Three Reasons Why Trefis Is Bullish On Tata Motors

The Trefis estimate for Tata Motors (NYSE:TTM) is 12% above the current price, which has risen 34% in the last six months alone. We have revised our estimate for Tata Motors upwards because of three reasons:

- Jaguar Land Rover Volumes Are Growing At >20% Y-O-Y

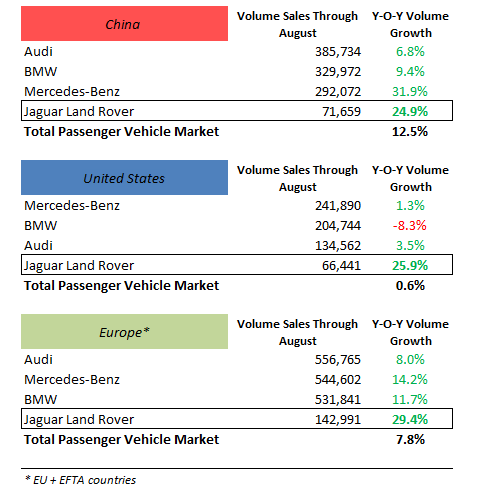

Jaguar Land Rover is the most important division for Tata Motors, as it contributes over 90% of the group’s valuation as per our estimate. This is because of the higher price points, broader margin, and higher anticipated future growth in sales for this division compared to the standalone division. JLR has reported record-breaking results for the first nine months, selling 434,025 vehicles between January and September, up 24% year-over-year. At the helm of this growth is the whopping 72% year-over-year growth in retail sales for Jaguar through September. High demand for compact luxury vehicles has been the main reason for Jaguar’s rapid sales rise in the last year or so. JLR has beaten the growth seen by any of the German trio of Mercedes-Benz, Audi, and BMW in the U.S. and Europe, falling short of only Mercedes’ growth rate in China.

Here are JLR’s numbers in major markets compared to the leading premium automakers in the world through August:

- Tata Motors Stock Up After Announcement Of Investment In EV Business, Will It Sustain?

- Will Tata Motors Achieve Pre-Corona Stock Price?

- Can Tata Motors Stock Grow After A Slowdown Warning?

- Is Jaguar Land Rover 50%, 70%, Or 80% Of Tata Motors?

- Why Tata Motors Stock Has Rallied 30% Over The Last Week

- How Does Tata Motors Compare Against A Giant Like Toyota Motors?

According to our estimates, JLR will continue to witness high growth in volume sales over the next few years, especially considering the automaker has opened its Brazilian production plant, and is planning a new plant in Slovakia, which will augment its supply. Trefis estimates Jaguar’s unit sales to grow at a CAGR of 9% between fiscal 2017 (ending March 2017) and fiscal 2024, and Land Rover’s unit sales to grow at a CAGR of 10%.

- Tata Motors’ Standalone Business Is Headed For Growth

Sales in India itself form over 40% of the net volume sales for Tata, however, contribute lower to the overall revenue and even lower to the valuation, because of the lower model prices compared to that of Jaguar Land Rover. In addition, the business in India is also not as profitable as JLR and is not expected to grow by as much as JLR’s estimated growth going forward, as aforementioned. However, the India business has been picking up for Tata Motors in recent times, buoyed by growth for the very segments that were struggling last year — passenger cars and light commercial vehicles (LCV), which formed 67% of the net domestic volume sales between April-September 2016 for the standalone division.

- JLR’s Quarterly Results Affected By One-Time Impacts

Despite strong revenue growth in Q1 fiscal 2017 (April-June 2016), owing to high volume sales, the consolidated profit after tax fell 38% year-over-year in the quarter. This was primarily due to unfavorable foreign exchange. Most of the foreign exchange impact on Tata Motors’ Q1 was at JLR. The foreign exchange impact at the division stood at £207 million, including revaluation of £84 million that mainly consisted of euro payables, resulting from the depreciation of the pound sterling after the June 23 U.K. vote to exit the European Union, and negative £123 million in the hedges realized in the quarter. In fact, excluding the £84 million, the EBITDA margin for JLR rose more than 150 basis points for Q1.

The pound has hit a six-and-a-half-year low against the euro and depreciated over 15% against the U.S. dollar since the June vote. As the company has hedged currency risks, it could realize losses for some time, however, a weaker pound is expected to benefit JLR over a longer period of time. More than 80% of the vehicles produced in the U.K. are sold abroad. In fact, 60% of the revenue is either linked to the U.S. dollar or depends on it, and 20-25% of the revenue is in euros. The depreciating pound should boost JLR’s top line. The other advantage could be that JLR’s competition, especially the German trio of BMW, Mercedes-Benz, and Audi could become more expensive in the U.K., as a result of higher model prices in order to mitigate their foreign exchange losses.

Either way, JLR’s financial woes due to the Brexit are not long term. The company is expected to benefit from its improving situation in India, and especially the continuing high sales growth at JLR. This is why we remain bullish about Tata Motors’ stock.

Have more questions on Tata Motors? See the links below.

- Tata Motors’ India Business Is Heading In A Positive Direction

- Tata Motors’ 50% Drop In Profits In Q1 Is Not All Bad News

- Brexit Could Be Good Or Bad News For Jaguar Land Rover

- New Compact Models Boost Jaguar Land Rover’s First Half Volumes

- Tata Motors Rides On Strong Q4 Performance By Jaguar Land Rover To Boost Fiscal 2016 Results

- Jaguar Land Rover Steps Up Unit Sales In Crucial Markets

- How Will Tata Motors’ Valuation Be Impacted If Jaguar Land Rover Sells Fewer Cars Than Estimated?

- What Will Be The Jump In Tata Motors’ Valuation If Jaguar Land Rover Sells More Cars Than Expected?

- Where Does Jaguar Land Rover Stand Relative To The German Top 3 In Crucial Markets?

- What’s Tata Motors’s Fundamental Value Based On Expected Fiscal 2016 Results?

- How Has Tata Motors’s Revenue And EBITDA Composition Changed Over FY12-FY16?

- By What Percentage Have Tata Motors’s Revenues And EBITDA Grown Over The Last Five Years?

- What Is Tata Motors’s Revenue And EBITDA Breakdown?

- Where Will Tata Motors’s Revenue And EBITDA Growth Come From Over The Next Three Years?

- Why Jaguar Land Rover Forms More Than 90% Of Tata Motors’ Valuation

Notes: