Samsung’s Q4 Earnings To Be Hit By Cooling DRAM Market

Samsung Electronics (OTC:SSNLF) provided its preliminary earnings guidance on Tuesday, indicating that its Q4 operating profit is likely to decline by 29%, ending a string of record profits it posted over the last two years. The numbers, which are well below analysts’ estimates, are likely due to weaker pricing for DRAM and NAND chips and higher competition in the smartphone market. The company has indicated that operating profits will stand at about 10.8 trillion South Korean won ($9.7 billion), with revenues expected to drop by 11% year-over-year to 59 trillion won ($52 billion).

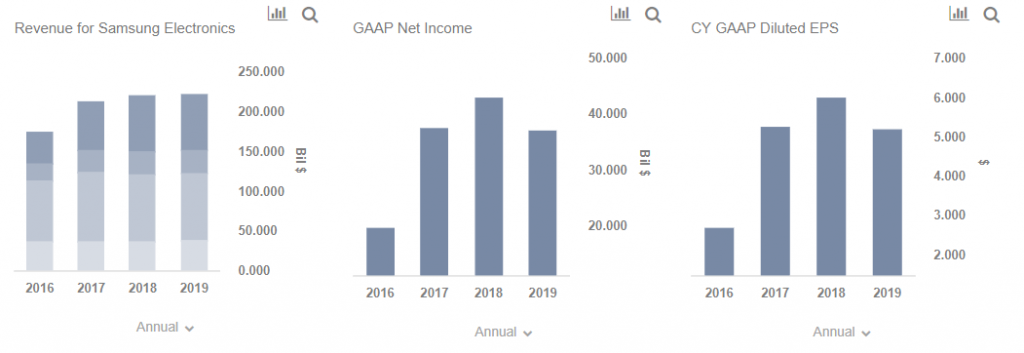

Our interactive dashboard analysis outlines our expectations for Samsung in 2019. You can modify any of our key drivers or forecasts to gauge the impact of changes on its earnings and valuation.

DRAM Price Declines

- Up 7% This Year, Will Halliburton’s Gains Continue Following Q1 Results?

- Here’s What To Anticipate From UPS’ Q1

- Should You Pick Abbott Stock At $105 After An Upbeat Q1?

- Gap Stock Almost Flat This Year, What’s Next?

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

Samsung’s memory business, which has accounted for roughly three-quarters of the company’s operating profits, is likely to be the biggest driver of the slowdown. Prices for NAND memory have seen significant declines over the last year, as major vendors largely completed the transition from planar NAND to 3D NAND, boosting supply. Moreover, prices for DRAM have been trending lower, after more than nine consecutive quarters of growth, with DRAMeXchange noting that contract prices fell 10% sequentially during Q4. Prices are expected to correct further, likely declining by 15% in Q1 FY’19 and by about 10% in Q2. The cooling off in the memory market is being driven partly by slowing investment in the cloud computing space, weaker smartphone shipments and likely lower PC shipments over the holiday quarter.

Smartphone Business Underperformance

Samsung’s smartphone business is also facing headwinds. As of Q3’18, Samsung’s smartphone market share declined to 18.9% from 22.3% in the year-ago quarter, per Gartner, and the company’s smartphone revenues declined by about 6% year-over-year during the first nine months of 2018. There are multiple factors driving the declines, including a lackluster performance of the Galaxy S9 flagship – which was perceived as being too similar to its predecessor, the S8 – and also due to mounting competition from Chinese vendors, who have been offering high-end devices at affordable prices.

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own