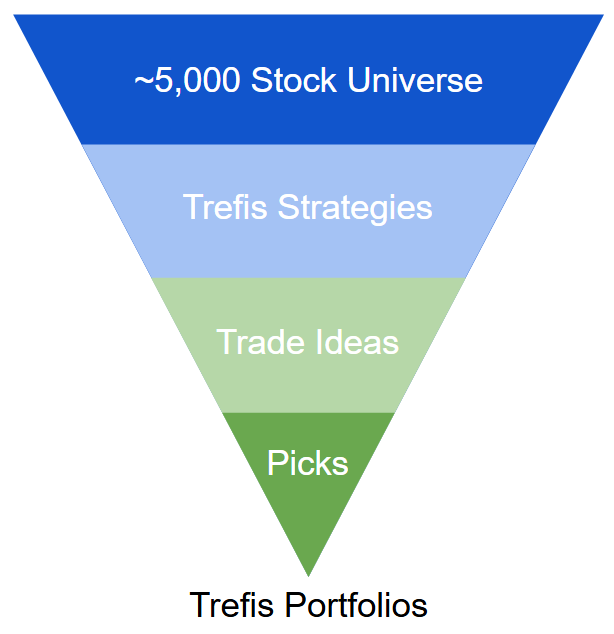

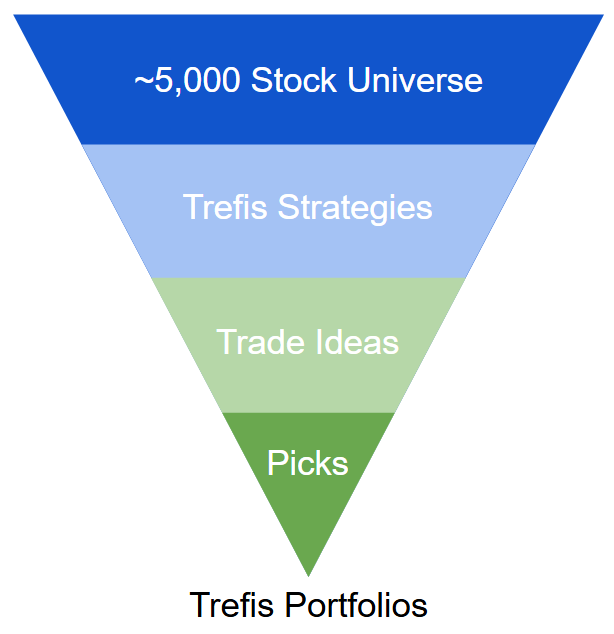

We're sharing a sample of the trade and investment strategies used by Trefis portfolios directly with you. You can see below how each trade strategy performs and what trade ideas it generates. Trade Ideas are an intermediary step between our various strategies and the final picks that make it to Trefis portfolios.

Why

Trade Ideas are to stimulate your thinking and to provide a jumping off point for you to dig deeper into any promising ideas.

What Next

For Stock Pickers: Dive in. Review, research and tell us what you think. What are your best ideas that we're missing? What other strategies would you like to see next? We welcome your feedback. For Fund Investors: Not the stock picking type? Consider Trefis Portfolios which consist of 30-50 stock holdings of some our best picks. For example, the Trefis High Quality (HQ) portfolio has a >91% cumulative return and has outperformed its benchmark. For asset allocation, sector rotation, conservative or tax-advantaged strategies, check out Help Me Invest.

Recent Trade Ideas & Performance (So Far)

| Unique Key | Date | Ticker | Company | Category | Trade Strategy | 6M Fwd Rtn | 12M Fwd Rtn | 12M Max DD |

|---|---|---|---|---|---|---|---|---|

| STZ_2132026_Dip_Buyer_FCFYield | 02132026 | STZ | Constellation Brands | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 0.0% | 0.0% | 0.0% |

| ADP_2132026_Dip_Buyer_ValueBuy | 02132026 | ADP | Automatic Data Processing | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.0% | 0.0% | 0.0% |

| EPAM_2132026_Dip_Buyer_ValueBuy | 02132026 | EPAM | EPAM Systems | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.0% | 0.0% | 0.0% |

| IQV_2132026_Dip_Buyer_ValueBuy | 02132026 | IQV | IQVIA | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.0% | 0.0% | 0.0% |

| TREX_2132026_Dip_Buyer_ValueBuy | 02132026 | TREX | Trex | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.0% | 0.0% | 0.0% |

| GDDY_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | GDDY | GoDaddy | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| INTU_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | INTU | Intuit | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| PATH_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | PATH | UiPath | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| PCTY_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | PCTY | Paylocity | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| SPSC_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | SPSC | SPS Commerce | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| TYL_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | TYL | Tyler Technologies | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| VERX_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | VERX | Vertex | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| WAY_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | WAY | Waystar | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| WDAY_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | WDAY | Workday | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| YELP_2132026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02132026 | YELP | Yelp | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| CXM_2132026_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 02132026 | CXM | Sprinklr | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| TRIP_2132026_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 02132026 | TRIP | Tripadvisor | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 0.0% | 0.0% | 0.0% |

| MA_2132026_Monopoly_xInd_xCD_Getting_Cheaper | 02132026 | MA | Mastercard | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 0.0% | 0.0% | 0.0% |

| MCO_2132026_Monopoly_xInd_xCD_Getting_Cheaper | 02132026 | MCO | Moodys | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 0.0% | 0.0% | 0.0% |

| ACN_2062026_Dip_Buyer_FCFYield | 02062026 | ACN | Accenture | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -6.8% | -6.8% | -7.7% |

| BR_2062026_Dip_Buyer_FCFYield | 02062026 | BR | Broadridge Financial Solutions | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -4.5% | -4.5% | -7.9% |

| HQY_2062026_Dip_Buyer_FCFYield | 02062026 | HQY | HealthEquity | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -7.0% | -7.0% | -7.9% |

| OMC_2062026_Dip_Buyer_FCFYield | 02062026 | OMC | Omnicom | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -1.2% | -1.2% | -3.7% |

| PAYX_2062026_Dip_Buyer_FCFYield | 02062026 | PAYX | Paychex | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -4.2% | -4.2% | -6.2% |

| DECK_2062026_Dip_Buyer_ValueBuy | 02062026 | DECK | Deckers Outdoor | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.2% | 0.2% | -0.8% |

