How Uber Could Justify A $120 Billion Valuation

Ride-hailing platform Uber is expected to file for its IPO in 2019, and there has been a lot of speculation surrounding the company’s potential valuation. While Toyota recently invested about $500 million in the company at a valuation of $76 billion, bankers have indicated that the company could be valued at as much as $120 billion. We have created an interactive dashboard analysis breaking down the company’s base-case valuation (shown in gray in the below charts) based on its most recent fundraising from Toyota. The key value drivers for the company include its total monthly active riders, the number of rides per rider annually, revenue per ride, net revenues and Price/Sales multiple (based on 2019 revenue). We also provide a scenario (shown in blue ) which explores how the company could justify a higher valuation of $120 billion. Sources for the historical data are provided in the dashboard link above.

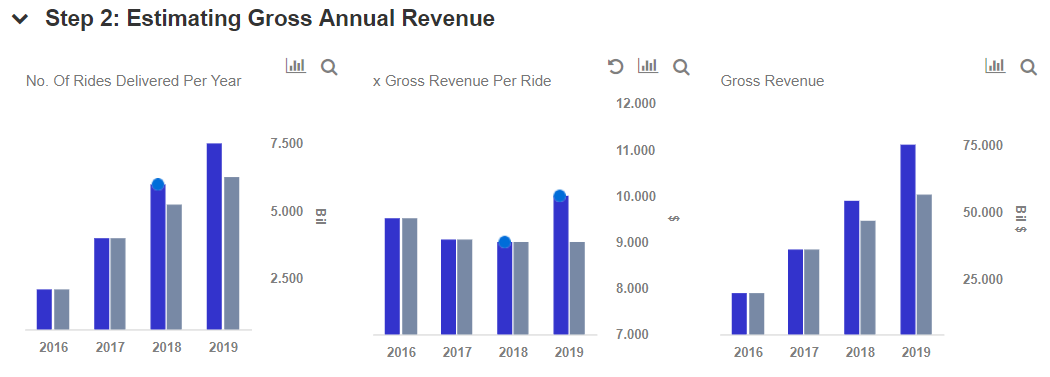

Uber’s monthly active riders base grew from 50 million in 2016 to 75 million in 2017, with the number of rides hailed by each rider also trending higher. We expect monthly active rider growth to remain strong in 2018, as Uber doubles down on emerging markets, taking total rides delivered to around 5.25 billion for 2018 and over 6 billion in 2019. The bull case assumes that monthly active riders over 2019 will rise to 125 million, with the number of rides per rider growing to 60.

We expect the company’s gross revenue per ride, which is the total value of the rides billed to customers before Uber takes its cut, to remain at levels of around $9 over 2018 and 2019. We forecast its total gross revenue – which is total rides multiplied by gross revenue per ride – to rise to $47 billion and $56 billion, respectively, in 2018 and 2019. Our bull case assumes that gross revenue per rider rises to $10.

Uber’s net revenue, which is the cut that the company takes from gross revenues, declined in 2017. However, the company has been cutting back on driver incentives and the promotions it offers to customers, as it looks to improve its net revenues. We expect the company’s take rate to rise to 23.5% in 2018 and 25% in 2019, translating into net revenue of about $11 billion in 2018 and $14 billion in 2019. Our bull case assumes that the company’s share of revenue rises to 30% in 2019.

Toyota made an investment in Uber at a reported valuation of about $76 billion in August 2018. We have used this value to arrive at a revenue multiple of 5.4x based on the company’s 2019 projected revenues. Our bull case valuation using the same revenue multiple would come in at about $120 billion.