Western Digital’s Q4 Earnings Highlighted In 5 Charts

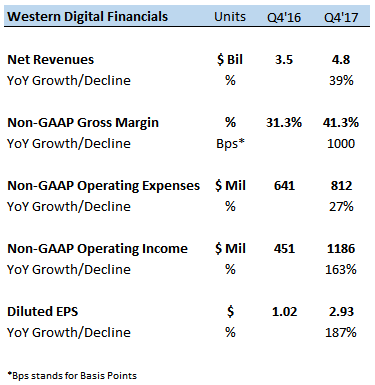

Western Digital (NASDAQ:WDC) announced its fiscal fourth quarter 2017 earnings on Thursday, July 27, reporting a 39% annual increase in net revenue to $4.8 billion. Revenue was in line with the guidance given by the company at the end of the March quarter, while the gross margin for the quarter exceeded guidance.

See our complete analysis for Western Digital

1. Key Financial Metrics

- Strong revenue growth was complemented by a 10 percentage point improvement in the non-GAAP gross margin. The addition of SanDisk’s product portfolio to the company’s business has helped boost revenues as well as gross margins, given that SanDisk’s flash-based storage hardware has higher margins than WD’s hard disk products. As a result, Western Digital has observed a surge in gross margins through fiscal 2017.

- The company’s operating profit margin (non-GAAP) also increased by almost 12 percentage points to 24.5% for the quarter, driven by a limited increase in operating expenses. Expense synergies from the SanDisk acquisition were primarily responsible for restricting non-GAAP operating expenses to around WD’s targeted range of around $800 million.

- Resulting net income and earnings per share were significantly higher on a y-o-y basis, as shown below.

- Should You Pick Western Digital Stock At $65 After 25% Gains This Year?

- After Rising Over 30% In 2023 Is This Casino Stock A Better Pick Over Western Digital Stock?

- Which Is A Better Pick – Western Digital Stock Or Expedia?

- Will Western Digital Stock Rebound To Its Pre-Inflation Shock Highs?

- Will Western Digital Stock See Higher Levels After A 20% Rise This Year?

- Western Digital Stock Set For Bounce After Weak Post-Earnings Performance?

2. Unit Shipments

- Hard disk drive (HDD) shipments for laptops and desktops combined were down 1% y-o-y to 19.2 million units. Shipments for this segment have remained low for Western Digital and rival hard drive manufacturer Seagate (NASDAQ:STX) over the last couple of years.

- Enterprise HDD unit shipments were up 3% on a y-o-y to 6.2 million HDDs for the June quarter. Sales in this segment have been driven by robust demand for the cloud-based storage and data center storage over the last few quarters.

- Shipments for consumer electronics HDDs and branded HDDs combined were down 5% on a y-o-y basis to 13.9 million units.

3. Capacity Shipments

- WD reported a massive 36% increase in capacity shipped for datacenter and enteprise storage to 33.5 exabytes for the quarter. The company has reported a strong demand for its 10TB and 12TB Helium drives over the last few quarters.

- Comparatively, client devices and client solutions segments observed a mild exabyte growth, as shown below.

4. Revenue By Segment

- Western Digital observed significant revenue growth from the Client Devices revenue stream, which includes notebook and desktop hard drives, consumer electronics hard drives, solid state drives (SSDs) for non-enterprise customers, embedded storage and wafer sales. Combined revenues for Client Devices were up 52% to $2.4 billion, with significant growth coming from SanDisk’s client SSD product portfolio.

- The Client Solutions segment – which primarily includes products sold via the retail channel including branded HDDs, branded flash products and removable storage products (such as memory cards and USB flash drives) – reported strong growth in revenues, despite a fall in unit shipments of HDDs. Product sales were up over 50% y-o-y to $1 billion in the June quarter, with retail products driving growth.

- Datacenter and enterprise revenues were up 14% y-o-y to $1.4 billion, driven by strong demand for cloud-related storage.

5. Guidance For September Quarter

- Western Digital’s management expects revenues of around $5.1 billion for the September quarter, which is 9% higher on a y-o-y basis.

- Gross margin is expected to be around 12 percentage points higher over the year-ago period to around 41%.

- The company expects non-GAAP operating expenses to be flat sequentially at around $810 million due continued expense synergies with the integration of SanDisk.

- Disciplined expense management, higher revenues and healthier gross margins could help the company achieve its expected diluted earnings per share of $3.30, which is over 100% higher over the September quarter of last year.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research