Snap To Miss Consensus For FY 2019?

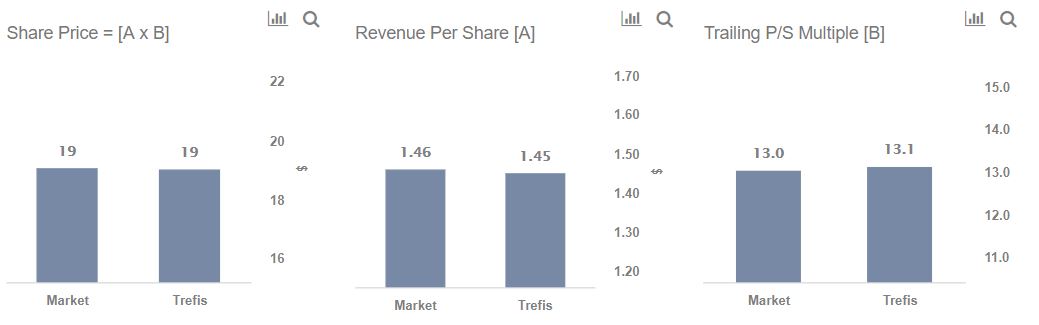

Snap (NYSE:SNAP) is slated to release its Q4 and full-year 2019 results on February 4, 2020. We believe that Snap’s Revenues will be slightly lower than consensus and earnings in line with consensus. We expect Snap to report revenues of $1.71 billion (vs. consensus estimate of $1.72 billion), which would be 26.4% higher than the previous year. Earnings are likely to be around -$0.20 (vs. consensus estimate of -$0.19), higher than -$0.47 reported in 2018, due to a better Total Revenue and a better net income margin. Our forecast indicates that Snap’s Valuation is $19 per share, which is in line with its current market price of roughly $19.

A] Revenue expected to be slightly below Consensus

- Total revenues have increased from $0.4 billion in 2016 to $1.18 billion in 2018.

- Trefis estimates Snap’s revenues to improve further by 26.4% to $1.71 billion in 2019 from $1.18 billion in 2018.

- Revenue improvement is expected to be driven by both North America and International segments.

A separate interactive dashboard for Snap provides an in-depth view of Snap’s revenue trend and segment-wise revenue performance, along with forecast for 2019 and 2020.

- Up 6% In The Last Trading Session, Where Is Snap Stock Headed?

- Beating S&P500 By 62% Since The Start Of 2023, How Will Snap Stock Trend After Q4 Results?

- Up 91% YTD, What’s Next For Snap Stock?

- Is Snap Stock Attractive At The Current Levels?

- What To Expect From Snap Stock?

- Snap Stock Is Fairly Valued

B] Sales Per Share to be in line with Consensus

- Snap’s 2019 Sales per share is expected to be $1.45 per Trefis analysis, in line with the consensus estimate of $1.46 per share.

- An increase in Total Revenue along with lower share count will drive the Sales per share improvement compared to 2018.

C] Stock Price Estimate in line with the Market Price

- A trailing P/S multiple of 13.1x looks appropriate for Snap’s stock, which is nearly in line with the current implied P/S multiple of 13x.

- As per Trefis, Snap’s 2019 revenue will be just below the market expectations. This forecast works out to a fair value of $19 for Snap’s stock, which is in line to its current market price of around $19.

Additionally, you can input your estimates for Snap’s key metrics in our interactive dashboard for Snap’s pre-earnings, and see how that will affect the company’s stock price.

See all Trefis Price Estimates and Download Trefis Data here

What’s behind Trefis? See How It’s Powering New Collaboration and What-Ifs For CFOs and Finance Teams | Product, R&D, and Marketing Teams