| EXLS_2062026_Dip_Buyer_ValueBuy | 02062026 | EXLS | ExlService | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -5.2% | -5.2% | -6.3% |

| WSC_2062026_Dip_Buyer_ValueBuy | 02062026 | WSC | WillScot | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -2.9% | -2.9% | -4.7% |

| DOCU_2062026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02062026 | DOCU | Docusign | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -4.9% | -4.9% | -7.2% |

| FRSH_2062026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02062026 | FRSH | Freshworks | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -18.8% | -18.8% | -21.1% |

| MGNI_2062026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02062026 | MGNI | Magnite | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 3.6% | 3.6% | -0.8% |

| ORCL_2062026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02062026 | ORCL | Oracle | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 12.1% | 12.1% | 0.0% |

| ZS_2062026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 02062026 | ZS | Zscaler | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 6.2% | 6.2% | 0.0% |

| A_2062026_Monopoly_xInd_xCD_Getting_Cheaper | 02062026 | A | Agilent Technologies | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -2.9% | -2.9% | -3.6% |

| CDNS_2062026_Monopoly_xInd_xCD_Getting_Cheaper | 02062026 | CDNS | Cadence Design Systems | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 5.6% | 5.6% | 0.0% |

| PANW_2062026_Monopoly_xInd_xCD_Getting_Cheaper | 02062026 | PANW | Palo Alto Networks | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 4.8% | 4.8% | 0.0% |

| SPGI_2062026_Monopoly_xInd_xCD_Getting_Cheaper | 02062026 | SPGI | S&P Global | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -6.8% | -6.8% | -11.0% |

| MLI_2062026_Quality_Momentum_RoomToRun_10% | 02062026 | MLI | Mueller Industries | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 1.4% | 1.4% | -1.7% |

| FBIN_1302026_Dip_Buyer_FCFYield | 01302026 | FBIN | Fortune Brands Innovations | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -5.1% | -5.1% | -5.1% |

| FDS_1302026_Dip_Buyer_FCFYield | 01302026 | FDS | FactSet Research Systems | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -19.1% | -19.1% | -23.8% |

| LULU_1302026_Dip_Buyer_FCFYield | 01302026 | LULU | Lululemon Athletica | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 1.1% | 1.1% | -2.8% |

| PAYC_1302026_Dip_Buyer_FCFYield | 01302026 | PAYC | Paycom Software | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -7.0% | -7.0% | -11.9% |

| ROP_1302026_Dip_Buyer_FCFYield | 01302026 | ROP | Roper Technologies | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -13.4% | -13.4% | -13.8% |

| TDC_1302026_Dip_Buyer_FCFYield | 01302026 | TDC | Teradata | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 17.7% | 17.7% | -8.7% |

| PFSI_1302026_Dip_Buyer_ValueBuy | 01302026 | PFSI | PennyMac Financial Services | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -7.6% | -7.6% | -9.2% |

| CVLT_1302026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01302026 | CVLT | CommVault Systems | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 2.3% | 2.3% | -5.1% |

| NTNX_1302026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01302026 | NTNX | Nutanix | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 6.2% | 6.2% | -6.3% |

| PINS_1302026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01302026 | PINS | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -30.3% | -30.3% | -30.3% | |

| RBLX_1302026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01302026 | RBLX | Roblox | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -3.9% | -3.9% | -7.9% |

| FICO_1302026_Monopoly_xInd_xCD_Getting_Cheaper | 01302026 | FICO | Fair Isaac | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -8.1% | -8.1% | -9.2% |

| VEEV_1302026_Monopoly_xInd_xCD_Getting_Cheaper | 01302026 | VEEV | Veeva Systems | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -14.6% | -14.6% | -15.7% |

| HTZ_1302026_Short_Squeeze | 01302026 | HTZ | Hertz Global | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 2.9% | 2.9% | 0.0% |

| KSS_1302026_Short_Squeeze | 01302026 | KSS | Kohl's | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 13.6% | 13.6% | -1.0% |

| B_1302026_Quality_Momentum_RoomToRun_10% | 01302026 | B | Barrick Mining | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 4.6% | 4.6% | -4.0% |

| GCT_1302026_Quality_Momentum_RoomToRun_10% | 01302026 | GCT | GigaCloud Technology | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -11.8% | -11.8% | -14.6% |

| FIS_1232026_Dip_Buyer_FCFYield | 01232026 | FIS | Fidelity National Information Services | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -22.6% | -22.6% | -22.6% |

| APP_1232026_Monopoly_xInd_xCD_Getting_Cheaper | 01232026 | APP | AppLovin | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -25.5% | -25.5% | -30.0% |

| FFIV_1232026_Monopoly_xInd_xCD_Getting_Cheaper | 01232026 | FFIV | F5 | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 5.7% | 5.7% | 0.0% |

| NTAP_1232026_Monopoly_xInd_xCD_Getting_Cheaper | 01232026 | NTAP | NetApp | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 5.1% | 5.1% | -2.0% |

| ADBE_1162026_Dip_Buyer_FCFYield | 01162026 | ADBE | Adobe | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -10.9% | -10.9% | -13.2% |

| BIIB_1162026_Dip_Buyer_FCFYield | 01162026 | BIIB | Biogen | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 19.5% | 19.5% | 0.0% |

| BMRN_1162026_Dip_Buyer_FCFYield | 01162026 | BMRN | BioMarin Pharmaceutical | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 9.7% | 9.7% | 0.0% |

| DT_1162026_Dip_Buyer_ValueBuy | 01162026 | DT | Dynatrace | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -6.7% | -6.7% | -16.1% |

| DOCS_1162026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01162026 | DOCS | Doximity | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -39.4% | -39.4% | -40.1% |

| PD_1162026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01162026 | PD | PagerDuty | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -38.1% | -38.1% | -39.6% |

| ADSK_1162026_Monopoly_xInd_xCD_Getting_Cheaper | 01162026 | ADSK | Autodesk | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -13.0% | -13.0% | -15.9% |

| META_1162026_Monopoly_xInd_xCD_Getting_Cheaper | 01162026 | META | Meta Platforms | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 3.1% | 3.1% | -2.6% |

| IRDM_1092026_Dip_Buyer_ValueBuy | 01092026 | IRDM | Iridium Communications | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 19.8% | 19.8% | -4.6% |

