Can Symantec Achieve Its Targeted Growth Amid Executive Exits?

Symantec (NYSE:SYMC) reported its Q3 on Jan 31. The company delivered EPS and revenue beats versus consensus expectations. While the company’s management also guided for a strong Q4, the CFO’s plan to leave amid fairly ambitious growth targets warrants close monitoring of the company’s business.

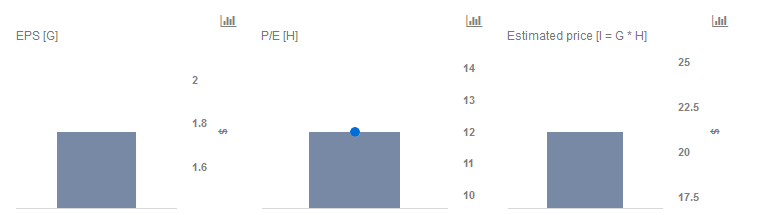

We currently have a price estimate of $21 per share for Symantec, which is slightly higher than the current market price after the modest rally in recent weeks. Our interactive dashboard on Symantec’s Price Estimate outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Is Kimberly-Clark Stock Fairly Valued At $135 After A Solid Q1?

- How Will AMD’s AI Business Fare In Q1?

- Up 9% Year To Date, Will Chevron’s Gains Continue Following Q1 Results?

- Earnings Beat In The Cards For Honeywell?

- Higher Keytruda Sales To Drive Merck’s Q1?

- Is Procter & Gamble Stock Appropriately Priced At $160?

Some key takeaways from Q3 include:

- Total non-GAAP revenues declined to $1.218 billion (-1% y-o-y)

- Enterprise Security: Non-GAAP revenues declined to $616 million (-4% y-o-y) with margins declining to 16% (-7% y-o-y). Upfront revenue increased to 24% of total versus 15% a year ago. Of the $1.9 billion of remaining performance obligations, 65% were expected to be recognized over the next 12 months. For Q4, management expects non-GAAP revenue (ex-forex) to come in between $608-628 million.

- Consumer Digital Safety: Non-GAAP revenues grew to $602 million (+1% y-o-y) with margins declining to 49% (-4% y-o-y). Upfront revenue was flat at 2% of total versus a year ago. Of the $1.1 billion of remaining performance obligations, 96% were expected to be recognized over the next 12 months. For Q4, management expects non-GAAP revenue (ex-forex) to come in between $604-614 million.

Symantec’s management believes that the sales and product organization realignment, coupled with its product portfolio in cyber defense, positions it well to grow its contract liabilities which ultimately will help the company achieve mid-single digit growth. The company expects many of its cost initiatives to also taper off, providing a boost to cash flows going into Q4 and fiscal 2020.

Symantec had appointed Matt Brown, who was previously the VP of Finance, as the Chief Accounting Officer. This move pairs with Nicholas Noviello, the current CFO, stepping down while continuing until a successor is found.

We believe while management’s plan to revive growth post-divestments sounds viable, a spate of executive exits (the COO in November and now the CFO) while the audit committee review fades is not necessarily the most inspiring set of events for investors. Accordingly, we will be closely monitoring the revenue growth trajectory to grow a bit more comfort with the company’s plans before revisiting our growth forecasts.

Do not agree with our forecast? Create your own price forecast for the Symantec by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.