What To Expect From AT&T’s Q2 2019 Results?

AT&T (NYSE:T) is expected to publish its Q2’19 results on July 24. In this analysis, we take a look at some of the trends that have been driving the company’s results in recent quarters.

View our interactive dashboard analysis What To Expect As AT&T Publishes Q2 2019 Results?

How Have AT&T’s Revenues Trended And What’s The Outlook?

- AT&T’s revenues grew by about 18% YoY to $45 billion in Q1 2019, on account of its acquisition of Time Warner.

- However, sales declined QoQ, on account of seasonally lower equipment sales and lower sales from Warner Media.

- How Will An Expanding Postpaid Phone Business Drive AT&T Stock’s Q1 Results?

- Down 50% From 2021, We Think There’s Upside For AT&T Stock

- Will AT&T Stock See Gains Post Q2 Results?

- At $15, AT&T Stock Appears Oversold

- AT&T Stock Held Up In A Tough Market. What Does 2023 Hold?

- What’s Happening With AT&T Stock?

What’s Are The Key Drivers Of AT&T’s Revenues?

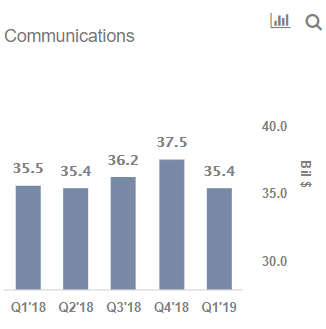

Communications

- AT&T’s communications division includes its Mobility, Entertainment, and Business Wireline operations and accounts for over 75% of AT&T’s revenues.

- On a QoQ basis, sales declined due to lower equipment sales in the mobility division and continued subscriber losses from the Pay TV business.

- On a YoY basis, revenues remained almost flat.

Warner Media

- AT&T acquired Time Warner in Q2 2018. The division accounts for close to 20% of AT&T’s total revenues.

- Revenues declined by about 8% QoQ in Q1, driven by lower revenues from Warner Brothers.

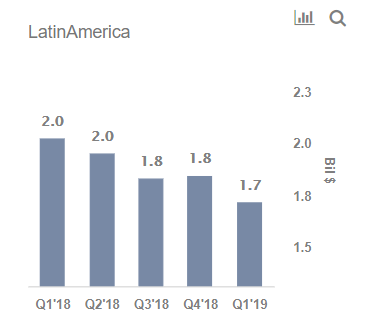

Latin America

- The Latin America segment includes AT&T’s Mexican Wireless business and its Latin American Pay TV operations. The segment accounts for less than 4% of total revenues.

- Revenues have been declining steadily, partly due to currency headwinds and a weaker Pay TV business.

How Have Key Subscriber Metrics For The Communications Segment Trended?

- AT&T’s postpaid phone business has seen its subscriber base moderate over the last few years, partly due to feature phone losses.

- AT&T’s prepaid phone business has been gaining traction, driven by its value-focused Cricket brand.

- AT&T’s pay-TV business has been underperforming due to subscriber losses at its DirecTV satellite service.

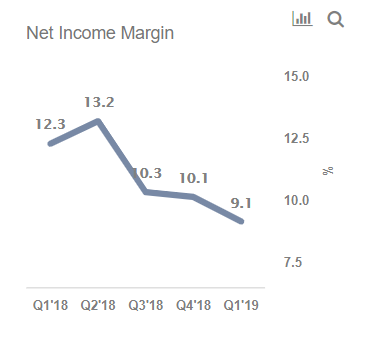

What Are The Key Drivers Of AT&T’s Expenses & Profitability?

- AT&T’s total operating expenses grew YoY on account of the Time Warner deal, they declined QoQ, partly due to lower equipment-related expenses.

- AT&T’s interest expenses have been trending higher, due to the higher debt associated with its recent acquisitions.

- AT&T’s net income margins have declined from about 12% in Q1’18 to about 9% in Q1’19.

Estimating AT&T’s EPS

AT&T’s EPS stood at $0.56 in Q1’19, marking a sequential decline.