After Solid Q4, Zynga Is Poised To See Strong Double-Digit Growth In 2019, Led By Recent Acquisitions And New Game Launches

Zynga (NASDAQ:ZNGA) recently reported its Q4 results, which were better than our estimates, led by strong growth in mobile bookings. The stock price rallied 5% following the earnings announcement. Looking forward, the company has guided for a very strong 2019, led by its recent acquisitions, as well as new game launches, that will aid its top line growth. The overall bookings are expected to grow around 40% in 2019, while we estimate mid-single-digit growth in adjusted earnings. This can be attributed to higher expenses estimated for 2019, along with a change in deferred revenue. We have created an interactive dashboard analysis ~ A Quick Snapshot of Zynga’s Q4 Performance And Trefis Estimates For The Full Year 2019. You can adjust various drivers to see the impact on the earnings.

Expect Total Bookings To See Roughly 40% Growth In 2019

Zynga will likely see mid-to-high twenties percent growth in its Online Games and Advertising & Other segments. The company is seeing continued growth in its forever franchises, such as CSR 2, and Words With Friends. This trend will likely continue in 2019 as well. However, the top line growth will primarily be driven by the impact of the company’s recent acquisitions of Gram Games, and Small Giant Games, which houses some of the popular gaming titles, including Empires & Puzzles, and Merge Dragons, along with its pipeline of games. Merge Dragons in Q4 saw a 132% jump in revenues, and 64% jump in bookings sequentially, and it is now part of the company’s forever franchises. Zynga’s pipeline of new games slated to launch in second half of 2019, and beyond, is also very strong, and includes popular titles, such as Game of Thrones, Harry Potter, and Star Wars. These games are expected to perform well, and help the top line growth.

Looking at adjusted EBITDA, we forecast a slight decline in margins, due to expected higher expenses, including higher royalties. As such, the growth in adjusted EBITDA will likely be around 25% to $161 million in 2019. Adjusted Net Income will likely grow in mid-single-digits to $223 million in 2019. Note that while the company’s top line will likely see strong growth in 2019, the bottom line is expected to see slow growth, being impacted by a change in deferred revenues. The company has guided for $200 million change in deferred revenues, which compares with $62 million in 2018.

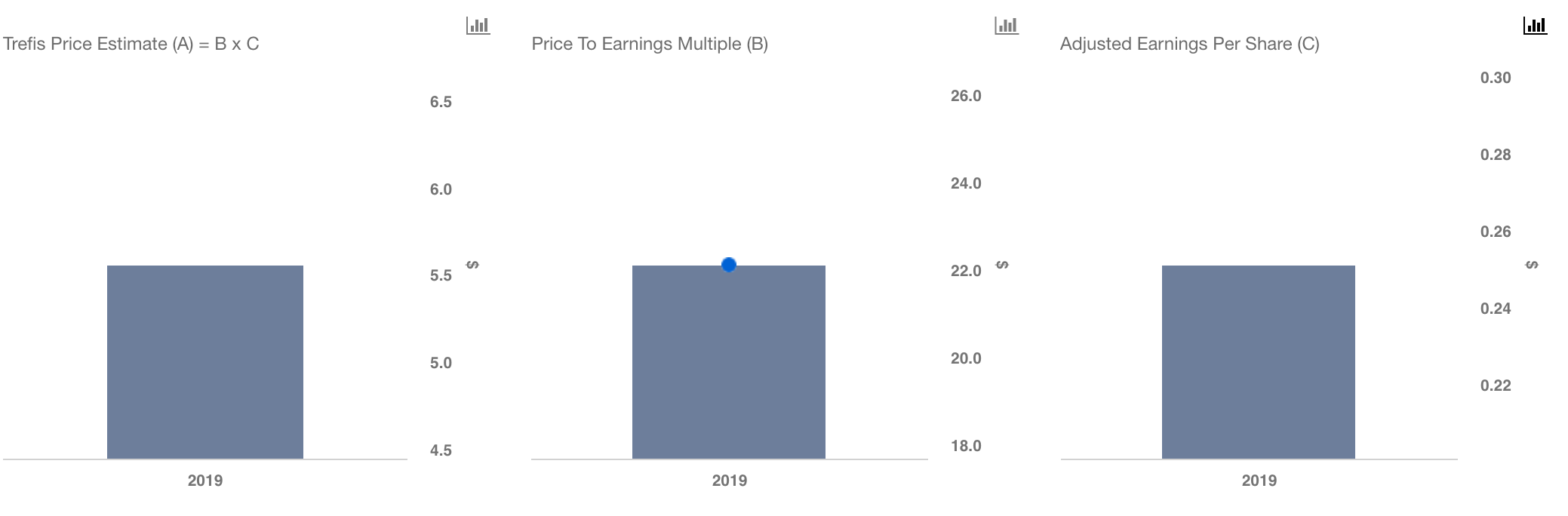

Overall, the impact of acquisitions, and new game launches, will drive the top line growth for the company in 2019. We forecast the adjusted earnings to be $0.25 per share, reflecting a mid-single-digit y-o-y growth. Our price estimate of $6 for Zynga is based of a 22x forward price to earnings multiple, and it is at a premium of over 15% to the current market price.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.