What To Expect From Symantec Post-Q2 Earnings

Symantec‘s (NYSE:SYMC) fiscal Q2 earnings could mark a turnaround for the company’s stock, which had been marred by its disclosure of an Audit Committee investigation for some time. On May 10, during its Q1 earnings release, Symantec announced that the company had initiated an Audit Committee investigation in response to concerns raised by an ex- employee about “the Company’s public disclosures including commentary on historical financial results, its reporting of certain Non- GAAP measures including those that could impact executive compensation programs, certain forward-looking statements, stock trading plans and retaliation.” Ever since that news broke, the markets were rife with speculation about the extent of the potential damage and its impact to the company’s stock price – and on May 11 the stock fell nearly 35%.

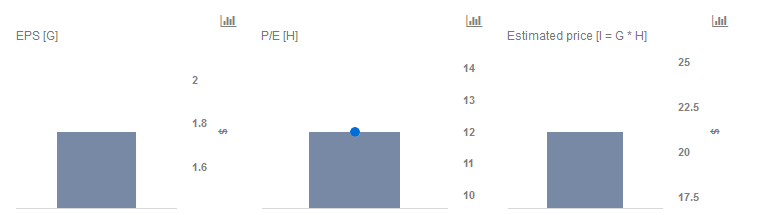

We currently have a price estimate of $21 per share for Symantec, which is slightly higher than the current market price after the post-earnings rally. Our interactive dashboard on Symantec’s Valuation Post Q2 Results outlines our forecasts and estimates for the company. You can modify any of the key drivers to visualize the impact of changes on its valuation.

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

During the earnings remarks, the company noted that the completion of the Audit Committee investigation in September had resulted in the revision of its Q4 FY2018 and Q1 FY2019 financials and the deferral of a $12 million contract.

The company’s fiscal Q2 total revenue declined to $1.175 billion from $1.24 billion (-5% y-o-y). In terms of the divisions, revenue for Enterprise Security declined to $583 million from $701 million (-17% y-o-y) due to the website security and related PKI products divestiture. Revenue increased sequentially (+3.2% q-o-q) from $556 million in Q1. Excluding divestments, Enterprise Security revenues came in ahead of guidance due to larger upfront recognition of revenue. Revenue for the Consumer Digital Safety division came in at $601 million (+5% y-o-y) versus $575 million a year ago. The increase was driven by ARPU improvements (+10% y-o-y) due to the integrated platform offerings, which help Symantec transcend hardware refresh cycles.

The completion of the Audit Committee investigations will also likely help reduce deal closure times for the company. This has led to the company reiterating its FY2019 guidance:

- Total revenue: $4.67 – 4.79 billion

- Enterprise Security revenue: $2.27 – $2.35 billion

- Consumer Digital Safety revenue: $2.40 – $2.44 billion

- Operating margin: 30%

For Q3, the company expects total revenue to be in the range of $1.16 – 1.19 billion (Enterprise Security: $565 – $585 million, Consumer Digital Safely: $595 – $605 million), with an expected operating margin of 30%.

Do not agree with our forecast? Create your own price forecast for the Symantec by changing the base inputs (blue dots) on our interactive dashboard.

Like our charts? Explore example interactive dashboards and create your own.