Can Macau Drive Growth For Wynn Resorts In Q2?

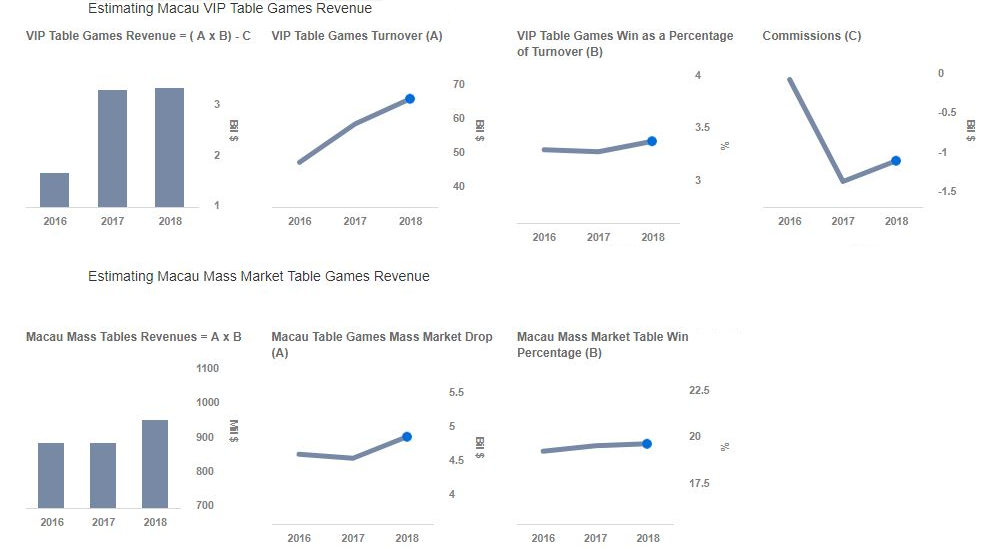

Wynn Resorts (NYSE:WYNN) is expected to publish its Q2 2018 results on August 1, reporting on what is likely to be another strong quarter. Consensus market estimates call for the company to report revenue of $1.7 billion and earnings of just under $2 per share on an adjusted basis. Macau contributes nearly 75% of its overall revenue, and has reported strong revenue growth in recent years, largely driven by increased VIP visitation due to the recovery of the Macau gaming industry. This trend continued in the first quarter of 2018, with net revenues growing at almost 21% year-on-year to over $1.7 billion. Macau revenue was up 28% year-on-year to just under $1.3 billion. However, robust interest in the FIFA World Cup dampened casino traffic in Macau in Q2. Despite this, the gaming revenues were up for the 23rd straight month in June 2018. The company is likely to benefit from the development of new hotel rooms at Wynn Las Vegas, renovation of its regional casinos, remodeling of its Encore suites and full scale development of two new restaurants at Wynn Macau. This should help improve gaming and non-gaming services in the domestic and Macau markets. We expect this to continue through the end of the fiscal year, driven by strong growth in the Macau VIP and mass market. Further, the expected opening of Encore Boston Harbor in the second half of 2019 should boost its domestic revenue and provide for significant medium term growth. Below, we take a look at what to expect when the company reports earnings.

We have a $200 price estimate for Wynn Resorts, which is higher than the current market price. The charts have been made using our new, interactive platform. You can click here to modify the different driver assumptions, and gauge their impact on the earnings and price per share metrics.

We have a $200 price estimate for Wynn Resorts, which is higher than the current market price. The charts have been made using our new, interactive platform. You can click here to modify the different driver assumptions, and gauge their impact on the earnings and price per share metrics.

Factors That May Impact Future Performance

- With Macau Business Picking Up Pace, Will Wynn Stock Recover To Pre-Inflation Shock Highs Of $140?

- Will Wynn Stock Recover To Pre-Inflation Shock Highs Of $140?

- Can Wynn Stock Return To Its Pre-Inflation Shock Highs?

- What’s New With Wynn Stock?

- With Optimism About A Macau Recovery, Is Wynn Stock A Buy?

- What’s Happening With Wynn Stock?

Macau enjoyed a strong Q1, as margins improved as a result of robust revenue growth due to the casino industry rebound in the region. The gross gaming revenues (GGR) in Macau grew consistently for the 23rd straight month in June 2018. The GGR grew by nearly 17% y-o-y in Q2’18, indicating a strong first half. We expect Macau to be the driving force for Wynn in 2018, driven by increased visitations in both VIP and mass market segments. While the VIP market continues to see robust growth since the anti-corruption cooldown, a noteworthy trend in Q1’18 has been robust growth in the mass market segment, growing at just over 20%. Further, this trend continued into in Q2, driving Macau growth. This growth can be attributed to increased visitation by casual gamblers due to the improved infrastructure development – the high-speed rail link and the Hong Kong-Zhuhai-Macau Bridge, both connecting Macau to Hong Kong. These tailwinds in the Macau casino market, coupled with its positioning in the VIP market, strong growth in the mass market, the strategic alliance with Galaxy Entertainment Group, and an improving Chinese economy, should provide for another year of robust growth for Wynn. Further, the addition of two new properties in Macau should provide long-term growth opportunities.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

More Trefis Research

Like our charts? Explore example interactive dashboards and create your own