Will The Galaxy S10 Lineup Move The Needle For Samsung?

Samsung Electronics (OTC:SSNLF) unveiled multiple premium handsets at an event held last week, including its flagship Galaxy S10 and S10 Plus, as well as a slightly cheaper device called the S10e alongside a variant of the S10 that works with upcoming 5G networks. While the devices offer an impressive design, upgraded software, and cutting-edge specifications, they come at a time when the global smartphone market has saturated, with mobile phones sales expected to remain flat over the year. In this note, we take a look at what the S10 launch could mean for Samsung.

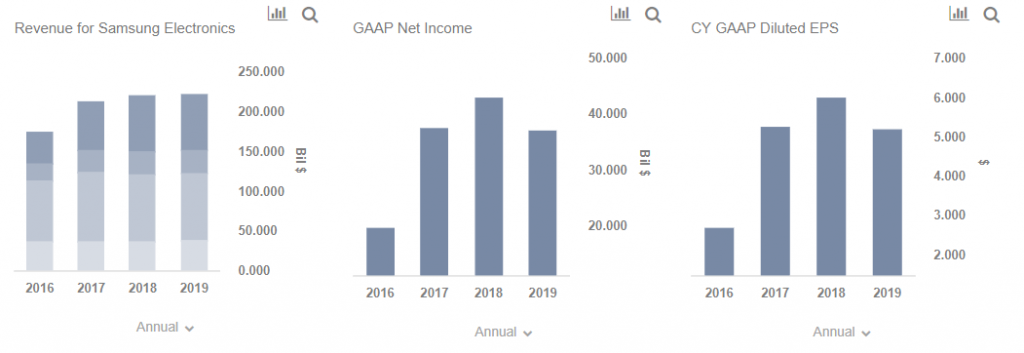

Our interactive dashboard analysis outlines our expectations for Samsung in 2019. You can modify any of our key drivers or forecasts to gauge the impact of changes on Samsung’s revenues and earnings, and see all of our data for Technology Companies here.

Impressive Hardware, Much-Needed Software Refresh

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

- Up 8% This Year, Why Is Costco Stock Outperforming?

- Down 7% In A Day, Where Is Travelers Stock Headed?

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- American Express Stock Is Up 17% YTD, What To Expect From Q1?

Samsung is offering a lot of choice with this year’s flagship handsets. The S10 and S10 Plus (starting at $900 and $1000, respectively) are positioned as the mainstream flagship devices, offering ultrasonic in-screen fingerprint sensors, three rear cameras and a relatively novel “hole-punch” display cutout for the front cameras. The Galaxy S10e, priced at $750, is a more affordable version of the S10 that has a smaller display and misses a few of the more advanced features of the flagships. Samsung is also looking to capture early demand from the launch of 5G networks, unveiling a 5G version of the S10 that it expects to go on sale in the first half of this year. That said, it’s unlikely that this device will drive meaningful volumes, as the first mobile 5G deployments in North America are only expected by the end of this year and ubiquitous coverage is still multiple years away.

Samsung appears to have made some progress on the software side, with its new One UI software, built on top of Android 9 Pie, which has been well-received by reviewers who have called it a big improvement from the TouchWiz interface built on top of its earlier devices. This is an important step for the company, as the basis of product differentiation in the premium end of the market has been shifting away from hardware to software and services, which have traditionally been a weak link for Samsung. While we still believe that rival devices such as Apple’s (NASDAQ:AAPL) iPhone and Google’s (NASDAQ:GOOG) Pixel may be better positioned to capitalize on this shift in the long run due to their vast experience, the new software is a positive step forward for Samsung.

Many Challenges Remain

The broader smartphone market is slowing down, with global shipments posting a 4% year-over-year decline in 2018, falling to 1,498 million units, per Counterpoint Research. This is being driven by increasing smartphone penetration, coupled with lengthening upgrade cycles for existing smartphone users (U.S. users are replacing their phones every 32 months on average, up from 25 months previously, per NPD). Samsung saw the biggest decline of the major vendors last year, with shipments falling 8% as it faced pressure from Chinese players such as Huawei and Xiaomi, who have been gaining market share by offering compelling products at low price points.

While these value devices are also based on Google’s Android software, much like Samsung’s offerings, players such as Huawei have also taken significant strides in terms of hardware – which has traditionally been Samsung’s forte. To mitigate this impact, Samsung has had to spruce up its low- and mid-range devices. For instance, the company launched a new line of entry-level devices called the Galaxy M in India earlier this month, offering premium design and features such as edge-to-edge displays, wide-angle cameras, and large batteries, at price points starting at just about $130. While it’s unlikely that these handsets will cannibalize sales of devices like the S10, which brings in much of Samsung mobile margins, the trend of well-specced low- and mid-range devices could eventually hurt Samsung.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.