UnitedHealth: 2016 In Review

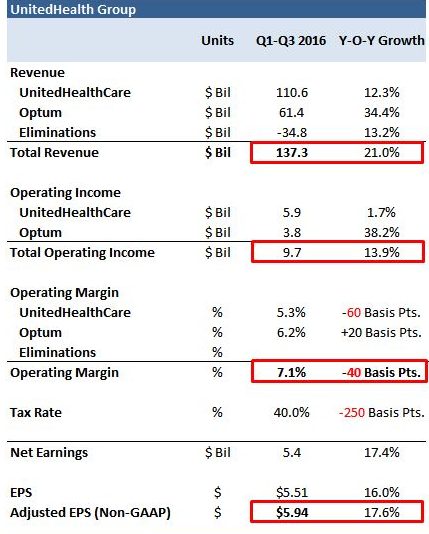

UnitedHealth Group‘s (NYSE:UNH) stock is up 37% year-to-date (YTD) following solid financial results in the first three quarters and raised full year guidance. This makes UnitedHealth the best performing stock in the Dow so far this year. The largest health insurer in the U.S. reported strong figures in the nine months ending September 30, with revenues growing 21% year-over-year (y-o-y) to over $137 billion and operating income rising by 14% y-o-y to $9.7 billion. This was largely driven by solid performance of the company’s pharmacy services business, Optum. In terms of earnings, the company’s adjusted earnings grew about 18% to $5.94 per share.  Buoyed by the strong quarterly results, the company raised its guidance for full year 2016 and expects to cross $182 billion in consolidated revenue for the year. In terms of earnings per share, UnitedHealth raised its full year guidance by $0.20 to $8.00 owing to a lower expected income tax rate and intangible amortization.

Buoyed by the strong quarterly results, the company raised its guidance for full year 2016 and expects to cross $182 billion in consolidated revenue for the year. In terms of earnings per share, UnitedHealth raised its full year guidance by $0.20 to $8.00 owing to a lower expected income tax rate and intangible amortization.

Segment Info: Optum Continues Robust Growth

UnitedHealth Group operates two major businesses – UnitedHealthCare and Optum. The UnitedHealthcare business includes the company’s private health insurance, Medicaid and Medicare segments, while the Optum division covers healthcare services such as pharmacy benefits management (PBM) and health care services.

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- Will The Q1 Medical Care Ratio Define The Move In UnitedHealth Stock?

- Which Is A Better Pick – UnitedHealth Stock Or Humana?

- Should You Pick UnitedHealth Stock After A 15% Fall This Year?

- Should You Pick UnitedHealth Stock At $510 After A Q4 Beat?

- After An 11% Fall Last Year Is Humana A Better Pick Over UnitedHealth Stock?

The UnitedHealthCare division posted revenues of $110.6 billion in the first nine months of the year, an increase of 12% year over year (y-o-y). This was primarily driven by a 4% increase in the number of customers served to 48.1 million. In terms of profitability, the division’s operating margin declined by 60 basis points to 5.3% owing to full year Affordable Care Act (ACA) plan losses of $200 million in the second quarter. The table below provides a breakdown of the division’s results in the past five quarters.

On the other hand, Optum again reported solid results. Segment revenues grew 34% y-o-y to about $62 billion driven by growth across all three sub-segments- OptumHealth, OptumInsight and OptumRx.

OptumHealth revenues grew by 20% y-o-y to $12.4 billion in the first three quarters, primarily driven by a 7% increase in customers served to 81 million as well as a 15% y-o-y increase in the average revenue per customer to $53.50.

OptumInsight revenues grew by 21% to $5.3 billion with its contract backlog growing from $10.4 billion at the end of December 2015 to $12.6 billion at the end of September 2016. The biggest source of growth was OptumRx, UnitedHealth’s PBM business, with revenues growing 41% y-o-y to about $45 billion in the first nine months of 2016. The increase in revenues was driven by growth in pharma care services and recent acquisitions- Catamaran and Helios.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap

More Trefis Research