Is Schlumberger’s Recovery Here To Stay?

Schlumberger (NYSE:SLB), the largest oilfield services company, published its Q2 2017 results on Friday, meeting market expectations on earnings although revenues fell short of consensus. The company’s revenues expanded by 11% year-over-year to $8.3 billion, while its adjusted EPS stood at $0.43. The company’s outlook for the rest of the year remains strong, driven by a broad recovery in oil and gas activity worldwide. Here are some of the key takeaways from the company’s earnings release. Our interactive dashboard analysis further outlines our expectations from Schlumberger over the next two years.

International Markets Are Seeing A Recovery

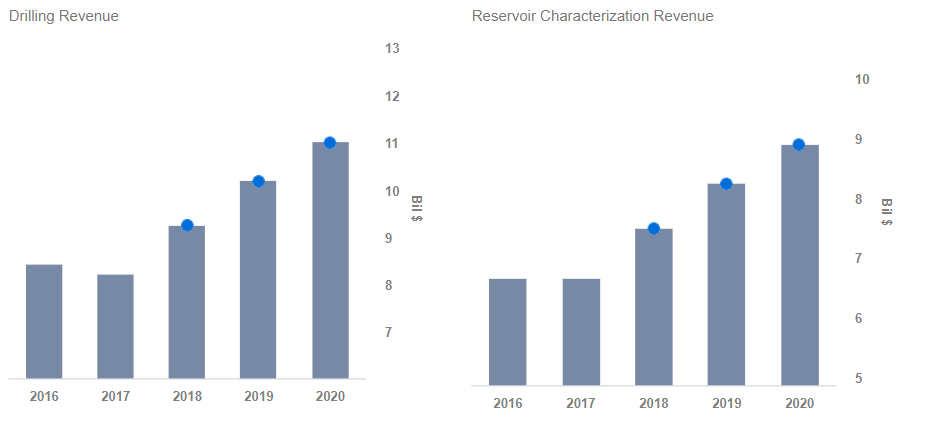

Schlumberger saw year-over-year revenue growth in all its geographic markets, barring Latin America, over the second quarter. The integrated drilling business, in particular, has been strong, driven by higher global drilling activity and the company’s leadership in the drilling hardware, fluids, and software space. Schlumberger indicated that it would not have any spare equipment capacity by the end of 2018, allowing it to improve its pricing and commercial terms for the product line. Schlumberger’s North American business grew by 11% sequentially and 43% year-over-year, driven by a growing rig count and higher service intensity. For instance, the company notes that the average length of lateral wells has risen by around 30% over the past four years. While the company deployed additional hydraulic fracking fleets over Q2 in the United States, it indicated that pricing remained flat, due to capacity additions.

- With The Stock Flat This Year, Will Q1 Results Drive SLB Stock Higher?

- Down 7% Already This Year, Will SLB Stock Recoup These Losses After Q4 Results?

- Flat Since The Beginning of 2023, What Is Next For SLB Stock?

- SLB’s Q2 Earnings: What Are We Watching?

- SLB Stock To Likely Trade Higher Post Q1

- SLB Stock Looks Attractive At $46

Tight Conditions In Oil Market Could Favor Schlumberger In The Long Run

Schlumberger has indicated that the fundamentals of the global oil and gas market are improving, with the balance of oil supply and demand tightening further. On the demand side, while oil prices have risen, demand is not expected to decline, with reporting agencies holding on to their forecasts for oil demand for this year and next year. Moreover, supply has also been weakening despite OPEC’s decision to raise oil production, due to declining production in Venezuela and a possibility that Iranian oil could leave the broader market, due to tensions with the United States which could bring about sanctions. These trends could point to a growing need for increased exploration and production spending, particularly in international markets. This could play to Schlumberger’s advantage, given the company’s wide global presence, its emphasis on performance-based contracts and integrated projects.

What’s behind Trefis? See How it’s Powering New Collaboration and What-Ifs

For CFOs and Finance Teams | Product, R&D, and Marketing Teams

Like our charts? Explore example interactive dashboards and create your own.