When Will Snap Reach Break-Even?

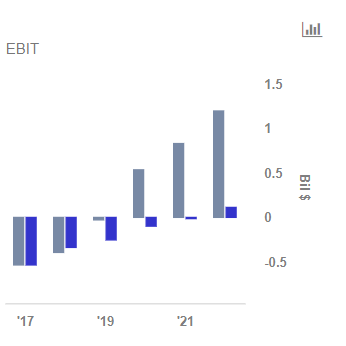

Snap (NYSE:SNAP) has been posting large losses since its inception, due to its heavy investments in research and development as well as relatively weak monetization of its user base. The losses are expected to persist into 2018, as Snap’s CPM rates get impacted by its roll-out of programmatic ads. The company’s CPMs (cost per thousand impressions) fell by more than 60% year-over-year in Q3’17 (related: How Snap’s Shift To Programmatic Is Impacting Its ARPU). However, we estimate that the company should be able to break even by 2020, as its ad business picks up amid a scale-up of its automated ad sales and a larger daily active user base. We have created an interactive analysis which puts forth some the assumptions underlying our forecast for a 2020 break-even (grey color graphs in the below charts). Our 2020 operating break-even forecast assumes that the company’s North American ARPU will rise to levels of over $30 per year, with gross margins expanding to 55% in the same period. We also assume that G&A, R&D and selling expenses will decline to levels of roughly 10% of gross profits by 2020. Separately, we have also created a scenario (blue graphs) under which Snap may only achieve operating break-even in 2022.

We Estimate That Snap Will Reach Operating Break-Even Between Fiscal 2019 and 2020

Snap’s mix of weak ARPU and high operating expenses has meant that the company has posted significant net losses. However, we forecast that the company will break even sometime in 2020 as its ad business picks up. Below we provide some of the assumptions for this forecast, along with a potential bear case which sees the company break even in 2022.

- Up 6% In The Last Trading Session, Where Is Snap Stock Headed?

- Beating S&P500 By 62% Since The Start Of 2023, How Will Snap Stock Trend After Q4 Results?

- Up 91% YTD, What’s Next For Snap Stock?

- Is Snap Stock Attractive At The Current Levels?

- What To Expect From Snap Stock?

- Snap Stock Is Fairly Valued

Snap’s U.S. Ad Business Should Gain Traction, Driven By Better ARPU

Our 2020 break even projection assumes that Snap’s North American ARPU will grow from levels of under $10 in 2017 to over $30 in 2020, with daily active users rising to 100 million and gross margins expanding to about 55%. However, slower than expected growth in these metrics could delay the company’s break-even point by a few years.

Moreover, Indirect Expenses Should Also Decline As A Percentage Of Revenue

See More at Trefis | View Interactive Institutional Research (Powered by Trefis)