VMware Earnings Preview: Fast-Growing Segments To Help End Year On A High Note

VMware (NYSE:VMW) is scheduled to announce its Q4’16 and full year earnings on Thursday, January 26. The virtualization and cloud computing provider had an uncertain start to 2016, with the pending Dell-EMC deal awaiting confirmation from shareholders in the first half of the year. Over the course of this year, VMware has demonstrated strength in its business, with its revenues and profits seemingly unaffected by the acquisition of the parent company. VMware’s license business as well as the services business continued to grow at a steady pace through the year, with the company reporting healthier margins through the year.

In the wake of uncertainty surrounding the pending EMC acquisition, VMware’s stock price plummeted from around $80 at the end of Q3 last year to $44 by the end of January. Subsequently, VMware’s stock price climbed back to over $80 through the year as the company posted steady growth, as discussed below. Moreover, VMware’s management provided robust guidance for Q4’16.

We maintain our $76 price estimate for VMware’s stock, which is slightly lower than the current market price.

See Full Analysis For VMware Here

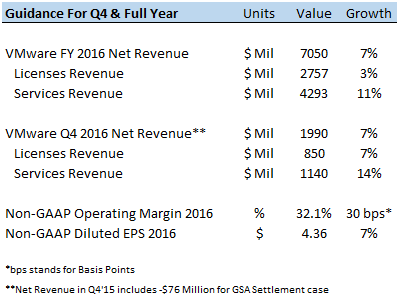

Robust Q4 Outlook

The company has given robust guidance for Q4, with quarterly revenues expected to touch the $2 billion mark as shown below. A strong performance over the last couple of quarters has led VMware’s management to revise its full year revenue and margin guidance. For the full year, license revenues are expected to increase by 3% to under $2.8 billion while services revenues could increase 11% to $4.3 billion. The company has further improved its operating profit margin expectation to 32.1% for the year, which is around 30 basis points higher than the previous year level. ((VMware Q3 2016 Earnings Call Transcript, Seeking Alpha, October 2016))

Services Business Sustains Growth

The strong growth in virtualization software sales has led market leader VMware to report strong growth in revenues over the last few years years. VMware’s net revenues surged from around $2 billion in 2009 to $6.6 billion in 2015 – a compound annual growth rate of almost 22%. Although the growth rate has slowed down in recent years, the company has reported an 8% annual growth in revenues this year. While software licenses revenues have only grown at around 1% this year, services revenues have grown at 9% y-o-y to $3.2 billion as shown below.

Over the last few quarters, VMware has attributed strong revenue growth to fast-growing product lines including network virtualization platform NSX, hybrid cloud platform, end-user computing offerings and software-defined storage platform Virtual SAN. VMware’s NSX had around 900 paying customers at the end of Q3’15, which surged to around 1900 paying customers by the end of the September quarter last year. Similarly, the number of Virtual SAN customers increased to 5500 by the end of Q3’16, up from under 3000 customers at the beginning of the year. VMware also reported that combined revenues of hybrid cloud and Software-as-a-Service (SaaS) offerings were up by over 30% on a y-o-y basis to almost $400 million through the first three quarters of the year. This growth was driven by a 35% annual increase in vCloud Air Network bookings in the same period. [1]

Over the years, VMware’s business has gradually transformed from primarily a software licenses vendor (over half of net revenues from license agreements in 2009) to a services-based model with software licenses revenues falling to around 40% of net revenues in 2015. As a result, VMware’s gross margin has compressed since services typically have lower gross margins than the licensing business. VMware’s gross profit margin has gone down from almost 88% in 2011 to under 87% in 2015. However, VMware reported an increase in Non-GAAP gross margins for both licenses and services division last year. The adjusted gross margin of the licenses division improved by 80 basis points to 97.7% while gross margin of the services division was around 30 basis points higher than the comparable prior year period to 80.4%. As a result, the company-wide gross profit margin was up by 50 basis points to 87%.

In addition to an improvement in gross margins, VMware’s operating income also grew at around 6% y-o-y to $1.5 billion through the first three quarters of the year. VMware’s management mentioned that the company aims to further improve its operational efficiency by reducing operating expenses and headcount. This could help the company sustain a high-single digit growth in earnings per share for the full year.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- VMware Q3 2016 Earnings Call Transcript, Seeking Alpha, October 2016 [↩]