How Did UnitedHealth’s OptumRx Revenues Increase In Q3 Despite A Drop In Retail Prescriptions?

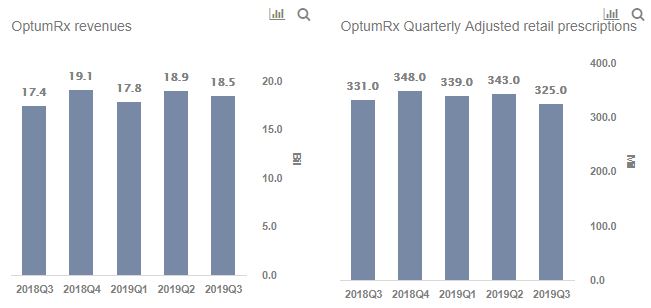

UnitedHealth Group (NYSE:UNH) is the largest health insurance company in the United States with consolidated revenue of $226 billion in 2018. It provides individual insurance, employer sponsored health insurance, managed care, private healthcare, health and wellness services, healthcare advisory & technology solutions and pharmacy benefits management services through its UnitedHealthcare and Optum subsidiaries. The company is heavily dependent on OptumRx segment – a subdivision of Optum – as it contributes more than 30% of its revenues. This makes the number of retail prescriptions a key operating metrics for the company, with small fluctuations in this metrics leading to noticeable changes on the top line. In the third quarter of 2019, UnitedHealth reported a 2%y-o-y decrease in the number of retail prescriptions filled for the quarter, while OptumRx revenues recorded a growth of 6% y-o-y. Trefis has analyzed the growth in UnitedHealth’s OptumRx revenues despite drop in retail prescriptions in an interactive dashboard.

Trefis has a price estimate of $294 for UnitedHealth’s stock, which is 15% ahead of the current market price. Our price estimate takes into account UnitedHealth’s earnings beat for the third quarter. The company reported total revenues of $60.4 billion – up by 7% y-o-y, which could be attributed to a 10% y-o-y jump in UnitedHealthcare Medicare & Retirement segment followed by a 34% jump in OptumHealth revenues, partially offset by a 3% drop in UnitedHealthcare Community & State.

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- Will The Q1 Medical Care Ratio Define The Move In UnitedHealth Stock?

- Which Is A Better Pick – UnitedHealth Stock Or Humana?

- Should You Pick UnitedHealth Stock After A 15% Fall This Year?

- Should You Pick UnitedHealth Stock At $510 After A Q4 Beat?

- After An 11% Fall Last Year Is Humana A Better Pick Over UnitedHealth Stock?

What Does OptumRx Offer?

- OptumRx provides a range of pharmacy benefits management (PBM) services, which means that it is responsible for processing and paying prescription drug claims of its clients.

- It served more than 65 million people nationwide in 2018 with its network of more than 67,000 retail pharmacies, multiple home delivery, specialty, compounding pharmacies etc.

- It also provides PBM services across nearly all of UnitedHealth’s businesses, as well as for external parties such as Medicare-contracted plans and Medicaid plans.

- The end users include individuals, senior citizens, employers, and managed care providers.

Additionally, Details about the individual revenue streams of UnitedHealth Group along with our forecast for the next three years are available in our interactive dashboard.

What Happened?

- OptumRx revenues increased 6% in Q3 2019 on a year-on-year basis. This translates into an increase of $1.1 billion in absolute terms.

- On the other hand, OptumRx quarterly adjusted retail prescriptions decreased 2% from 331 million in the year-ago period to 325 million in Q3 2019.

- The same trend is visible in retail prescriptions on a sequential basis, where the figure dropped from 343 million in the second quarter to 325 million in the third quarter of 2019.

- Although the segment revenue decreased by 2% on a sequential basis, it is quite low as compared to the 5% decrease in retail prescriptions.

Why Did It Happen?

- Decrease in OptumRx retail prescriptions on a year-on-year basis was mainly due to a large client transition.

- The revenue jump could be attributed to growth in specialty pharmacy care driven by diversification to more clinically focused services.

- Further, recent acquisitions like DaVita Medical Group helped it in achieving this growth.

- As a result, OptumRx revenue per retail prescription has increased 8% y-o-y to $56.8 in Q3 2019.

- Notably, it is the highest value of revenue per retail prescription in the last 5 quarters.

- This explains the reason behind increase in segment revenues despite drop in retail prescriptions.

So What?

- Increase in revenue per retail prescription is a good sign for segment growth.

- We expect this trend to continue and enable OptumRx to cross $74.9 billion for full year 2019, an increase of 8% as compared to the previous year.

- UnitedHealth Group is heavily dependent on OptumRx division, as it contributes more than 30% of its revenues.

Per Trefis, UnitedHealth’s Revenues (shows key revenue components) are expected to cross $306.6 billion in 2019 – leading to an EPS of $14.94 for the year. This EPS figure coupled with a P/E multiple of 19.7x, works out to a price estimate of $294 for UnitedHealth’s stock (shows cash and valuation analysis), which is 15% higher than the current market price.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams| Product, R&D, and Marketing Teams

All Trefis Data

Like our charts? Explore example interactive dashboards and create your own.