Target Beats Q2 Estimates On Growth In Comparable Sales, Raises Guidance

Target‘s (NYSE: TGT) stock rose slightly after the announcement of better-than-expected second quarter results, as both its revenue and earnings per share (EPS) came in ahead of market expectations. In Q2, the company’s revenue increased 2% year-over-year (y-o-y) to $16.4 billion, primarily due to growth in comparable store sales. Notably, Target’s digital sales grew 32% y-o-y in the second quarter, which accounted for 4.3% of total sales. Target also posted adjusted earnings of $1.23 per share, which was flat relative to last year. Among product categories, food, beverage, and pet supplies accounted for 24% of the first quarter sales.

Target’s gross margin was 30.5%, compared to 30.9% in Q2 2016. This drop was driven by increased fulfillment costs and improved pricing and promotions. However, merchandise mix had a slightly positive impact on the gross margin rate in the quarter, primarily due to strong performance in signature categories. On the cost side, earnings before interest and tax (EBIT) margin was 90 basis points lower than the year ago period at 6% of sales, driven by a slightly higher selling and general administrative (SG&A) expense rate of 20.6%.

- TGT Stock Up 21% YTD, What’s Next?

- Down 28% This Year Will Target Stock Rebound Past Q3?

- Will Target Stock Return To Pre-Inflation Shock Highs?

- Target’s Stock Is Down 20% This Year, What’s Next?

- Target Stock To Likely Trade Higher Post Q1 Results

- What’s Next For Target Stock After A 32% Fall In The Last Year?

Comparable Sales Grew Due To Increased Traffic

Target reported 1.3% y-o-y growth in its comparable sales in Q2, which was nearly double the analyst consensus estimate of 0.7%. Among the components of comparable sales, the number of transactions grew 2.1 % y-o-y while the average transaction amount declined 0.7% y-o-y. The company’s store comparable sales were positive in this quarter, which shows that Target’s strategy of investing in its stores to grow traffic is working out well for the company. This is important because Target has been seeing pressure on comparable sales growth due to declining traffic at brick and mortar stores in the last year. On the other hand, Target was also able to grow its digital comparable sales, which shows that the company is making progress in its e-commerce efforts as well.

Future Outlook

In the third quarter, the company expects to generate both GAAP EPS from continuing operations and adjusted EPS in the range of $0.75 to $0.95. The company also expects to see continued pressure on its EBIT due to ongoing investments.

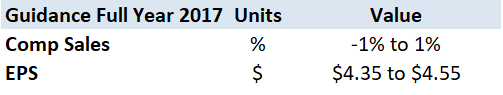

For the full year 2017, Target raised its full year adjusted EPS guidance, and now expects it to range between $4.35 to $4.55, up 11% from its prior guidance range. The company also expects its comparable sales to be in the range of -1% to 1%. In addition, the company also expects its capital expenditure to be in the $2 billion to $2.5 billion range.

See our complete analysis for Target

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)