Why Is Samsung Guiding For A Sharp Drop In Operating Profits?

Samsung Electronics (OTC:SSNLF) provided its earnings guidance for Q1 FY’19, which are summarized below:

- The company expects operating profit of 6.2 trillion South Korean won ($5.5 billion), down 60% year-over-year

- Revenue guidance stands at 52 trillion won ($46 billion), down 14% year-over-year

- The numbers are below Trefis expectations, as well as consensus revenue estimates of 53 trillion won and operating income of 6.8 trillion won, per S&P Global Market Intelligence

What caused the decline?

- While Samsung will provide more color when it reports results later this month, declines in the memory business – which accounted for ~75% of operating income in FY’18 – were likely the biggest factor.

- Although operating profits for memory business soared over last 3 years (CAGR of ~52%) driven primarily by favorable demand-supply dynamics for DRAM, the market has now entered a down cycle.

- The declines in memory were likely partly offset by smartphone business.

What’s ailing the memory business?

- DRAMeXchange noted that prices fell by over 20% in Q1, with declines projected at as much as 20% for Q2 and 10% for Q3.

- PC DRAM prices are falling due to a shortage of Intel CPUs, causing inventory build-ups.

- Mobile DRAM is being impacted by cooling smartphone sales

- Industry prices for NAND also fell by 20% in Q1, due to weak demand from server and smartphone space, although the recovery could be quicker

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

- Up 8% This Year, Why Is Costco Stock Outperforming?

- Down 7% In A Day, Where Is Travelers Stock Headed?

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- American Express Stock Is Up 17% YTD, What To Expect From Q1?

What to expect from the smartphone business

- While the smartphone segment has underperformed over the last 3 years, with profits remaining essentially flat, Samsung took notable steps to shore up business over Q1

- Samsung launched a trio of new high-end phones under the S10 moniker, with the devices garnering largely positive reviews

- The company also addressed its lack of traction in the budget segment, taking on Chinese vendors with the Galaxy M Series which features premium design at prices starting at just above $130.

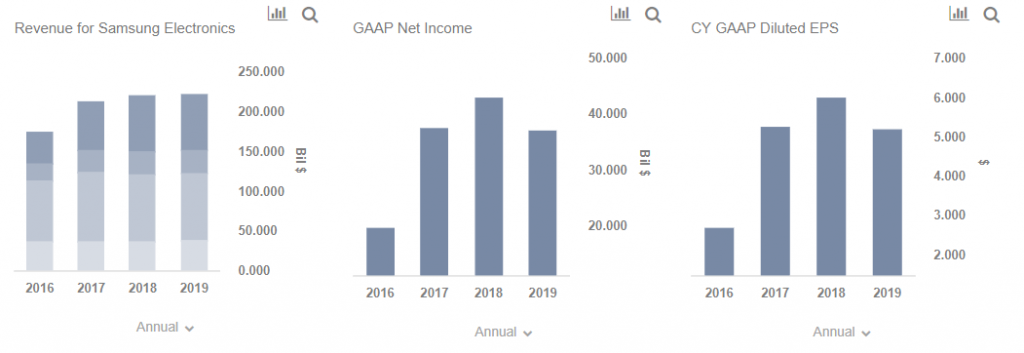

Our interactive dashboard analysis outlines our expectations for Samsung in 2019. You can modify any of our key drivers or forecasts to gauge the impact of changes on Samsung’s revenues and earnings and see all of our data for Technology Companies here.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.