Exxon Surprises The Market With Its Strong 3Q’17 Earnings

Exxon Mobil (NYSE:XOM), the world’s largest publicly traded oil and gas company, posted a strong set of financial numbers for its September quarter 2017 on 27th October 2017((Exxon Mobil Announces September Quarter Results, www.exxonmobil.com)). The company took the market by surprise as it exceeded the consensus estimate for both revenue and earnings, despite the negative impact of Hurricane Harvey on its downstream operations. Further, the fact that the company’s cash flows from operations and asset sales exceeded its dividend and net investments for the fourth consecutive quarter, pleased the investors. Going forward, Exxon will continue to focus on expanding its presence in the Permian basin, and in Guyana.

We currently have a price estimate of $84 per share for Exxon Mobil, which is in line with its market price.

See Our Complete Analysis For Exxon Mobil Here

- Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

- Down 9% Since The Beginning of 2023, What Should You Expect From Exxon Mobil Stock?

- Will Exxon Mobil Stock Trade Higher Post Q2?

- What’s Happening With Exxon Mobil Stock?

- Exxon Mobil Stock Likely To Trade Lower Post Q4

- What To Expect From Exxon Mobil’s Stock Post Q2?

Key Highlights of 3Q’17 Results

- Since Hurricane Harvey had a limited impact on Exxon’s upstream operations, its total production for the quarter stood at 3.9 million barrels of oil equivalent per day (boed), nearly 2% higher compared to the year ago quarter. Further, the company realized higher oil and gas prices during the quarter compared to the same quarter of last year. Consequently, the oil major’s upstream earnings rose to $1.6 billion, almost $950 million higher compared to the last year.

- Exxon experienced higher refining margins, primarily distillate and gasoline, which increased its downstream earnings by almost $1 billion. However, this was partially offset by lower throughput due to closure of its refining and chemical operations in Baytown, Mont Belvieu, and Beaumont due to Hurricane Harvey, along with some unfavorable one-time charges. Yet, the company’s reported downstream earnings of $1.5 billion, $300 million higher compared to the same quarter of 2016.

- However, Exxon’s chemical operations remained low during the quarter due to weaker commodity margins, partially offset by higher product sales backed by increased demand, and new capacity.

- The company generated cash flows of $8.4 billion from its operations and asset sales, which exceeded the dividend payments of $3.3 billion and net investments of $3.4 billion made during the quarter. Further, the company reduced its debt by roughly $1.4 billion, while it did not make any share repurchases during the quarter.

Going Forward

- Exxon has announced its fifth offshore discovery in Guyana with the successful results of the Turbot well. This discovery will further increase the estimated gross recoverable resource for the Stabroek Block (currently in the range of 2.25-2.75 billion boe). The company plans to drill an additional well in 2018 to help delineate this discovery, which is likely to produce world class oil and deliver strong returns.

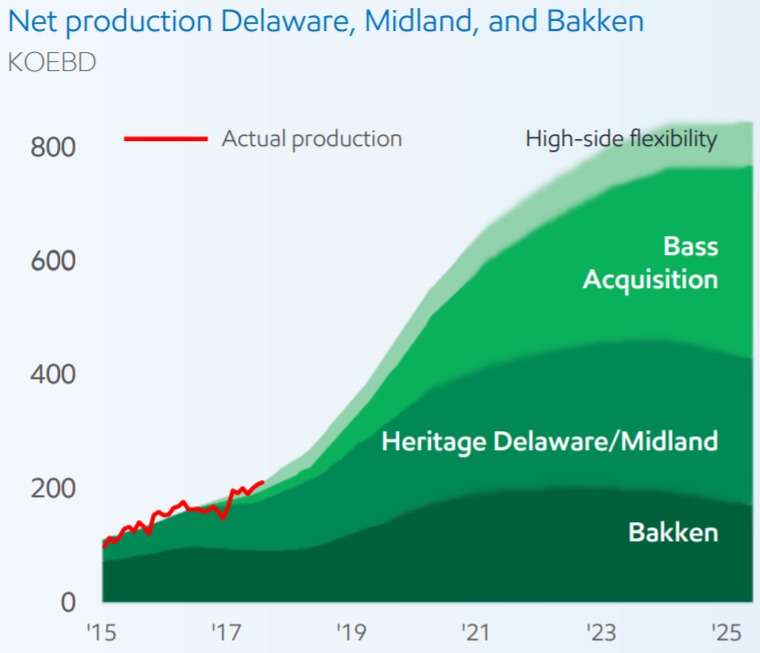

- Having added 22,000 acres to its existing 6 billion barrels of oil equivalent (boe) Permian Basin portfolio since May 2017, Exxon now plans to ramp up its operations in the region by deploying approximately 30 rigs by 2018. The company targets to grow its average production at a compounded annual rate of 20% until 2025.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap