How Much Will Las Vegas Contribute To Wynn’s Top Line Growth?

Wynn Resorts (NYSE:WYNN) has performed strongly over the past few years, with nearly 24% annual growth in revenue and a 14% jump in the stock price between 2015-2017. The strong growth was largely driven by a jump in overall Macau casino revenue and a full operational year of Wynn Palace, its newest property in the Cotai region. Las Vegas, which contributes about 27% of company’s overall revenue, saw modest growth due to saturation in the Las Vegas gaming industry.

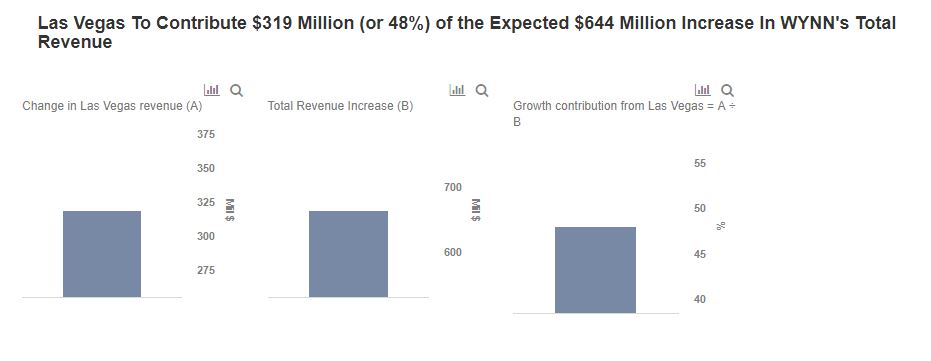

Based on recent market trends and the near-term outlook provided by the company’s management, we forecast Wynn to report 5-6% revenue growth in the next two years, from $7 billion in FY 2018 to about $7.7 billion in FY 2020. Of the estimated $660 million incremental revenues, we estimate that Las Vegas will contribute nearly half. We arrive at this estimate from Wynn’s key growth metrics such as slot games, food and beverage, and hotel revenue. We have summarized our expectations on our interactive dashboard platform. If you disagree with our forecasts, you can change the key drivers for Las Vegas to gauge how changes will impact its expected revenue.

- With Macau Business Picking Up Pace, Will Wynn Stock Recover To Pre-Inflation Shock Highs Of $140?

- Will Wynn Stock Recover To Pre-Inflation Shock Highs Of $140?

- Can Wynn Stock Return To Its Pre-Inflation Shock Highs?

- What’s New With Wynn Stock?

- With Optimism About A Macau Recovery, Is Wynn Stock A Buy?

- What’s Happening With Wynn Stock?

Estimates for Key Growth Drivers

The company’s Las Vegas operations have seen revenue growth of around 2% annually between 2015-2017. This was largely due to modest growth in casino and hotel revenue on a comparable basis, as a result of saturation in the Las Vegas gaming industry. The company expects domestic resorts to grow in mid-to-high single digits in the second half of 2018, driven by several citywide conventions and a recovery in the Vegas market. Further, the expected opening of Encore Boston Harbor in the second half of 2019 should boost its domestic revenue and provide for significant medium term growth. However, Wynn expects to see some near term pressure in Las Vegas given the development of Paradise Park – a lagoon-themed park – and its ongoing work at Boston Harbor, which should likely impact company’s margins. We expect the domestic market to remain the driving force led by the improved outlook of the U.S. economy, recovery in the Vegas market – owing to recent tax cuts and higher customer spending – and its expansion into Massachusetts. Further, we expect the legalization of sports gambling to boost its domestic operations.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own