Why Is Our Price Estimate For Tata Motors $14?

Tata Motors (NYSE: TTM), has seen its stock price drop by over 80% in the last year, driven primarily by a drop in Jaguar Land Rover (JLR) sales and an impairment of $4 billion in JLR in FY 2019 (ended March 2019) . Trefis is maintaining its price estimate for the company at about $14 per share, which is ahead of the current market price. Below, we provide our expectations of the company’s key divisions and the rationale driving our price estimate.

View our interactive dashboard analysis on What’s Driving Our $14 Price Estimate For Tata Motors? In addition, here is more Consumer Discretionary data.

JLR pulling down Tata Motors revenue growth:

- Tata Motors’ domestic brand business revenue has seen a good rise in revenue as it increased from $8.4 billion in FY 2017 to $10.8 in FY 2019.

- Jaguar Land rover (JLR) segment meanwhile has seen a fall in sales volume and thus revenue from $33.8 billion in FY 2018 to $32.8 billion in FY 2019.

- In the recently announced Q1 2020 (ended June 2019) results, Tata Motors posted revenue of around $9 billion as overall sales volume went down for both the Tata and JLR brands due to a global auto market slowdown.

- Earnings before Tax (EBT) was recorded at around $-469 million primarily due to the JLR segment which had a EBT of approximately $-445 million. For the quarter JLR sales were recorded at 118K, down 9.9% y-o-y. Tata Motors (domestic segment) wholesale sales were recorded at 136K, down 20.5% y-o-y.

- Tata Motors Stock Up After Announcement Of Investment In EV Business, Will It Sustain?

- Will Tata Motors Achieve Pre-Corona Stock Price?

- Can Tata Motors Stock Grow After A Slowdown Warning?

- Is Jaguar Land Rover 50%, 70%, Or 80% Of Tata Motors?

- Why Tata Motors Stock Has Rallied 30% Over The Last Week

- How Does Tata Motors Compare Against A Giant Like Toyota Motors?

JLR shipments down due to global auto market slowdown and Brexit uncertainty:

- JLR revenue has been growing at a steady pace till now but is expected to be affected due to the uncertainty of Brexit and the overall slowdown in the global auto market.

- Shipments have dropped from to 565K in FY 2019 from more than 600K in FY 2017. Trefis estimates a further fall in FY 2020 to around 548K.

- Revenue has been fluctuating from $32.5 billion in FY 2017 to $32.8 billion in FY 2019. For FY 2020 (ended March 2019) we expect revenue to be around $32.2 billion.

Domestic brand sales volume is rising consistently:

- The brand Tata has done well in the past few years and the domestic market is expected to continue expansion. Sales volume has increased from 480K in FY 2017 to 680K in FY 2019.

- Revenue has increased from $8.4 billion in FY 2017 to $10.8 billion in FY 2019. For FY 2020 (ended March 2019) we expect revenue to be around $12.1 billion.

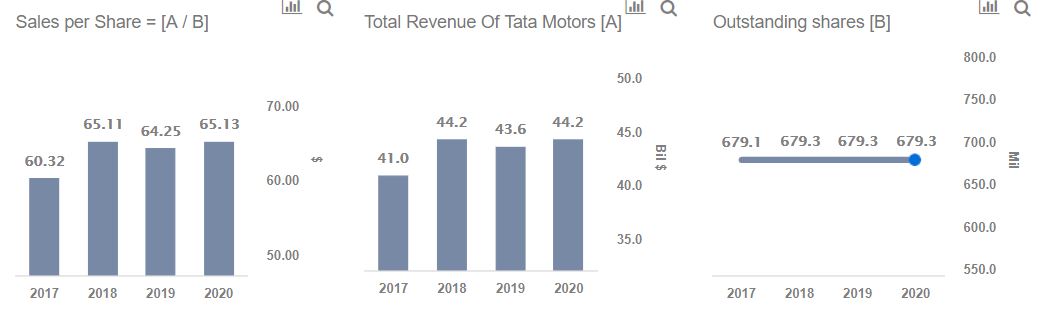

Estimating Sales per Share:

- Sales per share has moved with Total Revenue over the years with the shares outstanding remaining constant. Sales per share in FY 2020 is expected to be around $65.13

Estimating Share Price:

- Using Sales per share forecast of $65.13 from above and an implied Price to Sales multiple of 0.22, Trefis estimates Tata Motors Valuation to be $14.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.