Could Decreasing Silver Revenue Play Spoilsport In Wheaton Precious Metals’ Q4 2018 Results?

Wheaton Precious Metals (NYSE: WPM), one of the world’s largest precious metals streaming companies, is set to announce its fourth quarter results on March 20, 2019, followed by a conference call the next day. The market expects the company to report revenue of $1.9 billion in Q4 2018, 21% lower than in Q4 2017. Adjusted earnings for the quarter are expected to be $0.06 per share in Q4 2018 compared to $0.19 per share in the year-ago period. The lower revenue and EPS for the quarter is likely to be the result of lower shipments and a decline in the price of silver, slightly offset by higher gold revenue and the addition of Palladium sales in Q4.

We have summarized our key expectations from Wheaton Precious Metals’ earnings announcement in our interactive dashboard – Would Wheaton Precious Metals be able to report higher revenue and margins in its FY 2018 results? In addition, here is more Materials data.

- Down 8% From Highs Seen In December 2023, Will Wheaton Stock Gain Following Q4 Results?

- Up 23% This Year, Will Wheaton Precious Metals Stock Continue To See Gains?

- What To Expect From Wheaton Precious Metals Q2 2023 Results?

- What To Expect From Wheaton’s Q1 Results?

- With Production Set To Pick Up, Is Wheaton Stock A Buy?

- With Gold Prices Recovering, Is Wheaton Stock A Buy?

Key Factors Affecting Earnings

Decreasing Silver Revenue: Revenue from silver is expected to decline by about 6.6% to $392 million in 2018 from $419 million in 2017, driven by lower shipments and declining prices. In its preliminary operations report, WPM reported a decrease in silver volume to 24.5 million ounces in 2018 from 24.6 million ounces in 2017, due to weaker than expected silver production at Penasquito mine and expiry of the streaming agreement related to the Lagunas Norte, Veladero, and Pierina mines in March 2018. Additionally, the termination of the previous San Dimas PMPA in mid-2018 has contributed toward lower output and is expected to lead to further reduction in shipments going forward. Price realization is also likely to be lower as silver prices declined in 2018 on the back of a stronger dollar and rising interest rates in the US, which made the greenback a much more lucrative investment option compared to precious metals.

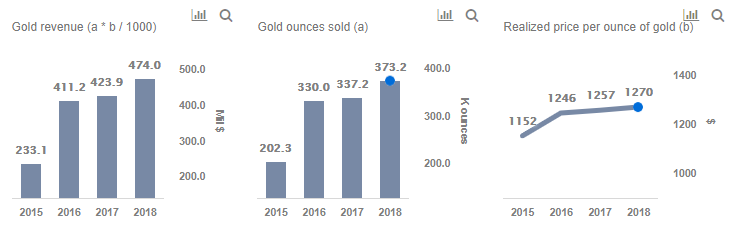

Increasing Gold Revenue: Revenue from gold is expected to increase by close to 12% to $474 million for the year 2018, compared to $424 million during the previous year. This increase is likely to be primarily driven by a 10.7% increase in volume sold. WPM’s acquisition of a new gold stream at Stillwater and the new agreement with First Majestic at the San Dimas mine would add to the gold sales and production volume. Under the new San Dimas agreement, the silver production would be converted to gold at a fixed ratio, which would, in turn, lead to higher gold volume attributable to WPM. Gold prices saw some volatility during 2018 due to a stronger dollar and rising interest rates in the US. However, toward the end of the year, prices increased with higher retail and institutional investment in the yellow metal, with many Central Banks buying gold as a hedge against rising economic uncertainty.

Addition of Palladium: As per its preliminary report, WPM sold about 14.7 million ounces of palladium in 2018. We expect the company to realize a price of $1,050 per ounce sold as prices increased during the second half of the year, which benefited the company. Palladium is a new addition to WPM’s revenue streams with the company having entered into an agreement with Sibanye-Stillwater to acquire palladium at an agreed ratio of total production at the site.

Higher Margins: The company’s net income margin is expected to witness a sharp increase in 2018. However, higher margins would be driven by a one-time benefit of gain from the termination of the previous San Dimas silver purchase agreement, which amounts to approximately $245.7 million. This gain would be slightly offset by higher interest expense on the back of rising interest rates and increased amount drawn under WPM’s revolving credit facility.

Growth Prospects

We expect the declining silver production to be completely offset by rising gold output, which would be driven by the new San Dimas agreement and Stillwater acquisition. Additionally, the company has announced the expansion of its Salobo III mine, thus ramping up its total gold production. With the addition of Palladium to its portfolio, WPM is expected to reap benefits of this diversification as palladium prices have increased sharply in the last couple of months. Thus, rising production of gold and palladium, along with a positive price outlook and expansion projects in the pipeline, is expected to support WPM’s stock price going forward.

We have a price estimate of $24 for the company’s share price, which is higher than its current market price.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.