Twitter’s Stock Tanks On Underwhelming Q4 Results As Growth Struggles Continue

Twitter (NYSE:TWTR) released another set of weak quarterly results on Thursday, February 9, with both top line and bottom line growth becoming ever more elusive. The company’s total revenue grew less than 1% year-over-year (y-o-y) to $717 million on the back of a slight decline in advertising revenue, and 14% growth in its data licensing business. This was far below the consensus estimates of $740 million for the quarter.

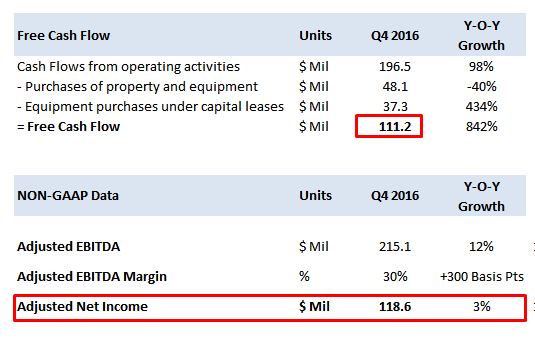

The company’s operating loss jumped about 114% to $144 million and its net loss rose 85% to $167 million on the back of a 40% increase in cost of revenue and 27% increase in general and administrative expenses. However, adjusting for several items including restructuring costs of over $101 million, Twitter reported earnings of 16 cents per share, beating consensus estimates by 4 cents. Owing to weak results and lackluster guidance, Twitter’s stock tanked over 12% following the earnings release Thursday.

Twitter’s average monthly active users (MAUs) grew 4% y-o-y to 319 million in Q4 2016, but the company was enthused with growth in its daily active users (DAUs). In the quarter ending December 2016, Twitter’s DAUs increased 11%, compared to 7% in Q3 2016, 5% in Q2 2016 and 3% in Q1 2016. Interestingly, the company did not report its DAUs in absolute numbers of users.

The company’s struggle to grow its active user base has been the primary investor concern for the past seven quarters, and that is unlikely to change in the near term. However, with the company redirecting its focus from user expansion to profit generation, the appropriate metric in focus is likely to become user engagement (DAUs/MAUs) and revenue-per-user going forward.

Revenue Growth Driven By Video Ad Engagements

Twitter’s overall revenues rose by 1% y-o-y to $717 million during Q4 2016. Advertising revenue slightly declined to $638 million, owing to a 5% decline in the U.S. advertising business offset by a 12% rise in international advertising revenues. This was primarily driven by a 151% y-o-y increase in the number of ad engagements due to growth in auto-play video ads. However, the average cost per ad engagement dropped by 60% y-o-y as the cost per view of auto-play video ads is significantly lower than click-to-play ads.

Video consumption has been growing tremendously over the past few quarters on Periscope as well as on the Twitter platform with the launch of auto-play videos. It will be interesting to see if this also translates into higher advertising revenue growth going forward.

2017 Guidance

Have more questions about Twitter? Please refer to our complete analysis for Twitter

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)