Zynga’s Bookings Will Likely See Strong Growth In The Near Term

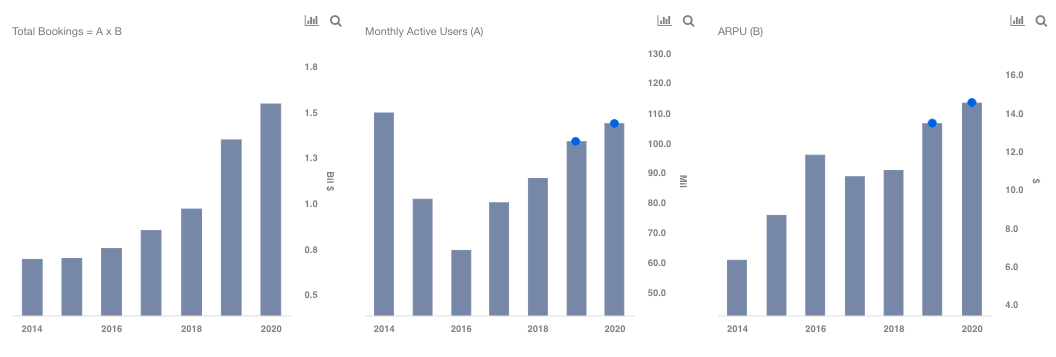

Zynga (NASDAQ:ZNGA) reported a 14% jump in net bookings in 2018. This was fueled by steady growth in both monthly active users (MAUs), and average booking per active user (ABPU). The company’s user base seems to be recovering steadily from the drastic declines suffered in 2015 and 2016. Also, the company is monetizing its existing user base better. We have created an interactive dashboard analysis ~ How Much Can Zynga’s Bookings Grow In Next Two Years? You can adjust the drivers to see the impact on the company’s total bookings.

Expect Total Bookings To See Strong Growth In The Near Term

We forecast the total bookings to grow in the high thirties percent in 2019 and in low teens in 2020. This can be attributed to strong growth in both MAUs and ABPU. MAUs are also likely to improve in the near term with the launch of new games, such as Game of Thrones, Harry Potter, and Star Wars. These games are expected to perform well, given the interest associated with these franchises. Also, the company is seeing continued growth in its forever franchises, such as the racing game CSR 2, and Words With Friends. This trend will likely continue in the near term as well. In addition, the company’s recent acquisitions of Gram Games, and Small Giant Games, which houses some of the popular gaming titles, including Empires & Puzzles, and Merge Dragons, will aid the active user growth.

Looking at ABPU, it declined in high single-digits in 2017, after seeing a strong growth in 2015 and 2016. It grew in low single-digits to $11 in 2018, and we forecast it to grow to north of $14 by 2020. This can be attributed to the strong expected growth in demand for its new games, which should give the company some room to better monetize its user base, primarily from advertising and in-game offerings. Note that Zynga also faces risk to its top line growth from the intense competition in the market. The social gaming market has become competitive as the cost of developing games is low. Other gaming giants such as Activision Blizzard and Electronic Arts are also focusing on mobile games. However, we expect strong top line growth in the near term and forecast the adjusted earnings to be $0.25 per share in 2019, reflecting a mid-single-digit y-o-y growth. Look at our interactive dashboard analysis ~ A Quick Snapshot of Zynga’s Q4 Performance And Trefis Estimates For The Full Year 2019. You can adjust various drivers to see the impact on the company’s earnings.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.