Key Takeaways From Viacom’s Fiscal Q3 Earnings

Viacom (NYSE:VIA) announced mixed Q3 results on August 3, as its earnings per share came in ahead of market expectations but revenues missed. The company’s stock fell 8% after the results announcement. Below we discuss some of the key takeaways from the earnings release.

Media Networks, Filmed Entertainment Drive Revenue Growth

Viacom’s total revenue increased 8% year-over-year (y-o-y) to $3.3 billion, due to growth in both the Media Networks and Filmed Entertainment segments. The company’s top line growth was driven by growth in advertising and affiliate revenues at the Media Networks business, along with robust growth in theatrical revenues due to a stronger film sate at Paramount studio.

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

Viacom’s operating expenses grew 14% y-o-y, due to higher segment expenses. In addition, the company’s operating income declined 3% y-o-y to $746 million, due to increased programming expenses at the networks and marketing costs at Paramount.

Viacom also posted adjusted earnings of $1.17 per share, up 11% year-on-year.

Operating Income Flat

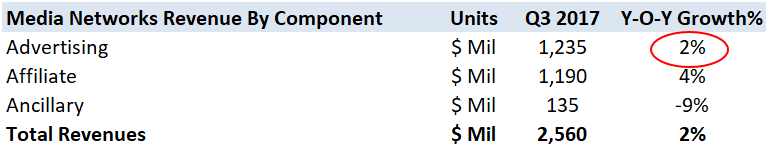

In Q3, Viacom’s media networks saw 2% y-o-y revenue growth, driven by a 2% y-o-y increase in affiliate revenues, along with 4% growth in the segment’s advertising revenues. However, Media Networks adjusted operating income remained flat due to investments in programming and employee costs.

Rate Increases

On the domestic front, Media Networks witnessed 4% y-o-y growth in affiliate revenues, driven by rate increases and the impact of SVOD and OTT agreements, partially offset by a decline in pay TV subscribers. Meanwhile, on the international front, the segment’s international affiliate revenues increased 1% y-o-y on the back of the acquisition of Telefe, the impact of rate increases, subscriber growth, new channel launches, as well as higher revenues from SVOD and OTT arrangements.

Viacom’s Filmed Entertainment revenues in the quarter were up 36% y-o-y, primarily due to growth across all its revenue streams, led by the theatrical business. The company collected $263 million in theatrical revenues during the June quarter, primarily led by the success of Transformers: The Last Knight and Baywatch. Moreover, the segment generated an adjusted operating profit of $35 million in the quarter, primarily reflecting the operating results as mentioned above.

Have more questions on Viacom? Please refer to our complete analysis for Viacom

See More at Trefis | View Interactive Institutional Research (Powered by Trefis) Get Trefis Technology