How Have VMware’s Prospects Changed Post-Q3 Results?

VMware‘s (NYSE:VMW) Q3 revenue of $2.2 billion and non- GAAP EPS of $1.56 came in ahead of consensus estimates. The company continues to see strong adoption across cloud and on-premise. However, continued investment needed to grow the business are likely to keep a lid on margin growth.

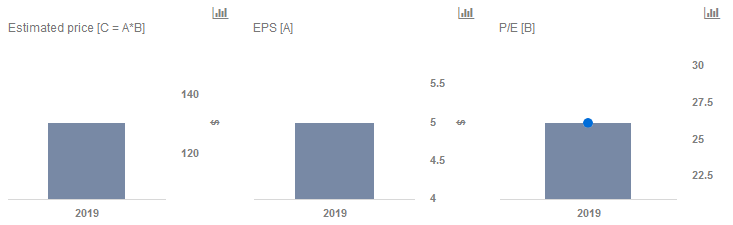

We maintain our price estimate of $130 per share for VMware, which is 20% lower than the current market price. Our interactive dashboard on VMware’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

While GAAP income came in lower than consensus expectations on the back of a $161 million loss on VMware’s investment in Pivotal Software, on a non-GAAP basis net income grew to $654 million from $509 million.

License revenue grew to $884 million (+17% y-o-y), software maintenance services revenue grew 10 $1,138 million (+12% y-o-y) and professional services revenue came in at $178 million (+9% y-o-y). Hybrid cloud subscription and SaaS accounted for 10% of the revenue and grew 35% y-o-y. The company’s management also raised its full year guidance, with license revenue expected at $3.7 billion and total revenue expected at $8.9 billion (+13% y-o-y) vs the earlier expectation of $8.8 billion. Management also announced a one-time special dividend of $11 billion. VMware also gave out preliminary guidance for the next fiscal year, stating that full-year revenue is expected to grow by 12% y-o-y and non-GAAP operating margin is expected to be around 33%.

The company’s optimism stems from the growth in its product portfolio along with the expectation of tech spending continuing to outpace the growth in the overall economy. However, the company’s expectation of operating margins remaining broadly at levels similar to those in the current fiscal year point towards the need for continued investment.

The company’s management believes that IT spending is becoming a part of business as opposed to a cost center, leading to growth in IT spending 4-5% above the rate of economic growth. Despite the pull nature of revenues, it is interesting to note that management still expects margins to remain flat.

Do not agree with our forecast? Create your own price forecast for VMware by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.