| DGII_1092026_Quality_Momentum_RoomToRun_10% | 01092026 | DGII | Digi International | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 18.2% | 18.2% | 0.0% |

| CALM_1022026_Dip_Buyer_FCFYield | 01022026 | CALM | Cal-Maine Foods | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 7.3% | 7.3% | -7.7% |

| FIZZ_1022026_Dip_Buyer_FCFYield | 01022026 | FIZZ | National Beverage | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 14.8% | 14.8% | 0.0% |

| QLYS_1022026_Dip_Buyer_FCFYield | 01022026 | QLYS | Qualys | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -19.9% | -19.9% | -20.0% |

| CPRT_1022026_Dip_Buyer_ValueBuy | 01022026 | CPRT | Copart | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -0.7% | -0.7% | -2.8% |

| MORN_1022026_Dip_Buyer_ValueBuy | 01022026 | MORN | Morningstar | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -23.9% | -23.9% | -26.8% |

| CORT_1022026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01022026 | CORT | Corcept Therapeutics | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 4.6% | 4.6% | -9.1% |

| CRWV_1022026_Dip_Buyer_High_CFO_Margins_ExInd_DE | 01022026 | CRWV | CoreWeave | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 21.1% | 21.1% | -5.9% |

| PTC_1022026_Monopoly_xInd_xCD_Getting_Cheaper | 01022026 | PTC | PTC | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -7.8% | -7.8% | -12.3% |

| AAP_1022026_Short_Squeeze | 01022026 | AAP | Advance Auto Parts | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 51.3% | 51.3% | -0.4% |

| ABR_1022026_Short_Squeeze | 01022026 | ABR | Arbor Realty Trust | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -2.9% | -2.9% | -6.7% |

| GFS_12262025_Dip_Buyer_FCFYield | 12262025 | GFS | GLOBALFOUNDRIES | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 36.8% | 36.8% | -2.5% |

| EMN_12262025_Dip_Buyer_ValueBuy | 12262025 | EMN | Eastman Chemical | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 26.1% | 26.1% | 0.0% |

| TPL_12262025_Dip_Buyer_ValueBuy | 12262025 | TPL | Texas Pacific Land | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 50.3% | 50.3% | -2.1% |

| ARDT_12262025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 12262025 | ARDT | Ardent Health | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 4.1% | 4.1% | -11.4% |

| KTB_12192025_Dip_Buyer_FCFYield | 12192025 | KTB | Kontoor Brands | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 5.2% | 5.2% | -10.3% |

| NOW_12192025_Dip_Buyer_FCFYield | 12192025 | NOW | ServiceNow | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -31.1% | -31.1% | -35.2% |

| LW_12192025_Dip_Buyer_ValueBuy | 12192025 | LW | Lamb Weston | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 14.3% | 14.3% | -8.3% |

| COUR_12192025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 12192025 | COUR | Coursera | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | -21.8% | -21.8% | -24.2% |

| DDOG_12122025_Monopoly_xInd_xCD_Getting_Cheaper | 12122025 | DDOG | Datadog | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -14.2% | -14.2% | -26.9% |

| APH_12122025_Quality_Momentum_RoomToRun_10% | 12122025 | APH | Amphenol | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 13.5% | 13.5% | -2.1% |

| INCY_12122025_Quality_Momentum_RoomToRun_10% | 12122025 | INCY | Incyte | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 6.0% | 6.0% | 0.0% |

| CAG_12052025_Dip_Buyer_ValueBuy | 12052025 | CAG | Conagra Brands | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 18.2% | 18.2% | -5.7% |

| CHE_12052025_Dip_Buyer_ValueBuy | 12052025 | CHE | Chemed | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 12.1% | 12.1% | -2.2% |

| CNK_12052025_Dip_Buyer_ValueBuy | 12052025 | CNK | Cinemark | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 13.3% | 13.3% | -0.1% |

| DVA_12052025_Dip_Buyer_ValueBuy | 12052025 | DVA | DaVita | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 26.9% | 26.9% | -11.5% |

| HRB_11282025_Dip_Buyer_FCFYield | 11282025 | HRB | H&R Block | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -26.3% | -26.3% | -32.7% |

| LRN_11282025_Dip_Buyer_FCFYield | 11282025 | LRN | Stride | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 33.6% | 33.6% | -4.0% |

| BF-B_11282025_Dip_Buyer_ValueBuy | 11282025 | BF-B | Brown-Forman | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 4.2% | 4.2% | -11.8% |

| CPB_11282025_Dip_Buyer_ValueBuy | 11282025 | CPB | Campbell's | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -1.8% | -1.8% | -13.1% |

| ENPH_11282025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11282025 | ENPH | Enphase Energy | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 50.7% | 50.7% | -0.9% |

| BBWI_11282025_Dip_Buyer_1M_Insider_Buying_GTE_1Mil_EBITp+DE | 11282025 | BBWI | Bath & Body Works | Dip Buy | DB | Insider Buys | Low D/EDip Buy with Strong Insider BuyingBuying dips for companies with strong insider buying in the last 1 month, positive operating income and reasonable debt / market cap | 38.3% | 38.3% | 0.0% |

| ABNB_11212025_Dip_Buyer_FCFYield | 11212025 | ABNB | Airbnb | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 6.2% | 6.2% | 0.0% |

| CNM_11212025_Dip_Buyer_FCFYield | 11212025 | CNM | Core & Main | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 27.4% | 27.4% | -1.6% |

| CRM_11212025_Dip_Buyer_FCFYield | 11212025 | CRM | Salesforce | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -16.3% | -16.3% | -18.4% |

| MTN_11212025_Dip_Buyer_FCFYield | 11212025 | MTN | Vail Resorts | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -0.5% | -0.5% | -4.9% |

| VRRM_11212025_Dip_Buyer_FCFYield | 11212025 | VRRM | Verra Mobility | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -13.9% | -13.9% | -15.2% |

| WU_11212025_Dip_Buyer_FCFYield | 11212025 | WU | Western Union | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 16.9% | 16.9% | -0.4% |

| CROX_11212025_Dip_Buyer_ValueBuy | 11212025 | CROX | Crocs | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 19.0% | 19.0% | -1.4% |

| LII_11212025_Dip_Buyer_ValueBuy | 11212025 | LII | Lennox International | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 22.2% | 22.2% | 0.0% |

