What Is Driving Growth At UnitedHealth’s Optum Business?

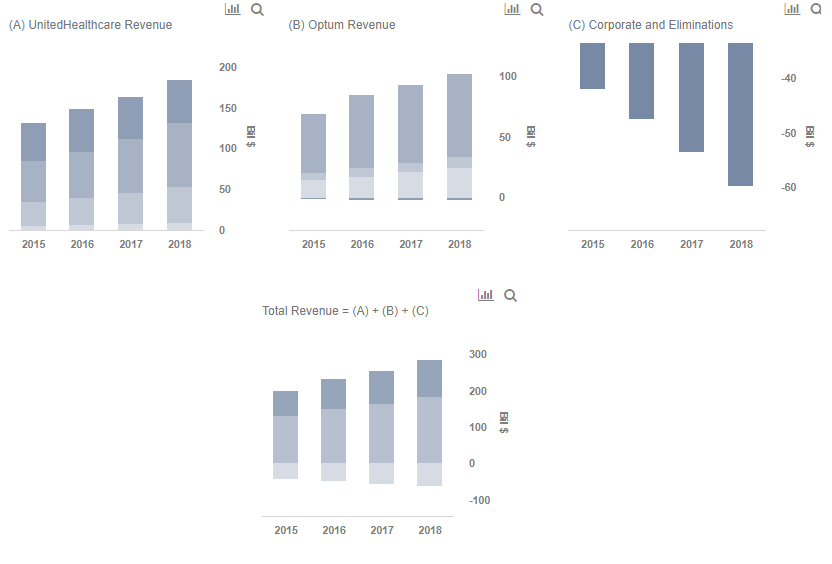

UnitedHealth Group (NYSE: UNH), the largest health insurer in the U.S., operates two primary businesses – UnitedHealthcare and Optum. UnitedHealthcare includes health insurance plans provided to employers & individuals, and community solutions such as Medicaid and children health insurance, while the Optum division covers services such as pharmacy benefits management (PBM) and health care services. The company has consistently surpassed expectations in recent years. One of the primary contributors to this impressive growth is the Optum business. In this note, we take a look at this business and its growth trajectory going forward.

Optum’s Past Performance

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- Will The Q1 Medical Care Ratio Define The Move In UnitedHealth Stock?

- Which Is A Better Pick – UnitedHealth Stock Or Humana?

- Should You Pick UnitedHealth Stock After A 15% Fall This Year?

- Should You Pick UnitedHealth Stock At $510 After A Q4 Beat?

- After An 11% Fall Last Year Is Humana A Better Pick Over UnitedHealth Stock?

Optum saw 9.2% revenue growth in 2017, which was impressive despite being lower than the previous two years. The division’s revenue jumped from $83.6 billion in 2016 to $91.2 billion in 2017. OptumRx, the largest contributor to Optum’s revenues, continued to perform strongly. However, OptumHealth saw the biggest jump. The 21.7% growth in revenue was driven by a 9.6% increase in the number of customers that resulted from growth in care delivery, consumer health engagement services, and health financial services. Meanwhile, growth in revenue management and business process services drove 10.3% revenue growth for OptumInsight.

Future Expectations

The greatest strength of UnitedHealth’s business model is that its divisions – UnitedHealthcare and Optum – complement each other well. This allows Optum to utilize UnitedHealthcare’s expertise (and vice versa) to provide painless consumer experience. OptumCare, a health service delivery business, is seeing strong growth and we expect this trend to continue in coming years. This will be driven by continued use of analytics that will help the business to penetrate into different markets. Also, the acquisition of DaVita Medical Group should create synergies and help OptumCare expand its portfolio. Furthermore, OptumRx, the largest Optum business, saw 5% revenue growth and is witnessing high retention rates, which bodes well for the company. Growth in script volume should further boost the revenue in 2018. We forecast Optum business to generate $68.4 billion in revenue, which roughly equates to about 45% contribution to UnitedHealth’s total revenue.

Detailed steps to arrive at Optum Revenue are outlined in our interactive dashboard, and you can modify our assumptions to arrive at your own estimate for the company.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.