What To Expect From US Steel’s Fourth Quarter Results?

US Steel (NYSE: X), an integrated steel producer, will release its fourth-quarter 2018 results on January 30, 2019. The market expects the company to report revenue of $3.75 billion, 19.8% higher on a year-on-year basis. The Non-GAAP earnings for the quarter is expected to be $1.84 per share compared to $0.76 per share reported a year ago. The higher EPS is likely to be the result of higher realized prices in the US and the European Tubular segment along with cost reduction on account of operational efficiency, along with lower interest expense and finance costs.

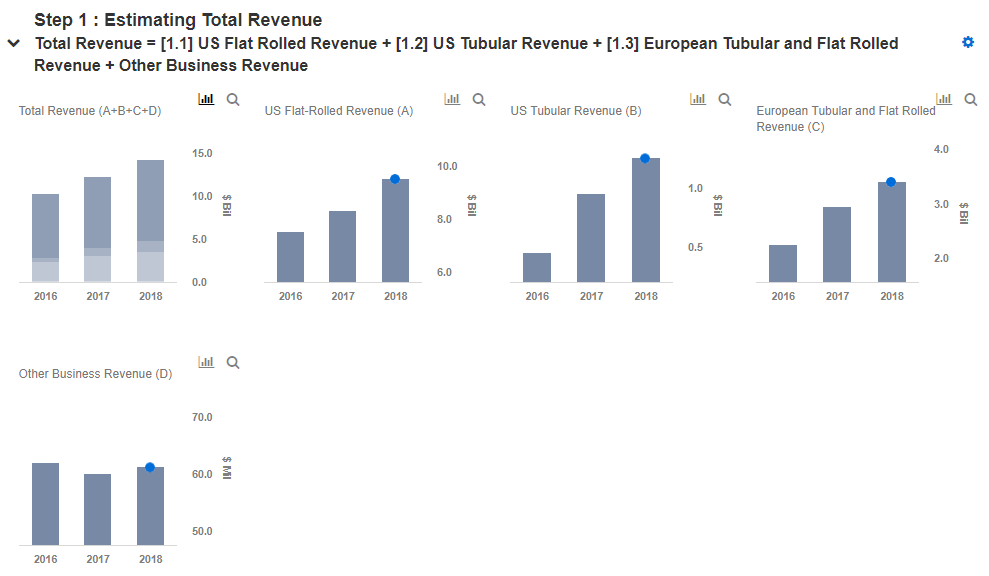

We have a price estimate of $35 per share for the company, which is higher than its current market price. Our detailed estimates for US Steel’s key drivers that impact its price estimate are available in our interactive dashboard – US Steel Q4 2018 Earnings Preview. You can make changes to our assumptions to arrive at your own price estimate for the company.

- Can U.S. Steel Stock Return To Pre-Inflation Shock Highs?

- What’s Happening With U.S. Steel Stock?

- Will U.S. Steel Stock Continue To Outperform Despite Economic Headwinds?

- Is U.S. Steel Set For Tough Q3 Results?

- Why We Are Cutting Our Price Estimate For U.S. Steel Stock

- How Will U.S. Steel Stock Fare In An Uncertain Economy?

Key Factors Affecting US Steel’s Q4 2018 Results

Revenue growth in the U.S. Flat-Rolled division, which accounts for nearly 64% of the company’s revenues, is expected to be muted on account of the ongoing production disruption due to the asset revitalization program. Though China’s production curtailment came into effect in Q4, it was less severe than the one implemented a year ago, causing steel prices to decline in Q4. However, for the full year, the flat-rolled segment is expected to grow by ~15%, driven by higher average realized prices and flat shipment growth compared to the previous year. The highest revenue growth is expected to be contributed by the US Tubular segment. 2018 saw oil prices heading north, which increased the demand in the Tubular segment. Though oil prices have subsided in the last quarter from their 2018 highs in Q3, for the full year the US Tubular revenue is expected to increase by over 32%. Revenue from European operations is likely to grow by 15% on account of increased volume and prices.

In December 2018, US Steel redeemed all of its outstanding Senior Notes due 2020 ($356 million aggregate principal amount). This is expected to be reflected in lower interest expense and finance costs for the year. Also, US Steel is expected to reap benefits in the form of operational efficiency and reduced cost from its ongoing $2.0 billion asset revitalization program. These factors would boost the net income margin for the year, which is likely to increase to 6.2% in FY2018 from 3.2% in FY2017. US Steel is expected to end the year with a net income of $875 million, translating into earnings per share of $4.94.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.