| WHD_11212025_Dip_Buyer_ValueBuy | 11212025 | WHD | Cactus | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 38.7% | 38.7% | 0.0% |

| HUBS_11212025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11212025 | HUBS | HubSpot | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -31.4% | -31.4% | -41.1% |

| DD_11212025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11212025 | DD | DuPont de Nemours | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 31.0% | 31.0% | -0.2% |

| ENR_11212025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11212025 | ENR | Energizer | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 26.7% | 26.7% | -5.3% |

| FIVN_11212025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11212025 | FIVN | Five9 | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | -11.6% | -11.6% | -15.5% |

| FLO_11212025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11212025 | FLO | Flowers Foods | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 0.3% | 0.3% | -2.4% |

| BSY_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | BSY | Bentley Systems | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -17.0% | -17.0% | -22.6% |

| CF_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | CF | CF Industries | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 21.2% | 21.2% | -3.1% |

| COIN_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | COIN | Coinbase Global | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -31.7% | -31.7% | -41.3% |

| FTNT_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | FTNT | Fortinet | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 8.5% | 8.5% | -4.4% |

| GEN_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | GEN | Gen Digital | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -10.1% | -10.1% | -15.5% |

| MSI_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | MSI | Motorola Solutions | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 25.6% | 25.6% | -1.1% |

| PEG_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | PEG | Public Service Enterprise | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 7.1% | 7.1% | -4.0% |

| TMUS_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | TMUS | T-Mobile US | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 5.3% | 5.3% | -11.9% |

| Z_11212025_Monopoly_xInd_xCD_Getting_Cheaper | 11212025 | Z | Zillow | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -38.9% | -38.9% | -38.9% |

| CW_11212025_Quality_Momentum_RoomToRun_10% | 11212025 | CW | Curtiss-Wright | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 27.7% | 27.7% | -0.4% |

| FIX_11212025_Quality_Momentum_RoomToRun_10% | 11212025 | FIX | Comfort Systems USA | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 49.6% | 49.6% | -1.2% |

| HL_11212025_Quality_Momentum_RoomToRun_10% | 11212025 | HL | Hecla Mining | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 68.9% | 68.9% | 0.0% |

| KLAC_11212025_Quality_Momentum_RoomToRun_10% | 11212025 | KLAC | KLA | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 33.5% | 33.5% | 0.0% |

| VICR_11212025_Quality_Momentum_RoomToRun_10% | 11212025 | VICR | Vicor | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 84.9% | 84.9% | 0.0% |

| CLX_11142025_Dip_Buyer_FCFYield | 11142025 | CLX | Clorox | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 22.8% | 22.8% | -6.0% |

| CRL_11142025_Dip_Buyer_FCFYield | 11142025 | CRL | Charles River Laboratories International | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -3.8% | -3.8% | -5.4% |

| MIDD_11142025_Dip_Buyer_FCFYield | 11142025 | MIDD | Middleby | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 38.9% | 38.9% | -5.4% |

| PYPL_11142025_Dip_Buyer_FCFYield | 11142025 | PYPL | PayPal | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -35.9% | -35.9% | -37.8% |

| MTH_11142025_Dip_Buyer_ValueBuy | 11142025 | MTH | Meritage Homes | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 21.5% | 21.5% | -3.3% |

| GDRX_11142025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11142025 | GDRX | GoodRx | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -26.6% | -26.6% | -27.3% |

| ASTH_11142025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11142025 | ASTH | Astrana Health | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | -12.8% | -12.8% | -15.7% |

| MLKN_11142025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11142025 | MLKN | MillerKnoll | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 49.3% | 49.3% | -6.0% |

| SGRY_11142025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11142025 | SGRY | Surgery Partners | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 1.2% | 1.2% | -12.1% |

| V_11142025_Monopoly_xInd_xCD_Getting_Cheaper | 11142025 | V | Visa | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -4.6% | -4.6% | -4.6% |

| IDCC_11142025_Quality_Momentum_RoomToRun_10% | 11142025 | IDCC | InterDigital | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 7.9% | 7.9% | -12.0% |

| LRCX_11142025_Quality_Momentum_RoomToRun_10% | 11142025 | LRCX | Lam Research | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 59.1% | 59.1% | -5.8% |

| NXT_11142025_Quality_Momentum_RoomToRun_10% | 11142025 | NXT | Nextpower | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 24.2% | 24.2% | -8.5% |

| STRL_11142025_Quality_Momentum_RoomToRun_10% | 11142025 | STRL | Sterling Infrastructure | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 29.3% | 29.3% | -16.3% |

| TFX_11072025_Dip_Buyer_FCFYield | 11072025 | TFX | Teleflex | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -5.2% | -5.2% | -8.3% |

| ZBH_11072025_Dip_Buyer_FCFYield | 11072025 | ZBH | Zimmer Biomet | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 9.3% | 9.3% | -2.9% |

| CDE_11072025_Dip_Buyer_ValueBuy | 11072025 | CDE | Coeur Mining | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 52.6% | 52.6% | -5.7% |

| NCLH_11072025_Dip_Buyer_ValueBuy | 11072025 | NCLH | Norwegian Cruise Line | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 12.7% | 12.7% | -8.2% |

| POOL_11072025_Dip_Buyer_ValueBuy | 11072025 | POOL | Pool | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 6.0% | 6.0% | -8.8% |

| PRKS_11072025_Dip_Buyer_ValueBuy | 11072025 | PRKS | United Parks & Resorts | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -7.7% | -7.7% | -17.5% |

| WD_11072025_Dip_Buyer_ValueBuy | 11072025 | WD | Walker & Dunlop | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -9.8% | -9.8% | -14.4% |

| ZTS_11072025_Dip_Buyer_ValueBuy | 11072025 | ZTS | Zoetis | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 5.8% | 5.8% | -3.7% |

| CCC_11072025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11072025 | CCC | CCC Intelligent Solutions | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -35.2% | -35.2% | -35.2% |

| CERT_11072025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11072025 | CERT | Certara | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -23.6% | -23.6% | -23.6% |

| DUOL_11072025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 11072025 | DUOL | Duolingo | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -44.1% | -44.1% | -45.7% |

| CNXC_11072025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11072025 | CNXC | Concentrix | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | -11.8% | -11.8% | -12.2% |

