Can Premium Products Help SunPower Drive A Turnaround After A Tough Q4?

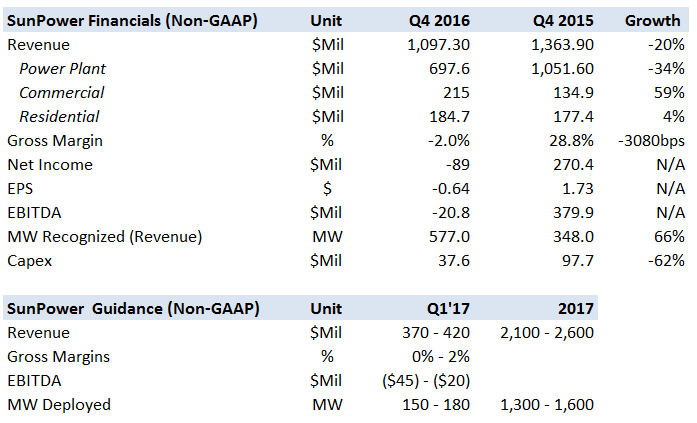

SunPower (NASDAQ:SPWR), the second largest U.S. solar panel manufacturer, published a relatively challenging set of fourth quarter 2016 results, posting a wider than expected net loss, while guiding lower than anticipated revenues for the first quarter of 2017, on account of oversupply and tough pricing conditions in the global solar market. As the company expects the pricing environment to remain extremely competitive through 2017, it has been shifting its focus away from lower-value products, while doubling down on its high-efficiency panels and integrated solutions to shore up margins. Below we review the key takeaways from the company’s earnings release and what lies ahead.

We have a $10 price estimate for SunPower, which is roughly 30% ahead of the current market price.

See our complete analysis for SunPower

- Rising 21% This Year, What Lies Ahead For Exxon Stock Following Q1 Earnings?

- Should You Pick General Electric Stock At $165?

- What’s Next For JetBlue Stock After A Sharp 19% Fall Post Q1 Results?

- Is Kimberly-Clark Stock Fairly Valued At $135 After A Solid Q1?

- How Will AMD’s AI Business Fare In Q1?

- Up 9% Year To Date, Will Chevron’s Gains Continue Following Q1 Results?

Power Plant Headwinds Hurt Results, Outlook Remains Tough

SunPower’s power plant business had a challenging quarter, with non-GAAP segment revenues declining by about 34% year-over-year and gross margins coming in at negative levels, amid weaker fixed cost absorption. The power plant market has been contending with significant headwinds, including mounting competition from third-party developers and the possibility of interest rate hikes by the Federal Reserve, which could drive up required rates of returns on projects, hurting pricing. The uncertain policy environment in the United States, under the new Presidential Administration is also likely to be weighing on contracting activity.

Overall, SunPower expects solar PPA pricing to face considerable near-term pressure, prompting it to focus development activity on a few core markets, in a move that should help to cut costs. SunPower intends to serve the broader global market via its Solar Solutions group, which sells complete equipment packages to developers. SunPower is also banking on its lower cost P-Series modules – which utilize mass market cells and a differentiated interconnection technology – to compete in the power plant market. (related:Why SunPower’s P-Series Panels Could Be Crucial To Its Turnaround)

Residential And Commercial See Revenue Growth Due To Strong Product Differentiation

SunPower’s performance in the residential market remained relatively strong over Q4, with segment revenues growing by 4% year-over-year, driven by the firm’s premium product portfolio and channel expertise. The company has been skewing production towards its high-end X-Series modules, while shutting down its Fab 2 facility in the Philippines, which produces the lower margin E-Series product. SunPower is also promoting its Equinox integrated residential solution, which combines panels, micro inverters and mounts into a single package. The product allows buyers to cut down on installation time and labor costs, while improving system performance. The product accounted for 67% of new orders in Q4. SunPower’s commercial business also had a solid quarter, with non-GAAP revenues growing by roughly 59% on a year-over-year basis, driven primarily by the public sector and light commercial channels in the United States. SunPower’s integrated commercial offering, called Helix, continues to see strong uptake, accounting for over 90% of Q4 bookings.

View Interactive Institutional Research (Powered by Trefis):

Global Large Cap | U.S. Mid & Small Cap | European Large & Mid Cap