Visa’s Digital Program & Transaction Volume Growth To Drive Its Q3 Results

American financial services company Visa (NYSE: V) is set to release its third quarter financial results on Wednesday, July 25. The company is expected to report a strong growth in its revenue backed by solid transaction volume growth due to a robust macro-economic environment. While the company’s operating expenses are likely to increase in the near term due to higher volumes, its focus on expanding its network of co-branding partners and improving technology to compete in the online payments segment will complement its top-line as well as bottom-line in the coming quarters. Backed by the stronger performance in the first half of fiscal 2018, Visa expects its fiscal 2018 net revenue to grow in low double digits on a nominal dollar basis.

View our interactive dashboard for Visa and alter the key drivers such as revenue and earnings to visualize the impact on its valuation.

Key Trends To Watch For In Q3 Results

- Similar to the last quarter, Visa’a Q3 revenue growth will be driven by a solid growth in its transaction volumes, supported by the transition towards digital payments and its expansion plans. Further, a robust macro-economic environment will continue to support debit and credit payments, complementing Visa’s volume growth.

- Additionally, the company’s recently launched Digital Commerce program is expected to boost its volumes for the quarter. The program is aimed at providing consumers with a simple, secure, and smooth experience while using their cards for digital payments. The company’s partnerships with large clients such as PayPal and Netflix will enable it to expand its customer base and drive its top-line growth.

- Further, Visa will continue to witness strong payment volume growth from the international markets, such China, Japan, Brazil, and Europe. However, its client incentives and discounts are likely to be higher in the third quarter due to strong volume growth and delay in some contract signings in Europe.

- The company’s operating expense growth is expected to be in double-digits due to large marketing spend on the Winter Olympics and the FIFA World Cup, coupled with the acquisition of Freedom and higher employee incentive accrual. This is likely to weigh on its bottom-line for the quarter.

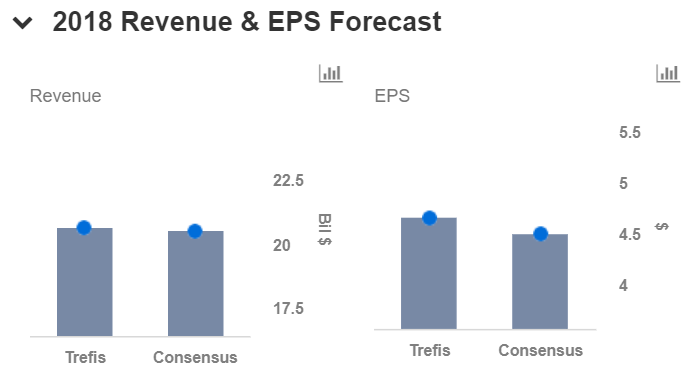

Disagree with our forecasts? Create your own price estimate for Visa by changing the base inputs (blue dots) on our interactive dashboard.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.