| RELY_11072025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 11072025 | RELY | Remitly Global | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 0.4% | 0.4% | -4.0% |

| SNPS_11072025_Monopoly_xInd_xCD_Getting_Cheaper | 11072025 | SNPS | Synopsys | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 11.1% | 11.1% | -2.4% |

| POWL_11072025_Quality_Momentum_RoomToRun_10% | 11072025 | POWL | Powell Industries | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 60.3% | 60.3% | -22.7% |

| TPR_11072025_Quality_Momentum_RoomToRun_10% | 11072025 | TPR | Tapestry | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 48.9% | 48.9% | -2.8% |

| UI_11072025_Quality_Momentum_RoomToRun_10% | 11072025 | UI | Ubiquiti | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 17.8% | 17.8% | -15.7% |

| BRO_10312025_Dip_Buyer_FCFYield | 10312025 | BRO | Brown & Brown | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -13.8% | -13.8% | -15.6% |

| CPAY_10312025_Dip_Buyer_FCFYield | 10312025 | CPAY | Corpay | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 29.5% | 29.5% | 0.0% |

| EEFT_10312025_Dip_Buyer_FCFYield | 10312025 | EEFT | Euronet Worldwide | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -10.4% | -10.4% | -10.7% |

| GEO_10312025_Dip_Buyer_FCFYield | 10312025 | GEO | GEO | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -16.3% | -16.3% | -20.6% |

| GPN_10312025_Dip_Buyer_FCFYield | 10312025 | GPN | Global Payments | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -11.7% | -11.7% | -13.3% |

| ZBRA_10312025_Dip_Buyer_FCFYield | 10312025 | ZBRA | Zebra Technologies | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -1.7% | -1.7% | -15.2% |

| ATR_10312025_Dip_Buyer_ValueBuy | 10312025 | ATR | AptarGroup | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 23.4% | 23.4% | -2.5% |

| SLGN_10312025_Dip_Buyer_ValueBuy | 10312025 | SLGN | Silgan | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 26.6% | 26.6% | -2.7% |

| DXCM_10312025_Monopoly_xInd_xCD_Getting_Cheaper | 10312025 | DXCM | DexCom | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 20.3% | 20.3% | -5.8% |

| TXN_10312025_Monopoly_xInd_xCD_Getting_Cheaper | 10312025 | TXN | Texas Instruments | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 41.0% | 41.0% | -5.0% |

| MPW_10312025_Short_Squeeze | 10312025 | MPW | Medical Properties Trust | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -1.3% | -1.3% | -5.8% |

| RUN_10312025_Short_Squeeze | 10312025 | RUN | Sunrun | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -8.0% | -8.0% | -19.1% |

| ATGE_10312025_Quality_Momentum_RoomToRun_10% | 10312025 | ATGE | Adtalem Global Education | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -2.6% | -2.6% | -8.8% |

| PLPC_10312025_Quality_Momentum_RoomToRun_10% | 10312025 | PLPC | Preformed Line Products | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 31.7% | 31.7% | -12.2% |

| GNTX_10242025_Dip_Buyer_FCFYield | 10242025 | GNTX | Gentex | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 5.8% | 5.8% | -7.7% |

| ACHC_10242025_Dip_Buyer_ValueBuy | 10242025 | ACHC | Acadia Healthcare | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -28.3% | -28.3% | -50.1% |

| TGLS_10242025_Dip_Buyer_ValueBuy | 10242025 | TGLS | Tecnoglass | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -11.5% | -11.5% | -25.2% |

| MRVL_10242025_Monopoly_xInd_xCD_Getting_Cheaper | 10242025 | MRVL | Marvell Technology | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -6.5% | -6.5% | -12.3% |

| NEM_10242025_Quality_Momentum_RoomToRun_10% | 10242025 | NEM | Newmont | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 51.3% | 51.3% | -5.7% |

| RGLD_10242025_Quality_Momentum_RoomToRun_10% | 10242025 | RGLD | Royal Gold | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 57.1% | 57.1% | -7.3% |

| LNW_10172025_Dip_Buyer_FCFYield | 10172025 | LNW | Light & Wonder | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 12.4% | 12.4% | -6.2% |

| OVV_10172025_Dip_Buyer_FCFYield | 10172025 | OVV | Ovintiv | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 31.4% | 31.4% | 0.0% |

| VRSK_10172025_Monopoly_xInd_xCD_Getting_Cheaper | 10172025 | VRSK | Verisk Analytics | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -21.8% | -21.8% | -26.9% |

| APO_10102025_Dip_Buyer_FCFYield | 10102025 | APO | Apollo Global Management | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 6.2% | 6.2% | 0.0% |

| CBT_10102025_Dip_Buyer_FCFYield | 10102025 | CBT | Cabot | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 10.9% | 10.9% | -15.1% |

| COP_10102025_Dip_Buyer_FCFYield | 10102025 | COP | ConocoPhillips | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 28.3% | 28.3% | -2.3% |

| HAL_10102025_Dip_Buyer_FCFYield | 10102025 | HAL | Halliburton | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 55.6% | 55.6% | -0.7% |

| OXY_10102025_Dip_Buyer_FCFYield | 10102025 | OXY | Occidental Petroleum | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 9.9% | 9.9% | -7.1% |

| QCOM_10102025_Dip_Buyer_FCFYield | 10102025 | QCOM | Qualcomm | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -7.9% | -7.9% | -10.8% |

| SLB_10102025_Dip_Buyer_FCFYield | 10102025 | SLB | SLB | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 61.1% | 61.1% | 0.0% |

| SWKS_10102025_Dip_Buyer_FCFYield | 10102025 | SWKS | Skyworks Solutions | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -9.2% | -9.2% | -19.2% |

| YETI_10102025_Dip_Buyer_FCFYield | 10102025 | YETI | YETI | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 49.5% | 49.5% | 0.0% |

| CARR_10102025_Dip_Buyer_ValueBuy | 10102025 | CARR | Carrier Global | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 16.4% | 16.4% | -10.8% |

| LEN_10102025_Dip_Buyer_ValueBuy | 10102025 | LEN | Lennar | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 3.4% | 3.4% | -13.4% |

| PBH_10102025_Dip_Buyer_ValueBuy | 10102025 | PBH | Prestige Consumer Healthcare | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 9.5% | 9.5% | -5.8% |

| VAC_10102025_Dip_Buyer_ValueBuy | 10102025 | VAC | Marriott Vacations Worldwide | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -12.5% | -12.5% | -27.2% |

| WEX_10102025_Dip_Buyer_ValueBuy | 10102025 | WEX | WEX | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 4.9% | 4.9% | -9.2% |

| GRND_10102025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 10102025 | GRND | Grindr | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -15.7% | -15.7% | -17.6% |

| KMX_10102025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 10102025 | KMX | CarMax | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | -4.0% | -4.0% | -28.5% |

| UWMC_10102025_Short_Squeeze | 10102025 | UWMC | UWM | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -6.7% | -6.7% | -16.4% |

| EBAY_10102025_Quality_Momentum_RoomToRun_10% | 10102025 | EBAY | eBay | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -6.6% | -6.6% | -10.0% |

| RMBS_10102025_Quality_Momentum_RoomToRun_10% | 10102025 | RMBS | Rambus | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 13.8% | 13.8% | -2.6% |

| HLNE_10032025_Dip_Buyer_FCFYield | 10032025 | HLNE | Hamilton Lane | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -3.4% | -3.4% | -10.7% |

| IPAR_10032025_Dip_Buyer_FCFYield | 10032025 | IPAR | Interparfums | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 9.2% | 9.2% | -15.8% |

| OC_10032025_Dip_Buyer_FCFYield | 10032025 | OC | Owens-Corning | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -2.1% | -2.1% | -28.8% |

| TDW_10032025_Dip_Buyer_FCFYield | 10032025 | TDW | Tidewater | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 31.2% | 31.2% | -11.3% |

| CHH_10032025_Dip_Buyer_ValueBuy | 10032025 | CHH | Choice Hotels International | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 5.9% | 5.9% | -19.0% |

| REGN_10032025_Dip_Buyer_ValueBuy | 10032025 | REGN | Regeneron Pharmaceuticals | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 34.0% | 34.0% | -7.0% |

| TEAM_10032025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 10032025 | TEAM | Atlassian | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -43.9% | -43.9% | -43.9% |

| TTD_10032025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 10032025 | TTD | Trade Desk | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -49.9% | -49.9% | -49.9% |

| FCX_10032025_Monopoly_xInd_xCD_Getting_Cheaper | 10032025 | FCX | Freeport-McMoRan | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 59.4% | 59.4% | -2.2% |

| MPWR_10032025_Monopoly_xInd_xCD_Getting_Cheaper | 10032025 | MPWR | Monolithic Power Systems | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 27.7% | 27.7% | -6.7% |

| CABO_10032025_Short_Squeeze | 10032025 | CABO | Cable One | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -36.4% | -36.4% | -59.2% |

| FUN_10032025_Short_Squeeze | 10032025 | FUN | Six Flags Entertainment | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -33.4% | -33.4% | -46.3% |

| HALO_10032025_Quality_Momentum_RoomToRun_10% | 10032025 | HALO | Halozyme Therapeutics | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 15.2% | 15.2% | -10.3% |

| AXTA_9262025_Dip_Buyer_FCFYield | 09262025 | AXTA | Axalta Coating Systems | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 21.5% | 21.5% | -6.1% |

| TAP_9262025_Dip_Buyer_FCFYield | 09262025 | TAP | Molson Coors Beverage | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 20.0% | 20.0% | -3.6% |

| FCN_9262025_Dip_Buyer_ValueBuy | 09262025 | FCN | FTI Consulting | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 0.8% | 0.8% | -6.1% |

| GIS_9262025_Dip_Buyer_ValueBuy | 09262025 | GIS | General Mills | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -0.9% | -0.9% | -12.0% |

| PCG_9262025_Dip_Buyer_ValueBuy | 09262025 | PCG | PG&E | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 21.9% | 21.9% | -0.8% |

| POWI_9262025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 09262025 | POWI | Power Integrations | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 18.7% | 18.7% | -22.7% |

| JKHY_9262025_Monopoly_xInd_xCD_Getting_Cheaper | 09262025 | JKHY | Jack Henry & Associates | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 5.2% | 5.2% | -2.1% |

| WAT_9192025_Monopoly_xInd_xCD_Getting_Cheaper | 09192025 | WAT | Waters | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 7.5% | 7.5% | -4.3% |

| ANF_9122025_Dip_Buyer_FCFYield | 09122025 | ANF | Abercrombie & Fitch | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 7.1% | 7.1% | -25.0% |

| DV_9122025_Dip_Buyer_FCFYield | 09122025 | DV | DoubleVerify | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -27.4% | -27.4% | -28.3% |

| ETSY_9122025_Dip_Buyer_FCFYield | 09122025 | ETSY | Etsy | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -22.4% | -22.4% | -22.4% |

| RVTY_9122025_Dip_Buyer_FCFYield | 09122025 | RVTY | Revvity | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 16.0% | 16.0% | 0.0% |

| SMPL_9122025_Dip_Buyer_FCFYield | 09122025 | SMPL | Simply Good Foods | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -41.2% | -41.2% | -41.2% |

| GPK_9122025_Dip_Buyer_ValueBuy | 09122025 | GPK | Graphic Packaging | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -39.3% | -39.3% | -40.3% |

| ODFL_9122025_Monopoly_xInd_xCD_Getting_Cheaper | 09122025 | ODFL | Old Dominion Freight Line | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 33.6% | 33.6% | -12.8% |

| KEX_9052025_Dip_Buyer_FCFYield | 09052025 | KEX | Kirby | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 40.2% | 40.2% | -10.2% |

| ADMA_9052025_Dip_Buyer_ValueBuy | 09052025 | ADMA | ADMA Biologics | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -4.6% | -4.6% | -17.1% |

| AES_9052025_Dip_Buyer_ValueBuy | 09052025 | AES | AES | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 29.0% | 29.0% | -3.2% |

| CNS_9052025_Dip_Buyer_ValueBuy | 09052025 | CNS | Cohen & Steers | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -7.3% | -7.3% | -17.6% |

| ISRG_9052025_Monopoly_xInd_xCD_Getting_Cheaper | 09052025 | ISRG | Intuitive Surgical | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 4.1% | 4.1% | -8.0% |

| IBKR_9052025_Quality_Momentum_RoomToRun_10% | 09052025 | IBKR | Interactive Brokers | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 24.4% | 24.4% | 0.0% |

