Will North America Continue To Power Schlumberger’s Earnings?

Schlumberger (NYSE:SLB), the largest oilfield services company, is expected to publish its Q3 2018 results on October 19, reporting on a quarter that saw an upswing in oil prices with Brent crude rising from levels of around $75 per barrel to about $85 currently. Oilfield services activity has also seen an uptick, with the average worldwide rig count over the quarter rising by about 8% year-over-year to 2262 units, driven primarily by stronger activity in the United States. Below we provide a quick overview of what to expect when Schlumberger publishes its earnings Friday. Our interactive dashboard analysis outlines our expectations for Schlumberger over the next two years. You can modify any of our forecasts to gauge the impact of changes on the company’s results and valuation.

What To Expect From Q3

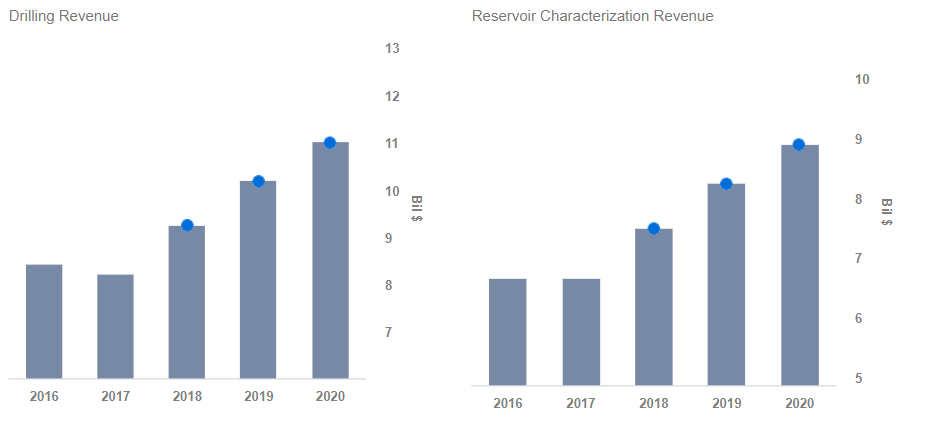

Schlumberger’s North American business is likely to remain the biggest driver of its quarterly results, driven by a growing rig count and higher service intensity. The U.S rig count was up 11% year-over-year, and it’s likely that service intensity also remained robust with the company previously indicating that the average length of lateral wells drilled has risen by around 30% over the past four years. That said, there could be some concerns as well. For one, activity in the Permian basin, which is the largest U.S. shale basin, has been trending lower due to a lack of pipeline capacity for the transportation of crude from the region. Moreover, the fracking market could see some pressure, due to the addition of hydraulic fracturing fleets over the quarter. The company’s performance in international markets could be more mixed. While markets such as Africa and the Asia Pacific are likely to have seen stronger activity with revenues growing from these regions, it’s possible that the Latin American market has yet to recover due to declines in Venezuela.

- With The Stock Flat This Year, Will Q1 Results Drive SLB Stock Higher?

- Down 7% Already This Year, Will SLB Stock Recoup These Losses After Q4 Results?

- Flat Since The Beginning of 2023, What Is Next For SLB Stock?

- SLB’s Q2 Earnings: What Are We Watching?

- SLB Stock To Likely Trade Higher Post Q1

- SLB Stock Looks Attractive At $46

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.