What To Watch As AT&T Publishes Its First Results Post Time Warner Deal Close

Telecom behemoth AT&T (NYSE:T) is expected to publish its Q2 2018 results on July 24, reporting on a quarter that saw the company close its $85.4 billion purchase of Time Warner (though the DoJ is appealing). We will be looking for updates on the performance of the company’s postpaid and prepaid wireless business and its strategy in the media and pay-TV space, following the blockbuster deal.

We have created an interactive dashboard analysis which outlines our expectations for AT&T (standalone) over 2018.

Will The Postpaid Business Pick Up?

- How Will An Expanding Postpaid Phone Business Drive AT&T Stock’s Q1 Results?

- Down 50% From 2021, We Think There’s Upside For AT&T Stock

- Will AT&T Stock See Gains Post Q2 Results?

- At $15, AT&T Stock Appears Oversold

- AT&T Stock Held Up In A Tough Market. What Does 2023 Hold?

- What’s Happening With AT&T Stock?

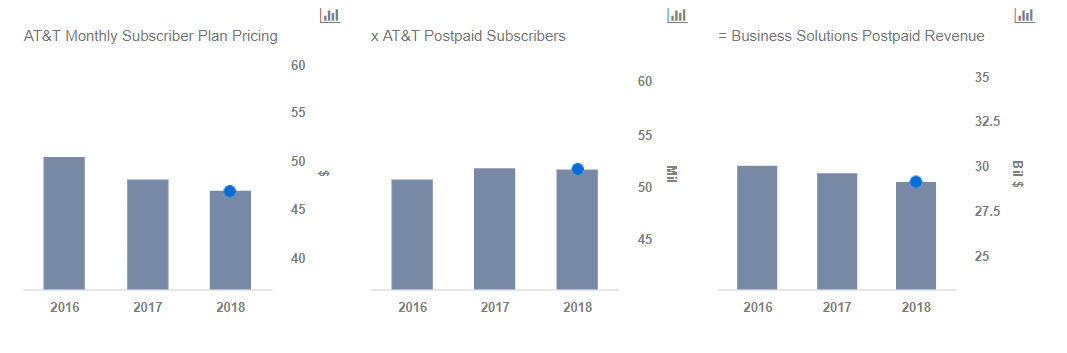

AT&T’s postpaid wireless business has been posting mixed results in recent quarters. The company lost about 22k postpaid wireless phone customers over Q1 2018, after posting about 329k net subscriber additions over the 2017 holiday quarter. While a significant portion of the declines are coming from the attrition of lower-value feature phone customers, it’s likely that these subscribers are being absorbed by other carriers such as T-Mobile. We expect postpaid phone churn to remain low, driven by AT&T’s increased bundling of wireless and video services. Last month, the company launched a new skinny bundle called WatchTV, which it will be providing for free to customers of its unlimited plans. That said, it’s likely that the carrier’s postpaid phone-only ARPU will trend lower, due to the continued shift to unsubsidized plans and an increasing shift towards unlimited plans, which limit overage fees. AT&T’s prepaid operations could fare well, driven by the Cricket prepaid brand which has been seeing some traction in the recent quarters. The company added a total of 192k prepaid phone subscribers during the first quarter.

Updates On Media And Pay-TV Strategy Post Close Of Time Warner Deal

The Time Warner deal will integrate AT&T’s vast distribution network, which spans wireless, broadband services and pay TV, with Time Warner’s media assets, and could open up some new opportunities for AT&T. For one, the company could lower its content costs, considering Time Warner’s vast library of original content and the potential bargaining leverage that AT&T could have in acquiring content from other companies for distribution. Advertising could also be another focus area for AT&T, considering the massive ad inventory from its TV channels, its large customer data sets, and its control over the distribution network. We will be looking for updates on how the company intends to execute on its content and distribution strategy, following the deal.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.