| BRBR_8312025_Dip_Buyer_ValueBuy | 08312025 | BRBR | BellRing Brands | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -56.5% | -56.5% | -57.1% |

| FI_8312025_Dip_Buyer_ValueBuy | 08312025 | FI | Fiserv | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -53.8% | -53.8% | -55.4% |

| HAE_8312025_Dip_Buyer_ValueBuy | 08312025 | HAE | Haemonetics | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 5.9% | 5.9% | -12.6% |

| OKE_8312025_Dip_Buyer_ValueBuy | 08312025 | OKE | ONEOK | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 16.1% | 16.1% | -14.5% |

| IT_8312025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 08312025 | IT | Gartner | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | -36.9% | -36.9% | -39.5% |

| LNTH_8312025_Dip_Buyer_High_CFO_Margins_ExInd_DE | 08312025 | LNTH | Lantheus | Dip Buy | DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 26.4% | 26.4% | -8.7% |

| AMAT_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | AMAT | Applied Materials | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 121.2% | 121.2% | -2.8% |

| COO_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | COO | Cooper Companies | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 23.1% | 23.1% | -4.6% |

| EFX_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | EFX | Equifax | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -21.4% | -21.4% | -28.6% |

| ON_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | ON | ON Semiconductor | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 45.6% | 45.6% | -9.5% |

| UHAL_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | UHAL | U-Haul | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -13.7% | -13.7% | -15.3% |

| WST_8312025_Monopoly_xInd_xCD_Getting_Cheaper | 08312025 | WST | West Pharmaceutical Services | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 1.6% | 1.6% | -6.3% |

| BWXT_8312025_Quality_Momentum_RoomToRun_10% | 08312025 | BWXT | BWX Technologies | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 23.8% | 23.8% | -1.2% |

| LEU_8312025_Quality_Momentum_RoomToRun_10% | 08312025 | LEU | Centrus Energy | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -1.3% | -1.3% | -8.2% |

Disclaimers

Investing Tips

Individual stock trading carries considerable risk and volatility. Before you invest:

Performance by Trade Strategy

Wondering what performance looks like at a strategy level?See below. Some strategies perform well while others are included to showcase interesting concepts despite mediocre performance.

| Trade Ideas | Forward Returns [1] | Win Rates [2] | |||||||

|---|---|---|---|---|---|---|---|---|---|

| Trade Strategy | Category | # of Ideas | Since | Med 6M | Med 12M | Avg 6M | Avg 12M | WR 6M | WR 12M |

| DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | Dip Buy | 481 | 12312016 | 9.2% | 16.9% | 9.6% | 18.8% | 62.6% | 70.7% |

| DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | Dip Buy | 312 | 12312016 | 11.3% | 19.2% | 11.4% | 21.8% | 66.7% | 67.9% |

| DB | CFO/Rev | Low D/EDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | Dip Buy | 158 | 12312016 | 2.7% | 3.1% | 3.9% | 14.6% | 53.8% | 52.5% |

| DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | Dip Buy | 134 | 12312016 | 13.7% | 29.1% | 22.5% | 51.1% | 69.4% | 64.9% |

| DB | Cash/EquityDip Buyer with High Net Cash % EquityBuying dips for companies with significant net cash as a % of market cap along with meaningful cash flow generation | Dip Buy | 19 | 12312016 | 15.4% | -3.8% | 15.1% | 6.5% | 73.7% | 47.4% |

| DB | Insider Buys | Low D/EDip Buy with Strong Insider BuyingBuying dips for companies with strong insider buying in the last 1 month, positive operating income and reasonable debt / market cap | Dip Buy | 9 | 12312020 | 6.7% | -4.9% | 8.7% | 13.1% | 66.7% | 44.4% |

| MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | Monopoly | 258 | 12312016 | 7.7% | 15.8% | 11.8% | 21.0% | 69.8% | 73.6% |

| Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | Special | 117 | 12312017 | 0.1% | -2.1% | 8.8% | 11.1% | 49.6% | 47.9% |

| DB | Growth | FCF YieldDip Buy with Growth and High Free Cash Flow YieldBuying dips for companies with growth, and significant free cash flow yield (FCF / Market Cap) | Dip Buy | 32 | 12312016 | 15.5% | 67.6% | 14.1% | 63.1% | 81.2% | 100.0% |

| Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | Quality | 329 | 12312016 | 6.4% | 7.1% | 9.0% | 13.6% | 60.2% | 61.1% |

| Trade Ideas | Forward Returns [1] | Win Rates [2] | |||

|---|---|---|---|---|---|

| Trade Strategy | # of Ideas | Since | Med 12M | Avg 12M | WR 12M |

| DB | FY MDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 481 | 12312016 | 16.9% | 18.8% | 70.7% |

| DB | P MDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 312 | 12312016 | 19.2% | 21.8% | 67.9% |

| DB | C/RDip Buy with High Cash Flow MarginsBuying dips for companies with significant cash flows from operations and reasonable debt / market cap | 158 | 12312016 | 3.1% | 14.6% | 52.5% |

| DB | FCFDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 134 | 12312016 | 29.1% | 51.1% | 64.9% |

| DB | Cash/EDip Buyer with High Net Cash % EquityBuying dips for companies with significant net cash as a % of market cap along with meaningful cash flow generation | 19 | 12312016 | -3.8% | 6.5% | 47.4% |

| DB | InsBDip Buy with Strong Insider BuyingBuying dips for companies with strong insider buying in the last 1 month, positive operating income and reasonable debt / market cap | 9 | 12312020 | -4.9% | 13.1% | 44.4% |

| MY | P/SMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 258 | 12312016 | 15.8% | 21.0% | 73.6% |

| Shrt SqzShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 117 | 12312017 | -2.1% | 11.1% | 47.9% |

| DB | Gr | FCFDip Buy with Growth and High Free Cash Flow YieldBuying dips for companies with growth, and significant free cash flow yield (FCF / Market Cap) | 32 | 12312016 | 67.6% | 63.1% | 100.0% |

| Q |M | UQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 329 | 12312016 | 7.1% | 13.6% | 61.1% |

Notes:[1] Median and average forward returns for 6 and 12 month periods since idea date across # of ideas shown[2] Win rate = % of trade ideas with positive returns during forward periods

