What’s The Upside On Western Digital’s Stock?

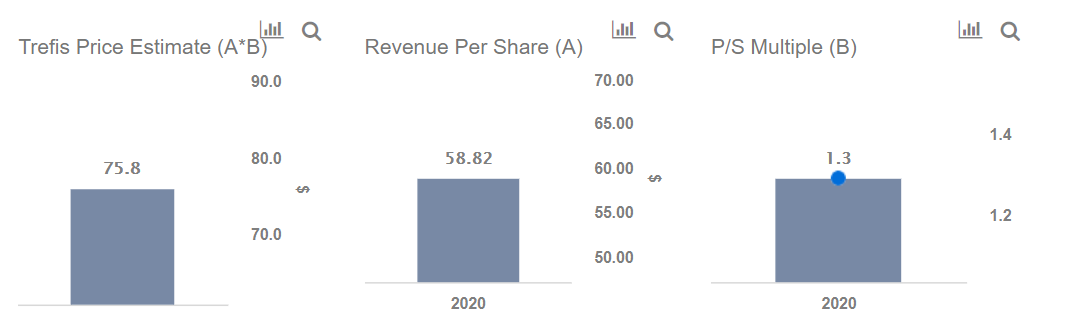

Western Digital’s (NASDAQ: WDC) stock currently stands at around $69 per share, while we expect a fair price of around $75.80 per share of WDC’s stock. Our price estimate is based on expected 2020 revenue per share of $58.82 and a price-to-sales multiple of around 1.3x.

We have summarized our forecasts in our interactive dashboard on Western Digital’s Valuation where we detail some of the key steps in identifying WDC’s valuation sensitivity to changes in its segment revenues, shares outstanding, and valuation multiple.

We arrive at the stock price estimate for WDC as:

Stock Price = (Total Revenue / Shares Outstanding) x P/S Multiple

- Should You Pick Western Digital Stock At $65 After 25% Gains This Year?

- After Rising Over 30% In 2023 Is This Casino Stock A Better Pick Over Western Digital Stock?

- Which Is A Better Pick – Western Digital Stock Or Expedia?

- Will Western Digital Stock Rebound To Its Pre-Inflation Shock Highs?

- Will Western Digital Stock See Higher Levels After A 20% Rise This Year?

- Western Digital Stock Set For Bounce After Weak Post-Earnings Performance?

A] Estimating Total Revenue

- Total revenue has dropped from $19.09 billion in 2017 to $16.57 billion in 2019, on the back of a supply glut in the memory market.

- Also, a drop in electronics demand has affected client devices revenue, but we expect electronics demand to get back on track towards late-2020.

- A shift toward streaming services and cloud storage has dragged down external storage demand, and we expect client solutions revenue to remain under pressure due to this.

- However, a rise in enterprise demand can help support WDC’s total revenue, which should rise marginally to $16.88 billion in 2020.

B] Determining Western Digital’s Revenue Per Share

- Revenue per Share (RPS) has decreased from $66.30 in 2017 to $56.74 in 2019 due to a sharp drop in revenue, combined with a rise in shares outstanding.

- We estimate RPS to increase marginally to $58.82 in 2020.

- Expected rise in RPS in 2020 can be attributed to marginal revenue growth combined with a drop in outstanding share count.

C] Estimating Western Digital’s Share Price

- Our Price Estimate of $75.8 For Western Digital’s stock is based on our Detailed Valuation Model, and implies a P/S Multiple of 1.3x on expected 2020 RPS of $58.82

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams