Is T-Mobile’s Stock Fairly Valued?

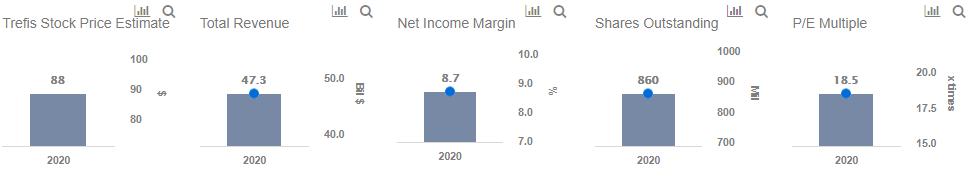

Based on its current stock price and future growth prospects, T-Mobile US (NASDAQ: TMUS) looks undervalued. Trefis has a price estimate of $88 per share for T-Mobile’s stock, which is higher than its current market price of $77.53 as of January 3, 2020. This reflects an upside of 14% from its current level.

To understand the major factors that are driving our stock price estimate for T-Mobile, view Trefis interactive dashboard – T-Mobile US Valuation: Expensive or Cheap? – and alter the key assumptions to arrive at your own estimate for the company’s stock price.

- T-Mobile Stock Has Traded Sideways This Year. Will It See Gains Following Q1 Results?

- Up 12% Over The Last Year, Will T-Mobile’s Mid-Band Spectrum Edge Help It Outperform In 2024?

- Rising 15% In The Last 3 Months, How Will T-Mobile Stock Fare Following Q4 Earnings?

- T-Mobile Stock A Buy At $140?

- Are T-Mobile’s Earnings Set For A Boost In Q1?

- Why T-Mobile Stock Continues To Outperform

Company Overview

- T-Mobile offers wireless communication services through a variety of service plan options. It also offers a wide selection of wireless devices, including smartphones, tablets, and other mobile communication devices, which are manufactured by various suppliers.

- Competition: (a) Wireless Carriers: Verizon Wireless, Sprint, and AT&T, and regional carriers such as U.S. Cellular and C-Spire; (b) Mobile Virtual Network Operators (MVNOs): TracFone Wireless, Comcast, Charter Communications, Altice USA; (c) Technology Companies: Microsoft, Google, Apple.

Estimating Total Revenue

- T-Mobile U.S has added $6 billion to its revenue over the last two years.

- Increasing sales from both its Postpaid and Prepaid services are likely to add about $4 billion in revenue over the next two years.

a) Postpaid

- Overall, Postpaid Plans & Phones revenue increased from $24.1 billion in 2016 to $27.7 billion in 2018, driven by higher revenues from postpaid mobile plans and equipment.

- Over the last few years, T-Mobile has been expanding its retail presence and improving coverage. The company has a sizeable amount of low-band spectrum, particularly in the 600 MHz spectrum bands, which allows it to improve its presence in rural and suburban areas in a relatively capital-efficient manner.

- T-Mobile also appears to be successful at retaining customers. Over Q1-Q3 2019, T-Mobile’s branded postpaid phone churn stood at 0.85%, marking a decline of 17 basis points year-over-year. This is likely being driven by the company’s improving customer service as well as moves to bundle video services such as Netflix with family plans.

- Going forward, we expect the launch of 5G to accelerate subscriber growth.

- We expect revenue to grow by 11% in the next two years, to about $30.7 billion in 2020, driven by growth in postpaid revenues.

- Postpaid services contributed 65% of total revenue in 2018. This share is expected to remain at similar levels by 2020.

b) Prepaid

To see how T-Mobile’s prepaid plans and phones’ revenue has trended and what is the outlook, view our dashboard analysis.

Estimating Net Income

- Net Income increased from $1.5 billion in 2016 to $2.9 billion in 2018, with a sharp rise in 2017 driven by one-time tax benefits realized due to the TCJ Act.

- We expect net income to rise from $2.9 billion in 2018 to a little over $4 billion by 2020. This rise in 2019 and 2020 will likely be led by higher revenues and rising margins.

- Higher margins are likely to be led by lower interest expense, driven by refinancing of $2.5 billion of Senior Reset Notes in April 2018, and lower interest on $600 million aggregate principal amount of Senior Reset Notes retired in April 2019.

Estimating Earnings Per Share

- EPS has grown from $1.75 in 2016 to $3.36 in 2018, with a sharp rise in 2017 led by higher margin due to tax benefits recorded. We estimate EPS to rise to $3.98 in 2019 and further to $4.78 in 2020.

- EPS increase in 2019 and 2020 can be attributed to higher Net Income, driven by higher revenue and rising margins, partly offset by elevated share count.

Share Price Estimation

As per T-Mobile’s Valuation by Trefis, we have a price estimate of $88 per share for T-Mobile’s stock. The stock price estimate is arrived at by using the discounted cash flow valuation technique, which you can find in T-Mobile’s detailed financial model here. Based on projected EPS of $4.78 per share and a stock price estimate of $88 per share, T-Mobile’s forward price-to-earnings (P/E) multiple stands at 18.5x.

To understand how T-Mobile’s P/E multiple compares with major peers like Verizon and AT&T, view our dashboard analysis.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.