Here’s Why We Believe Visa Is Worth $145 Per Share

American financial services company Visa (NYSE: V) has had a good year so far. The stock has surged almost 25% since the beginning of the year as the company continues to witness solid revenue growth backed by double digit growth in payments volume and processed transactions both in domestic and international markets. This coupled with the company’s efforts to tap into the global contactless transaction markets through its Visa Direct Program have been bolstering its performance through the year. Additionally, the company’s strategy to enhance its Digital presence by expanding its network of co-branding partners and improving its technology is showing positive results and is expected to drive its value in the long term. Below we discuss these key factors that will drive Visa’s value in the coming years.

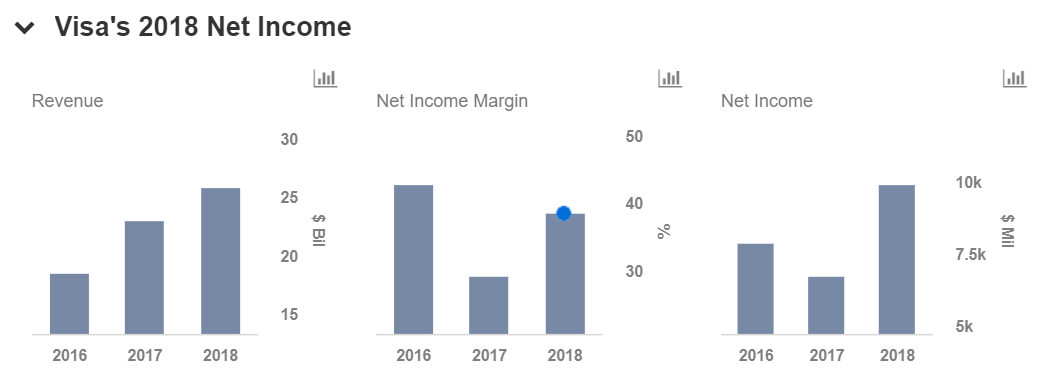

We currently have a price estimate of $145 per share for Visa, which is in line with its market price. You can view our interactive dashboard – Visa’s Price Estimate and alter the key drivers to visualize the impact on its valuation.

Payment Volumes Growth

Visa remains the undisputed leader in the credit card payments market holding a share of over 53% at the end of 2Q’18. In fact, the company is likely to capture a larger share of the market as its payment volumes are growing at a faster rate than the industry. The company’s transactions processed grew at a rate of roughly 16% annually to 111 billion in the last five years. Given the healthy macro-economic environment globally, we expect Visa’s transaction processed to grow at a rate of over 10% to 149 billion in the next 3 years. This growth is likely to be driven by strong payment volume growth from the international markets, such China, Japan, Brazil, and Europe.

Visa Direct Program

The Visa Direct Program offers real-time push payment capabilities that utilize Visa’s global payment system. The system allows participating financial institutions, businesses and consumers to send money to eligible Visa card accounts using the company’s platform. At present, Visa Direct platform can deliver transactions to over 2 billion Visa debit cards globally in more than 150 countries. The company continues to expand this program through rapid geographic expansion, enablement of new use cases, and repeat customer usage.

Further, the company has been cementing partnerships with corporate and institutional clients to augment the success of this program. For instance, the company has partnered with MoneyGram, the second largest money transfer provider in the world, to deliver domestic and cross-border remittances utilizing debit credentials to receive funds. Further, the company entered into a partnership with Postmates, a logistics company that operates a network of couriers who deliver goods locally, to enable instant payouts to the delivery couriers in their fleet. Given the optimistic results from the program, we expect Visa Direct to contribute significantly to the company’s top-line as well as bottom-line in the coming years.

Visa Digital Commerce Program

Visa has also launched its Digital Commerce program earlier this year, which is aimed at providing consumers with a simple, secure, and smooth experience while using their cards for digital payments. The company has been growing its ecosystem to include merchants, acquirers, gateways, issuers, and digital platforms. The company’s partnerships with large clients such as PayPal and Netflix will enable it to expand its customer base that will drive its top-line growth and, in turn, its valuation.

Disagree with our forecasts? Create your own price estimate for Visa by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.