Is The Market Pricing Domino’s Pizza Fairly?

Domino’s Pizza (NYSE: DPZ) is one of the most recognized food brands in the world. In 2017, the company managed to push its stock price up by over 24%, while revenues came in over 12% higher than the previous year. And this momentum is expected to continue going forward as well. That said, it appears as though, at the moment, the market is pricing the stock price substantially higher than our estimate of $210. While there are definite long-term growth strategies that will boost the price going forward, it appears as though, right now, it is too expensive. As of writing this article, the market price stood at around $226.

We have created an interactive dashboard analysis to estimate Domino’s Pizza’s valuation based on its expected revenues for FY 2018. Click on the link to modify the figures to arrive at your own price estimate.

- With Smartphone Market Recovering, What To Expect From Qualcomm’s Q2 Results?

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

- Up 8% This Year, Why Is Costco Stock Outperforming?

- Down 7% In A Day, Where Is Travelers Stock Headed?

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

Our estimate of $210 is based on a few expectations:

- Domino’s Pizza will deliver $3031 million in revenues in FY 2018.

- The P/S multiple in FY 2018 will be around 3.01, which is slightly lower than 3.11 in FY 2017.

- The company’s average share count in FY 2018 will be around 44 million.

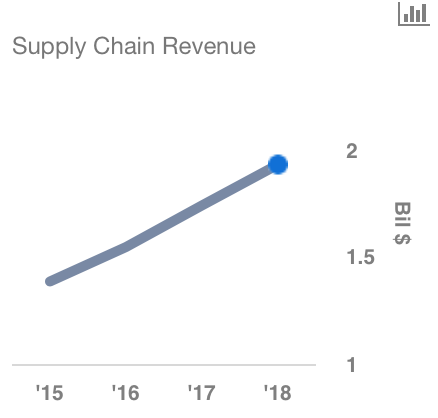

Domino’s Pizza’s revenue comes from four main sources: domestic company-owned stores, domestic franchise stores, supply chain, and international franchise stores.

In order to estimate the revenues for each of the divisions, we broke down the historical data to their core revenue drivers (except in the case of supply chain). This enabled us to forecast each of the drivers, thereby making our estimates as accurate as possible.

Domestic company-owned stores:

Domestic franchise stores:

Supply chain:

International franchise stores:

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.