What Can Insider Trading Activity Tell Us?

Submitted by Sizemore Insights as part of our contributors program

What Can Insider Trading Activity Tell Us?

by Charles Lewis Sizemore, CFA

- Will United Airlines Stock Continue To See Higher Levels After A 20% Rise Post Upbeat Q1?

- Up 8% This Year, Why Is Costco Stock Outperforming?

- Down 7% In A Day, Where Is Travelers Stock Headed?

- What’s Next For Johnson & Johnson Stock After Beating Q1 Earnings?

- Should You Pick UnitedHealth Stock At $480 After A Q1 Beat?

- American Express Stock Is Up 17% YTD, What To Expect From Q1?

I’ll start this with an important distinction: There are two very different kinds of insider trading.

There’s the “Martha Stewart” kind that will get you thrown into white-collar prison. And there’s the legal kind that is tracked and reported by the U.S. Securities and Exchange Commission (SEC).

Don’t worry, I’m not here to recommend a move out of Martha’s playbook (I don’t think prison would agree with me). There’s something much more important we can learn from insider trading.

The SEC requires all company officers, directors, and shareholders owning 10% or more of a company’s voting shares to disclose any dealings they have in their company’s stock. If the CEO of the company is buying — or selling — the stock of the company he manages, the investing public has a right to know, and the SEC makes the data available to anyone who cares to look.

I’m a big believer that the men and women running a company should have real skin in the game, so I take notice when a stock has heavy insider buying.

An insider can sell for any number of reasons. They could be diversifying, doing tax planning, or even buying a chalet for their mistress.

But there is only one reason why an insider would buy the shares of their company on the open market: At current prices, and based on their intimate knowledge of the company, they consider the stock to be attractively priced.

Well, what is true of the parts can also be true of the whole. The literature shows that company insiders tend to be pretty good value investors, and their moves as a group can give us insight as to the overall attractiveness of the market.

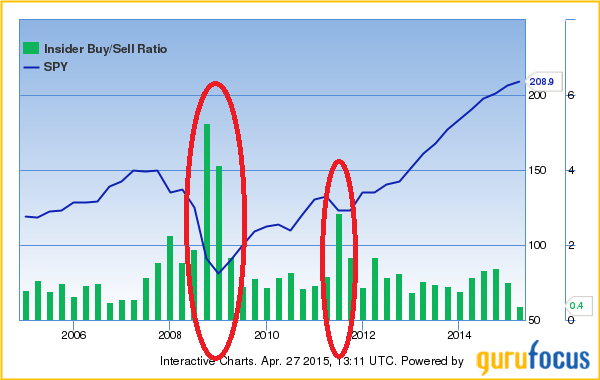

Take a look at the chart above, which tracks aggregate insider trading alongside the S&P 500. Insider buying was insignificant in the quarters leading up to the 2007 top, but insisders went on a buying spree as the S&P 500 was bottoming in late 2008 and early 2009. Insider buying spiked again duing the last real correction we had, back in 2011, and it’s been mostly modest ever since.

Notably, insider buying has really trailed off over the past several quarters as the market has grinded higher. Insiders—again, the men and women running the largest companies in America—clearly aren’t seeing the value these days.

Does this mean that the bottom is about to fall out? No, of course not. But it tells me that it might be a good idea to keep a little more dry powder than usual. When the insiders start buying hand over fist again, we’ll want to have cash on hand to follow their lead.

This piece first appeared on Economy & Markets.

Charles Lewis Sizemore, CFA, is chief investment officer of the investment firm Sizemore Capital Management and the author of the Sizemore Insights blog.

This article first appeared on Sizemore Insights as What Can Insider Trading Activity Tell Us?