Prior Trade Ideas & Performance

Trade ideas before 8/17/2025. Some of these may still be good ideas!

| Unique Key | Date | Ticker | Company | Category | Trade Strategy | 6M Fwd Rtn | 12M Fwd Rtn | 12M Max DD |

|---|---|---|---|---|---|---|---|---|

| ACLS_7312025_Dip_Buyer_FCFYield | 07312025 | ACLS | Axcelis Technologies | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 36.2% | 39.7% | 0.0% |

| BMY_7312025_Dip_Buyer_FCFYield | 07312025 | BMY | Bristol-Myers Squibb | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 28.6% | 43.9% | -0.3% |

| KWR_7312025_Dip_Buyer_FCFYield | 07312025 | KWR | Quaker Houghton | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 36.3% | 57.8% | 0.0% |

| MKSI_7312025_Dip_Buyer_FCFYield | 07312025 | MKSI | MKS | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 157.2% | 174.9% | -5.8% |

| UTHR_7312025_Dip_Buyer_FCFYield | 07312025 | UTHR | United Therapeutics | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 70.3% | 72.4% | 0.0% |

| ALGN_7312025_Dip_Buyer_ValueBuy | 07312025 | ALGN | Align Technology | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 27.2% | 44.8% | -3.2% |

| CNC_7312025_Dip_Buyer_High_FCF_Yield_ExInd_DE_RevG | 07312025 | CNC | Centene | Dip Buy | DB | FCF Yield | Low D/EDip Buy with High Free Cash Flow YieldBuying dips for companies with significant free cash flow yield (FCF / Market Cap) and reasonable debt / market cap | 67.2% | 55.7% | -3.3% |

| CMCSA_7312025_Monopoly_xInd_xCD_Getting_Cheaper | 07312025 | CMCSA | Comcast | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -4.2% | 3.5% | -19.5% |

| FICO_7312025_Monopoly_xInd_xCD_Getting_Cheaper | 07312025 | FICO | Fair Isaac | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 4.5% | -6.4% | -8.7% |

| MANH_7312025_Monopoly_xInd_xCD_Getting_Cheaper | 07312025 | MANH | Manhattan Associates | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | -29.1% | -36.1% | -38.3% |

| MRK_7312025_Monopoly_xInd_xCD_Getting_Cheaper | 07312025 | MRK | Merck | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 41.3% | 58.3% | 0.0% |

| CAR_7312025_Short_Squeeze | 07312025 | CAR | Avis Budget | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -32.1% | -30.5% | -32.7% |

| HTZ_7312025_Short_Squeeze | 07312025 | HTZ | Hertz Global | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -20.7% | -21.4% | -24.3% |

| KSS_7312025_Short_Squeeze | 07312025 | KSS | Kohl's | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 57.9% | 85.5% | -1.0% |

| RKT_7312025_Short_Squeeze | 07312025 | RKT | Rocket Companies | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 40.6% | 26.5% | 0.0% |

| VSAT_7312025_Short_Squeeze | 07312025 | VSAT | Viasat | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | 181.4% | 197.3% | 0.0% |

| EXEL_7312025_Quality_Momentum_RoomToRun_10% | 07312025 | EXEL | Exelixis | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 16.7% | 21.3% | -4.6% |

| SII_7312025_Quality_Momentum_RoomToRun_10% | 07312025 | SII | Sprott | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 95.5% | 84.5% | -6.7% |

| SJM_6302025_Dip_Buyer_FCFYield | 06302025 | SJM | JM Smucker | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 3.1% | 16.0% | -1.8% |

| FTV_6302025_Dip_Buyer_ValueBuy | 06302025 | FTV | Fortive | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 8.0% | 9.4% | -10.7% |

| WMS_6302025_Dip_Buyer_ValueBuy | 06302025 | WMS | Advanced Drainage Systems | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 29.8% | 49.2% | -3.5% |

| MU_6302025_Monopoly_xInd_xCD_Getting_Cheaper | 06302025 | MU | Micron Technology | Monopoly | MY | Getting CheaperMonopoly-Like with P/S DeclineLarge cap with monopoly-like margins or cash flow generation and getting cheaper based on P/S multiple | 139.3% | 234.7% | -14.8% |

| ABR_6302025_Short_Squeeze | 06302025 | ABR | Arbor Realty Trust | Special | Short Squeeze PotentialShort Squeeze PotentialHas potential for a short squeeze. High short interest, rising short interest and high debt. | -22.4% | -23.5% | -26.4% |

| HCI_6302025_Quality_Momentum_RoomToRun_10% | 06302025 | HCI | HCI | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | 27.3% | 4.3% | -9.4% |

| PLMR_6302025_Quality_Momentum_RoomToRun_10% | 06302025 | PLMR | Palomar | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -12.2% | -14.4% | -28.8% |

| SKWD_6302025_Quality_Momentum_RoomToRun_10% | 06302025 | SKWD | Skyward Specialty Insurance | Quality | Q | Momentum | UpsideQuality Stocks with Momentum and UpsideBuying quality stocks with strong momentum but still having room to run | -9.8% | -21.7% | -25.9% |

| AKAM_5312025_Dip_Buyer_FCFYield | 05312025 | AKAM | Akamai Technologies | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 17.9% | 47.2% | -7.1% |

| BBWI_5312025_Dip_Buyer_FCFYield | 05312025 | BBWI | Bath & Body Works | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | -36.4% | -12.1% | -45.7% |

| BIO_5312025_Dip_Buyer_FCFYield | 05312025 | BIO | Bio-Rad Laboratories | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 43.2% | 13.1% | -4.6% |

| GMED_5312025_Dip_Buyer_FCFYield | 05312025 | GMED | Globus Medical | Dip Buy | DB | FCFY OPMDip Buy with High FCF Yield and High MarginBuying dips for companies with high FCF yield and meaningfully high operating margin | 53.8% | 48.9% | -12.3% |

| BF-B_5312025_Dip_Buyer_ValueBuy | 05312025 | BF-B | Brown-Forman | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | -11.7% | -8.0% | -22.4% |

| BLD_5312025_Dip_Buyer_ValueBuy | 05312025 | BLD | TopBuild | Dip Buy | DB | P/E OPMDip Buy with Low PE and High MarginBuying dips for companies with tame PE and meaningfully high operating margin | 60.0% | 94.7% | -0.8% |