Exxon Mobil Is Adopting An Aggressive Approach To Beat The Commodity Slump

At a time when oil and gas companies across the globe are consciously weighing their actions, Exxon Mobil (NYSE:XOM) appears to be taking an aggressive approach to beat the ongoing commodity trough. While the oil and gas giant failed to impress investors with its December quarter performance, the company’s management is pleased with the way its exploration and expansion activities are panning out. Not only is the company actively looking at acquisitions and partnerships that can boost its resource base and augment its future growth, it is also making strong progress in exploring its existing assets to leverage the anticipated recovery in commodity prices. In this note, we briefly discuss the recent discoveries and acquisitions made by the company and how they are likely to impact its value in the long term.

See Our Full Analysis For Exxon Mobil Here

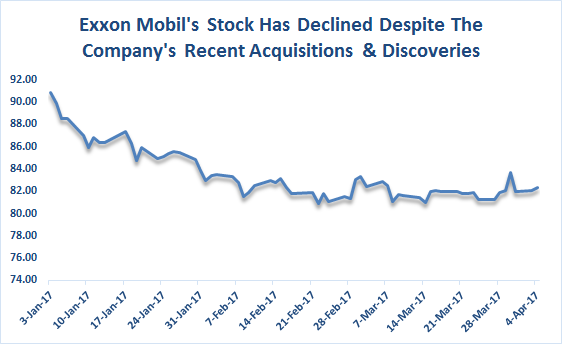

Source: Google Finance

- Down 9% Since The Beginning of 2023, What Should You Expect From Exxon Mobil Stock?

- Will Exxon Mobil Stock Trade Higher Post Q2?

- What’s Happening With Exxon Mobil Stock?

- Exxon Mobil Stock Likely To Trade Lower Post Q4

- What To Expect From Exxon Mobil’s Stock Post Q2?

- Can Amazon Stock Add Two Exxon Mobils To Its Market Capitalization?

Continued Success At Increasing The Resource Base In Guyana

After the successful initial results from the Liza-1 in 2015 and Liza-2 wells in 2016, Exxon Mobil was in the news earlier this year when the company’s Liza-3 well identified an additional high quality, deeper reservoir directly below the Liza field, with an estimated resource potential of 100-150 million barrels of oil equivalent (BOE). This resource discovery is in addition to the 1 billion BOE of recoverable oil already identified in the Liza Field. Further, according to the company’s estimates, the appraisal of the Liza-4 well, which is expected to take place later this year, is likely to increase the recoverable resource base of the area to 1.4 billion BOE.

Apart from the Liza Field, Exxon has also received positive results from its Payara-1 well and Snoek well offshore Guyana in the last few months. These successive discoveries have instilled confidence in the company, causing it to ramp up its exploration and drilling activity in the region to take advantage of the low cost opportunity. For the first phase of the production process, the oil and gas major aims to make an investment decision in 2017, and the project is estimated to potentially add 100,000-120,000 BOE per day to Exxon’s production post 2020.

Phase 1 & 2 of Exxon’s Liza Field

Rapid Expansion Plans In US Gulf Coast

Earlier this month, Exxon Mobil announced its plans to expand its manufacturing capacity along the U.S. Gulf Coast through planned investments of $20 billion over the next 10 years. The move is strategically motivated by the U.S. government’s stance of incentivizing the manufacturing sector in the country. The company’s Gulf expansion program consists of 11 major chemical, refining, lubricant, and liquefied natural gas projects at proposed new and existing facilities along the Texas and Louisiana coasts. Most of the new chemical capacity will be targeted toward export markets in Asia and adjoining areas. These projects are likely to generate around 45,000 new high-paying jobs and increased economic activity in the region.

Apart from this, Exxon is also trying to expand its operations in Brazil, since it is the only oil major that does not have a sizable presence in the country. While the company is working with Hess Corp., Exxon’s partner in various projects, to enter the Brazilian markets, there has been speculation that the company is in talks to enter a joint venture through which it plans to invest in projects with Petrobras, the Brazilian state-controlled oil and gas company. With this deal, the integrated company aims to gain access to Brazil’s deep-water oil resources. However, there has been no confirmation from the two companies. If Exxon Mobil manages to make this deal, it will have a huge opportunity to expand its operations in the Brazilian market, which has been largely dominated by Petrobras.

Growing Presence In The Permian Basin

At the beginning of the year, Exxon Mobil acquired an estimated resource base of 3.4 billion BOE in New Mexico’s Delaware Basin, which is considered to be a highly prolific, oil-prone section of the Permian Basin. The deal entails a one-time sum of $5.6 billion in the form of shares and a series of additional contingent cash of roughly $1 billion, to be paid between 2020 and 2032, depending upon the development of the resource. With this deal, Exxon’s estimated resources base in the basin has doubled to approximately 6 billion BOE, making the company one of the most prominent producers in the largest and most economical oil plays in the US.

Since the Permian Basin is known for an abundance and high quality of oil reserves, the cost of production in the region is significantly lower compared to the other oil plays in the country. As a result, oil producers can generate higher profits and returns by operating in this region. To this end, Exxon plans to add 15 or more rigs, in addition to its existing 10 working rigs, in the region following the closure of the deal. Moreover, the company has managed to drastically bring down well development costs in the oil play, and it is estimated to yield 30-35% higher margins compared to its other assets. With an increased resource base in one of the most profitable oil plays in the country, Exxon will have significant upside potential if and when the commodity markets bounce back.

Thus, we believe that while most of its peers are taking a defensive approach to deal with the downturn, Exxon Mobil is rapidly expanding its presence in high-potential and high-margin markets through acquisitions and extensive exploration activities in order to maintain its leading position in the industry.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap