What To Expect From Unilever In Fiscal 2018

Unilever‘s (NYSE: UL) turnover revenues decreased 5% year-over-year (y-o-y) in its recent quarterly earnings, primarily due to a negative currency impact of 5.2% and a net impact from the disposal of spreads business to KKR. However, the company benefitted from better volumes, pricing, and a Brazil recovery in the quarter. The company’s organic growth of 3.8% was mostly comprised of volume growth of 2.4% and a pricing growth of 1.4%. The consumer goods company reported an improvement across all its major business divisions, and benefitted from strong volume growth in the emerging markets.

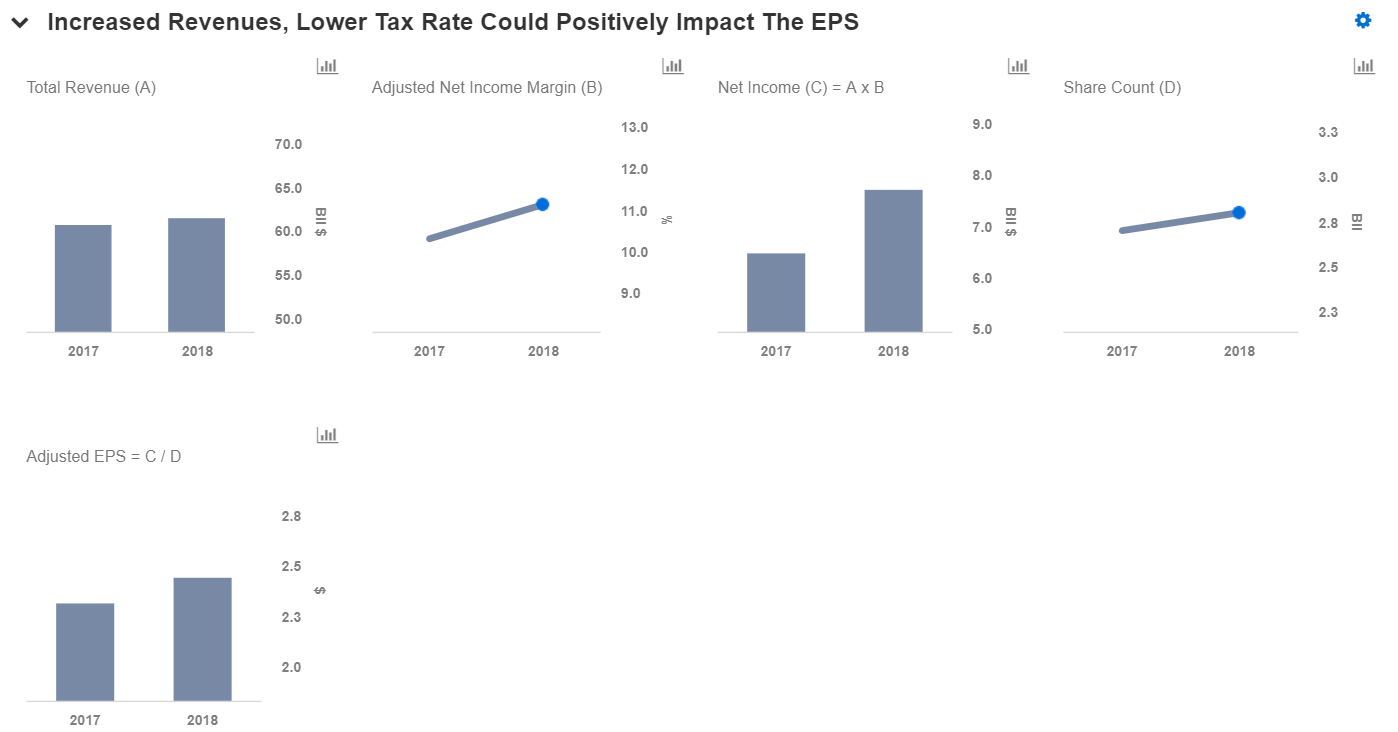

Our $58 price estimate for Unilever’s stock is slightly ahead of the current market price. We have created an interactive dashboard on A Closer Look At Unilever’s Q3 And Beyond which outlines our forecasts for the company. In this dashboard, we have estimated the company’s full-year fiscal 2018 results (in U.S. dollars). You can modify our forecasts to see the impact any changes would have on the company’s earnings and valuation.

Emerging Markets Lead The Way

Emerging Markets Lead The Way

Emerging markets play a vital role in Unilever’s business, as almost 60% of its total revenues comes from this market. Unilever’s emerging markets revenue grew 5.6% in the Q3, whereas developed markets grew at 1.3%. China’ s e-commerce continued to be the key driver of this market growth. Across Southeast Asia, the pick-up in pricing helped overall market growth in Indonesia, which had been weak for some time. In developed markets, Unilever saw a recovery in North America following a weaker first half, while a combination of good weather and strong innovation helped the ice cream business to continue its growth in Europe.  Future Outlook

Future Outlook

Going forward, Unilever expects its full-year underlying sales growth to be at the bottom end of its range of 3% to 5% for 2018 and an improvement to 20% in the underlying operating margin, which will keep it on track for its 2020 targets. Overall, we expect Unilever to generate around $61.4 billion (+1% y-o-y) in revenues in 2018, and earnings of almost $7.7 billion. Of the total expected revenues in 2018, we estimate $13.7 billion in the Foods business, around $11.5 billion for the Refreshments business, nearly $23.8 billion for the Personal Care segment, and almost $12.2 billion in the Home Care business.

Personal Care is Unilever’s largest division, having overtaken the Foods division in 2011 to take the top spot. The company’s shifting priority is evident from the fact that the revenue share of its Foods unit has fallen from 30% in 2011 to 23% in 2017, while the share of its Personal Care segment has grown from 33% to 39% over the same period. More recently, Unilever named the expansion of the segment through acquisitions as one of its top priorities. Some of the recent acquisitions in the space include Quala, Carver Korea, Sundial, Schmidt’s Naturals, and Equilibra. Such key strategic acquisitions will ensure that this segment becomes a key growth driver for the company going forward.

The company is expected to benefit from its ‘Connected 4 Growth’ initiative, which includes supply chain simplification, innovation, and cost-saving initiatives. Going forward, the company expects increased investment in brands and marketing, which could help grow volumes in the Personal Care segment. We expect the company’s full-year adjusted EPS to come in at around $2.44.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.