What To Expect From Vale’s Third Quarter Results?

Vale (NYSE: VALE) will release its third-quarter results on October 24th and conduct a conference call with analysts the following day. The market expects the company to post 3Q revenue of $9.46 billion, 4.5% higher compared to the year ago quarter and an EPS (Non-GAAP) of $0.40. The company’s performance for the quarter is expected to benefit from its record iron ore and pellet output and a higher premium portfolio mix. Additionally, the company’s bottom-line growth is expected to be favorably impacted by lower debt levels.

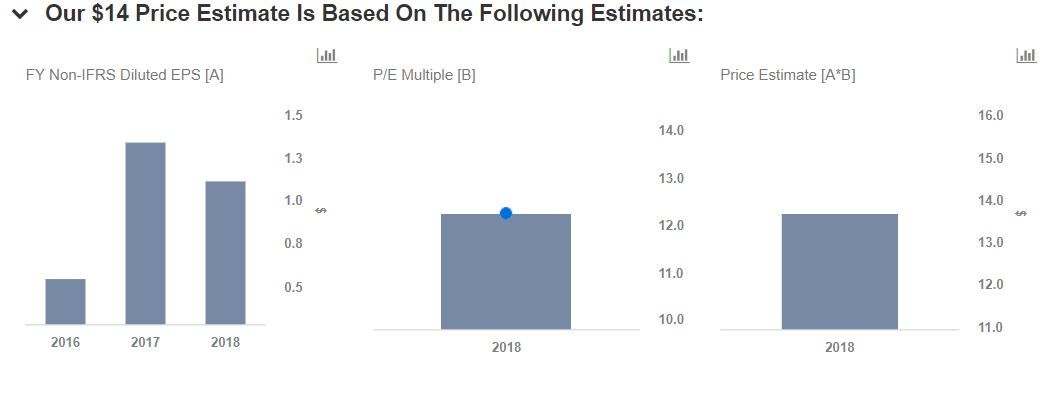

We have a price estimate of $14 per share for the company. View our interactive dashboard – Vale’s Outlook For 2018 – and modify the key drivers to visualize the impact on the company’s revenue and valuation.

Based on the latest production report, Vale achieved record sales of iron ore and pellet of 98.2 million tons (Mt) in Q3’18, representing a jump of over 9% on a year-on-year basis. This growth in volumes was largely driven by higher production level achieved by its S11D mine. Accordingly, the company reaffirmed its iron ore production guidance of 390 Mt and 400 Mt for 2018 and 2019, respectively. However, it expects the offshore inventories to increase at a lower rate compared to the previous quarters.

Higher volume growth from Vale’s S11D mine has increased the company’s share of premium product offerings, enabling the company to benefit from increased market premiums. Vale reported that its share of premium products (pellets, Carajás, blended ores, pellet feed, and sinter feed low alumina) increased from 77% in Q2 to 79% in Q3. As a result, the company has been able to realize average premium of $8.6 per ton in Q3’18 versus $7.1 per ton in Q2’18 and $5.6 per ton in Q3’17.

Further, nickel, copper, and cobalt sales from Vale’s Sudbury mines were low due to the first annual scheduled maintenance of these mines since the shift to a single furnace. However, the production is expected to revert to the previous guidance Q4 onward. We expect the company’s copper production to be around 411,000 tons in 2018, compared to 438,500 tons in 2017. Further, the company’s nickel production is also expected to come in lower at 268,000 tons shipments in 2018, versus 288,200 tons in 2017. Accordingly, we estimate Vale to report $2.2 billion in revenues from copper and $2.9 billion in revenues from nickel in 2018.

Besides, Vale is poised to enjoy higher demand in China as the country resumes major infrastructure projects after almost a year. Higher iron ore demand from China would boost Vale’s top-line growth as well as cash flows, which the company could utilize to pare down its debt. Lower debt would result in lower interest obligations as well as a balanced balance sheet, which would strengthen investor confidence in the company.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.