VMware Posts Steady Top Line Growth Driven By NSX, Hybrid Cloud & SaaS Offerings

VMware (NYSE:VMW) announced its Q3 results on October 26, reporting 6% annual growth in revenues to under $1.8 billion. [1] The company observed strong growth in its operating income and net income, as shown in the table below. Non-GAAP operating income was up by 12% year-over-year to $592 million while non-GAAP diluted earnings per share were also up by 12% to $0.75.

Similar to the trend observed over the last few quarters, VMware’s revenue growth was primarily driven by maintenance and services revenues rather than software license sales. Services revenues have witnessed double digit growth over the last few quarters, with software license sales growing by low single digits in the same period. Many of VMware’s fast growing businesses such as network virtualization, hybrid cloud and Software-as-a-Service (SaaS) offerings include a primary service-based solution that have driven services revenues over the last couple of years. This trend is likely to continue over the next few quarters, with standalone license sales expected to continue to diminish.

Comparatively, the gross margin for the software license division (which is the high-margin business for VMware) improved by a percentage point to 94.2%. This helped the company-wide gross margin (GAAP) expand by 40 basis points over the comparable prior year period to 85% for the September quarter.

In terms of key growth areas for the company, VMware’s network virtualization platform NSX had around 900 paying customers at the end of Q3 last year. This has jumped to around 1900 paying customers by the end of the September quarter this year. The company announced the acquisition of cyber security and software-defined data center operations company Arkin Net during Q2 to help customers adopt its NSX platform faster. [2]

In addition, the number of Virtual SAN customers increased to 5500, up from under 3000 customers at the beginning of the year. VMware also reported that combined revenues of hybrid cloud and SaaS offerings were up to 8% of net revenues, up from only 6% of net revenues in the comparable prior year period. This growth was driven by a 35% annual increase in vCloud Air Network bookings through the quarter. [3]

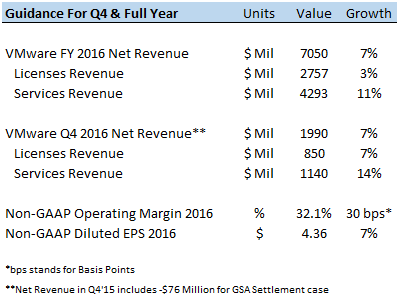

The company has given robust guidance for Q4 with quarterly revenues expected to touch the $2 billion mark as shown below. A strong performance over the last couple of quarters has led VMware’s management to revise its full year revenue and margin guidance. For the full year, license revenues are expected to increase by 3% to under $2.8 billion while services revenues could increase 11% to $4.3 billion. The company has further improved its operating profit margin expectation to 32.1% for the year, which is around 30 basis points higher than the previous year level. ((VMware Q3 2016 Earnings Call Transcript, Seeking Alpha, October 2016))

See Our Full Analysis For VMware.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research

- VMware Reports Third Quarter 2016 Results, VMware Press Release, October 2016 [↩]

- VMware Announces Intent to Acquire Arkin Net to Help Customers Accelerate Adoption of VMware NSX and Software-Defined Data Centers, VMware Press Release, June 2016 [↩]

- VMware Q3 2016 Earnings Call Transcript, Seeking Alpha, October 2016 [↩]