Why Is Walmart Acquiring Cornershop?

Walmart (NYSE:WMT) recently announced a $225 million acquisition of online marketplace Cornershop, which provides on-demand delivery from supermarkets, pharmacies and specialty food retailers in Mexico and Chile. This acquisition seems to be in line with Walmart’s strategy to expand its omnichannel capabilities and growth in Latin America – by leveraging its strong supply chain and store network. In fact, this move follows Walmart’s deals in online delivery across the world, including an investment of $320 million in Dada-JD Daojia in China and a strategic alliance with Rakuten in Japan.

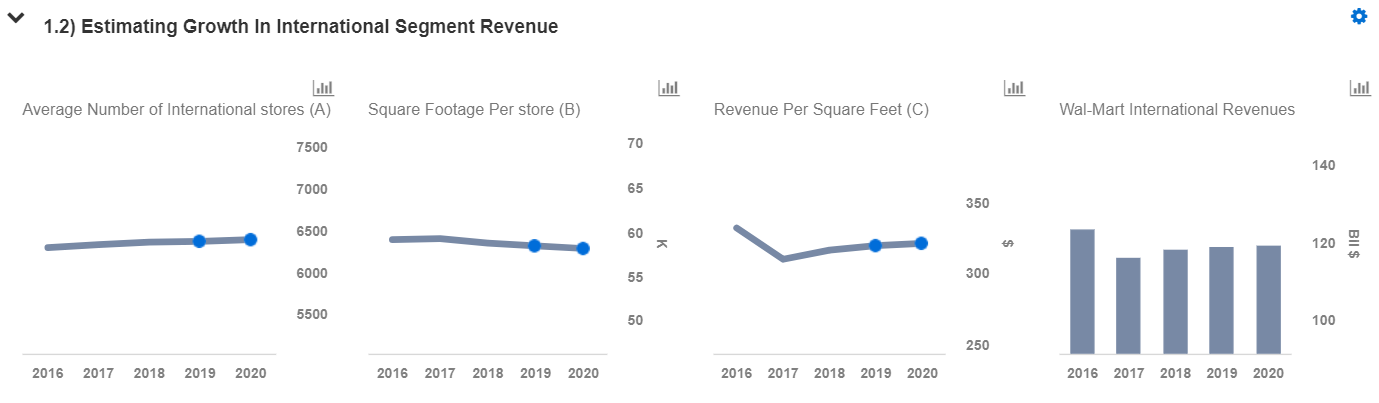

Accordingly, we expect Walmart’s revenue to grow by nearly $24 billion (2% CAGR) through fiscal 2020 (year ending January 2020). To arrive at our fiscal 2020 net revenue estimates for Walmart, we have broken down the revenues and estimated separately. We have also created an interactive dashboard analysis on how Walmart is likely to grow in the next two years which provides detailed steps of how to arrive at this growth number. You can make changes to these variables to arrive at your own revenue estimates for the company. We expect Walmart to generate around $524 billion in revenues in fiscal 2020, and earnings of almost $15 billion. Of the total expected revenues in fiscal 2020, we estimate $340 billion in the Walmart U.S. business, almost $119 billion for the Walmart International business, and nearly $60 billion for Sam’s Club. We have a $98 price estimate for Walmart, which is slightly ahead of the current market price.

Growing Presence of Walmex

- Where Is Walmart Stock Headed Post Stock Split?

- Up 7% Already This Year , Where Is Walmart Stock Headed Post Q4 Results?

- Up 18% This Year, Will Walmart Stock Continue To Grow Past Q3?

- Can Walmart’s Stock Trade Lower Post Q2?

- Walmart Stock Likely To See Little Movement Post Q1

- Walmart Stock To Trade Lower Post Q3 Results?

Walmex includes the consolidated results of Mexico and Central America. In the recent Q2 results, Walmex’s net sales increased 7.3% y-o-y, while the comparable sales increased 5.4% y-o-y. It makes sense for Walmart to invest in emerging economies with growth potential to increase its international revenues going forward. Mexico and Central America have substantial scope for improvement in supply chain operations, and also offer an opportunity for growth in discount retailing because of the relatively lower (but growing) average disposable incomes, lifestyle changes in the middle class and increased digital connectivity.

The Cornershop deal could lead to higher growth in online sales for Walmart in its international business. E-commerce has been on the rise in the last several years, thanks in large part to internet retailers. Consequently, it is necessary for brick-and-mortar retailers to pick up their digital initiatives to grow further. By 2020, we expect Walmart’s e-commerce sales to contribute about 4% of the company’s total sales. While this figure is unlikely to be massive, it should help the company offset secular pressure on brick-and-mortar retail locations. Total U.S. e-commerce sales came in at $453 billion for 2017 (8.9% of total retail sales), and are expected to reach $526 billion for 2018. Additionally, total e-commerce sales could grow to represent 12.4% of U.S. retail sales in 2020 and reach over $70o billion.

We have calculated Walmart’s total revenue by estimating the revenues from the company’s domestic sales, international sales, Sam’s Club sales, and other income. Further, we have calculated the retailer’s divisional revenues by estimating the number of stores, square footage per store and revenue per square foot. We expect close to 6390 stores in international markets with an average square footage per store of 58k and revenue per square foot of $321, translating into $119 billion (+1% y-o-y) in international revenues in fiscal 2020.

The value addition of Walmart’s expansion in markets outside the U.S. could significantly impact the company’s financials in the long run due to the growth potential of these markets. Further, we also expect online grocery to drive growth for the company. However, we expect this aggressive push in online initiatives to put pressure on margins in the near term, due to increased fulfillment costs resulting from growth in digital sales.

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own