Time Warner Beats Q1 Estimates On Turner Network Growth, Strong Studio Performance

Time Warner Inc (NASDAQ: TWX) reported better-than-expected first quarter results, as both its earnings and revenue beat analysts’ estimates. The company’s revenue increased 6% year-over-year (y-o-y) to $7.7 billion, which beat consensus estimates by $70 million. This increase was primarily driven by growth in all divisions, particularly cable TV, HBO and film business. Time Warner’s adjusted operating income grew 7% y-o-y to $2.1 billion, and it also posted adjusted earnings of $1.66 per share, which was an 11% y-o-y increase. In addition, the company’s free cash flow grew by a robust 92% to $1.4 billion in the first quarter.

The company began fiscal 2017 on a strong note, benefiting from investments in content across all its divisions, namely Big Little Lies on HBO, action films like Kong: Skull Island, and the NBA on TNT, just to name a few. CNN saw solid ratings growth in the March quarter, as it witnessed its most-watched first quarter since Q1 2003 among both adults 25-54 and total viewers. For the quarter ending March, the network grew 12% y-o-y in Total Day viewers, and 22% y-o-y in the 25-54 demo. [1] In addition, HBO also witnessed accelerating subscription trends in the quarter. Also, Warner Bros. saw 16% growth in total viewing this quarter across all CW platforms. [2]

On the AT&T (NYSE:T) and Time Warner merger, the odds appear to be increasingly favorable, since the regulator does not expect to review the deal on account of a transaction structure which is likely to avoid the transfer of broadcast licenses. Accordingly, both the companies have been positive about obtaining the requisite approval, indicating that they expect the deal to close by the end of 2017.

- Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

- Should You Pick General Electric Stock At $165?

- What’s Next For JetBlue Stock After A Sharp 19% Fall Post Q1 Results?

- Is Kimberly-Clark Stock Fairly Valued At $135 After A Solid Q1?

- How Will AMD’s AI Business Fare In Q1?

- Up 9% Year To Date, Will Chevron’s Gains Continue Following Q1 Results?

Growth In Turner Network

In the first quarter, Turner segment revenue grew 6% y-o-y to $3.1 billion, primarily due to growth in domestic affiliate renewals. The network’s subscription revenue increased 12% y-o-y in the first quarter, due to higher domestic subscription revenues of $165 million. However, the segment’s overall advertising revenue was down 2% y-o-y in the quarter due to lower domestic revenue, primarily driven by lower audience at Turner’s entertainment networks. The 16% y-o-y growth in content and other revenue was due to higher television licensing revenues.

The segment’s operating income declined 6% y-o-y in the quarter, due to significantly higher programming costs, investments in new digital initiatives, and higher marketing spend. Moreover, the segment’s programming expenses grew 17% y-o-y due to the increased costs associated with the first year of its new NBA deal and higher original programming expenses. Going forward, the company expects this deal to have a material impact on programming costs in the second quarter as well.

HBO Grows On Higher Domestic and International Subscriptions

HBO’s revenues grew 4% y-o-y in the first quarter, driven by increased subscription revenues. This growth in subscription revenues was due to higher domestic subscription revenue of $49 million, reflecting higher contractual rates and increased subscribers, as well as higher international subscription revenues of $17 million, primarily reflecting growth in Europe. The segment’s operating income was up a very strong 22% in the quarter, as total expenses declined 5%.

Solid Performance by Warner Bros. Film Business

Time Warner’s studio operations are widely diversified with TV production, movies, electronic sales, video games and licensing. Warner Bros’ revenue increased 8% y-o-y, while operating income grew 15% y-o-y, led by its TV and theatrical businesses. The film studio collected $386 million at the U.S. box office during the March quarter, primarily led by the success of The LEGO Batman Movie and Kong: Skull Island. The LEGO Batman Movie has so far grossed close to $174 million at the global box office, against a production budget of $80 million. [3] However, the revenue from console games declined in this quarter, due to a difficult comparison from Q1 2016.

Future Outlook

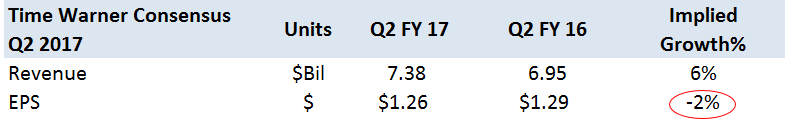

Reuters’ compiled analyst estimates forecast revenues of $7.38 billion and earnings of $1.26 per share for Q2 2017, implying growth of about 6% and (2%), respectively.

In Q2, the company expects Turner networks to see the biggest impact related to its new contract with NBA. The company also expects a decline in the Turner and overall adjusted operating income in the second quarter, due to continued investments in new digital initiatives and marketing of original programming on TNT. At HBO, the company expects subscription revenue growth to accelerate into high single digits in the second quarter, based on the healthy growth of OTT products and solid international trends. At Warner Bros., the company expects growth led by its theatrical and video game businesses, along with two more DC installments as well as the release of Wonder Woman.

Have more questions on Time Warner? Please refer to our complete analysis for Time Warner

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)

Notes:- Q1 2017 Ratings: CNN Has Most-Watched Q1 Since the Iraq War, Adweek, Mar 28 2017 [↩]

- Time Warner (TWX) Q1 2017 Results – Earnings Call Transcript, Seeking Alpha, May 3 2017 [↩]

- The Lego Batman Movie, Box Office Mojo [↩]